3 Profitable Healthcare Services Firms at Good Prices

Uncertainties regarding healthcare loom large, but we think these profitable stocks are being punished too harshly.

Join retirement experts this Saturday as we walk you through practical steps to ensure you are on the right track to retirement in our free Morningstar Retirement Readiness Bootcamp. Register now.

Healthcare is a shifting landscape these days. The Trump administration has vowed to repeal and replace the Affordable Care Act, but even as details emerge, questions remain.

The market is still sorting out the winners and the losers. Over the trailing 12-month period, the healthcare sector has trailed the S&P 500, but it has outperformed the broad index in 2017.

Some healthcare industries are doing very well. For instance, many stocks of device manufacturers have soared due to the possibility that the ACA-imposed tax on medical devices might be repealed or regulations reduced under the newly introduced American Health Care Act.

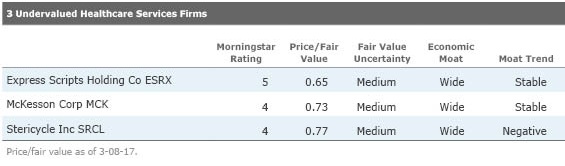

Other parts of the healthcare sector have lagged, though, such as the three firms we highlight below. But we think their underperformance presents investors with a great opportunity to pick up high-quality firms for a low price.

Not only are these stocks undervalued, in our view, they have economic moat ratings of wide (we think they have advantages that will fend off competitors for at least 20 years). They also have fair value uncertainty ratings of medium, which means we think we can more tightly bound their fair value, because we can estimate the stock's future cash flows with a greater degree of confidence.

Express Scripts

ESRX

Express Scripts is a pharmacy benefit manager, which is a third-party distributor of prescription drugs programs for healthcare plans. Express Scripts is the largest PBM, which gives the firm unparalleled supplier pricing power and scale advantages. As senior equity analyst Vishnu Lekraj pointed out in a recent Analyst Report, the firm's substantial claim volume gives it the opportunity to take advantage of two key industry drivers: superior supplier pricing leverage and unmatched centralized cost scale. Due to the large number of adjusted claims processed, Express Scripts can negotiate favorable drug pricing with suppliers, which allows it to expand its client base by providing low-cost products, while at the same time preserving its gross margins. Lekraj says scale is also a source of competitive advantage, as each additional claim processed is more profitable than the previous. Centralized and technology system costs are able to be spread across the entire level of claims, which clearly gives an advantage to larger PBMs. "As a result of these factors, Express Scripts can produce top-tier gross and operating profit per adjusted claim. The firm's significant advantages have produced outsize economic profits, and we believe this trend will remain in place over an extended period," Lekraj said.

McKesson

MCK

McKesson, a major distributor of pharmaceuticals, specialty drugs, and medical products, plays a critical role along the pharmaceutical supply chain as it is able to procure and distribute drugs efficiently from manufacturers to pharmacies, hospitals, and clinics. Lekraj thinks the firm plays a critical role in the pharmaceutical industry, as many supply chain participants depend on McKesson's services for streamlined product distribution and procurement. He also believes McKesson--like AmerisourceBergen and Cardinal Health, the other two major pharmaceutical distributors--possesses a wide economic moat. Those three firms have a combined market share well above 90%; a new competitor would have a tough time carving out enough share to efficiently leverage its distribution assets into positive economic profits. In addition, McKesson's colossal distribution operations allow the firm to build excellent asset efficiency: The firm is able to produce top-tier asset turns, cash conversion, and inventory management metrics that have led to outsize ROICs, a trend we believe will last several years.

Stericycle

SRCL

Stericycle, which is classified an industrial stock, is the largest domestic provider of regulated medical waste management to large-quantity generators (such as hospitals and pharmaceutical companies) and small-quantity generators (such as medical and dental offices). Equity analyst Barbara Noverini believes that Stericycle is well-positioned to profit from a changing healthcare landscape. Rising costs have created a permanent need for large quantity medical waste generators, such as hospitals, to closely manage operational overhead, supporting an industry appetite for outsourced waste disposal. Its wide moat owes to its unmatched scale in medical waste collection, treatment, and disposal assets, which combine to create cost advantage and customer switching costs supported by intangible assets (regulatory permits). State medical waste regulations place liability on generators, which must ensure safe collection, storage, transfer, treatment, and disposal of medical waste from cradle-to-grave, so to speak; Noverini believes this level of regulation increases customer switching costs more so than for customers of municipal solid waste companies. Stericycle's ability to manage the entire process has attracted a dense network of customers (over 500,000) with an annual retention rate of over 90%.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)