2 Options for Gender-Lens Investing

Investing in these diversified portfolios of quality companies can signal support for more women in corporate leadership positions.

Even though women make up more than half of the U.S. workforce, they remain significantly underrepresented on corporate boards and in the ranks of corporate executives. Just 5% of S&P 500 companies are headed by a female CEO, 20% of board seats are held by women, and 25% of executive and senior level managers are women, according to Catalyst, a nonprofit that works to accelerate progress for women in business. A 2016 Government Accountability Office report on women directors of companies in the S&P 1500 found that women account for just 16% of corporate board members and estimated that, if women started joining boards as often as men today, it would take another 40 years for women to reach parity on corporate boards.[i]

These numbers by themselves are sufficient to conclude that companies need to move faster to place more women in management and leadership positions. This, in turn, would likely speed progress on gender-related workplace issues, such as pay equality, career-pathing, diversity, and work-life balance. More broadly, research suggests that gender diversity can improve decision-making. According to Columbia Business School professor Katherine W. Phillips, socially diverse groups are more innovative because their members' different backgrounds bring new information to the table and because "simply interacting with individuals who are different forces group members to prepare better, to anticipate alternative viewpoints and to expect that reaching consensus will take effort."[ii]

Recent research by Credit Suisse, RobecoSAM, and Morgan Stanley has shown that companies with more women in management and on boards, as well as those with better gender diversity reflected throughout their businesses, tend to outperform companies with fewer women in management and with lower gender diversity. [iii]

By investing in such companies, investors can achieve impact by helping shine a light on gender issues while also achieving competitive investment returns. That was the view of the $200 billion California State Teachers’ Retirement System, which committed $250 million to seed the SPDR SSGA Gender Diversity ETF SHE in March 2016, with plans to eventually double its allocation. In addition to that exchange-traded fund, which is focused on large-cap U.S. stocks, Pax Ellevate Global Women’s Index Fund PXWIX invests in developed-markets stocks, including those of the United States. These two funds, plus a Barclays-sponsored exchange-traded note (Barclays Women in Leadership ETN WIL), are the only public offerings focused on investing in a gender-aware manner, although most funds that actively incorporate environmental, social, and governance, or ESG, factors into their investment process include employee-diversity policies and board composition as considerations.

SHE and PXWIX: What Types of Investments Are These? Both are broadly diversified funds appropriate for a U.S. (SHE) or global (PXWIX) large-cap allocation. Both track specially designed indexes with similar but not identical criteria for inclusion. They also use different rules for portfolio construction. As a result, their sector compositions differ and they have fewer common holdings than one might expect. PXWIX has a broader global mandate than the U.S.-focused SHE, but if we consider only the U.S. holdings of PXWIX, the two funds share just 49 names out of the 352 holdings in their portfolios domiciled in the U.S.

Starting with a universe of the 1,000 largest U.S. companies by market capitalization, the SSGA Gender Diversity Index, upon which SHE is based, ranks companies within each of 10 sectors based on their ratios of women on the board and in executive leadership positions. For each ratio, companies representing the top 10% of market cap within each sector are eligible for inclusion, but only if they have a female CEO, board chair, or member of the board. The resulting index has 186 holdings, less than 20% of holdings in the starting universe. Without additional sector or position constraints, the index has large individual positions.

PXWIX is based on the Pax Global Women’s Leadership Index, which uses the MSCI World Index as its starting universe. The Pax World Gender Analytics team evaluates companies based on the ratios of women on the board and in executive management, whether a firm has a female CEO or CFO, and whether a firm is a signatory to the Women’s Empowerment Principles, which encourage businesses to promote gender equality in the workplace, marketplace, and community. Companies must also meet certain ESG standards, and firms involved in weapons or tobacco manufacturing are excluded altogether. The resulting index has 405 holdings, about 25% of the number of holdings in the MSCI World Index, with about 65% of assets in the U.S. The ESG criteria helps PXWIX earn a Morningstar Sustainability Rating of High based on its underlying holdings. By contrast, SHE has a Sustainability Rating of Above Average.

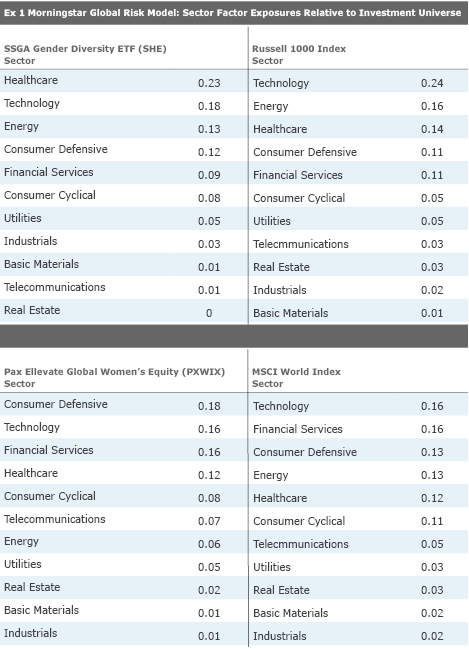

Using the Morningstar Global Risk Model, we can further evaluate the differences between these gender-aware investments and their conventional benchmarks. Exhibit 1 highlights the sector exposures relative to each fund’s investment universe. Investing in SHE results in significantly more exposure to healthcare than the Russell 1000 Index and less exposure to technology. SHE has slightly higher exposure to consumer cyclicals and slightly lower exposure to energy than the Russell 1000 Index. PXWIX, on the other hand, has significantly more exposure to the consumer defensive sector and less exposure to energy than does the MSCI World Index. It also has less exposure to the developed Asia-Pacific region.

- source: Morningstar Analysts

Despite the differences in their sector exposures, both SHE and PXWIX have similar style signatures, as estimated by the Morningstar Global Risk Model (see Exhibit 2). Companies that have more women in leadership tend to be large, high-quality companies that are financially healthy and have economic moats. Their stocks tend to be somewhat cheaper, very liquid, and less volatile than the overall market.

- source: Morningstar Analysts

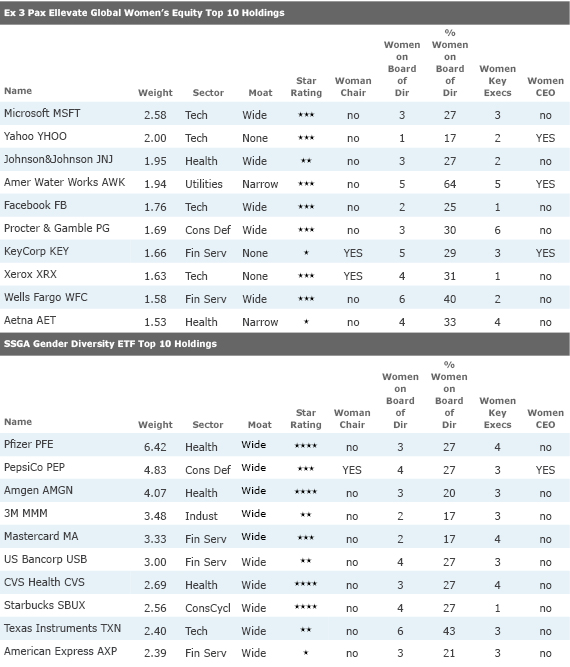

Exhibit 3 shows the top 10 holdings of each fund, their Morningstar Economic Moat Ratings, their Morningstar Ratings, and statistics on women in leadership positions. Names of company directors and key executives were taken from Morningstar Direct. Out of these 20 top holdings, four have female CEOs, three have female board chairs, and the average percentage of female board members in this group is 30%. Interestingly, research from Catalyst suggests that when women's representation on boards reaches three or more, which is about 30% of the average size board, governance improves and companies perform better.[iv]

- source: Morningstar Analysts

Companies that are gender-leaders tend to be high-quality firms. Three fourths of the companies in Exhibit 3 have wide moats and 17 of 20 have wide or narrow moats. A moat indicates that analysts in Morningstar Research Services LLC believe the firm has an enduring competitive advantage that will enable it to achieve normalized excess returns on invested capital over at least the next 10 years.

Neither fund has a truly long-term record. Although it had existed as an actively managed fund since 1995, PXWIX has been index-based only since May 2014. Since then, it has performed on par with the MSCI World Index, trailing by just 6 basis points annualized through Feb. 28.

SHE has been in existence for just under a year but has trailed well behind the Russell 1000 so far because of the fund’s sector biases. SHE has been hurt by its technology underweighting, as the Russell 1000 Technology Index is up nearly 30% since SHE’s inception. SHE has also been hurt by its healthcare overweighting, as the Russell 1000 Healthcare Index is up only 12% since SHE’s inception.

That said, investors know what they’re getting here: portfolios of high-quality companies that have more women in leadership and management positions than their peers. It is just that SHE's portfolio comes with bigger sector biases. Those biases will be mitigated over time if and when more technology companies add more women to their leadership ranks.

Investing in a fund focused on gender diversity helps call attention to the need for companies to expand the number of women in leadership positions and provides the opportunity to profit from the possibility that such companies will be better performers over the long run, as research suggests they may.

[i] Government Accountability Office. 2016. Women on Corporate Boards: Strategies to Address Representation of Women Include Federal Disclosure Requirements. http://www.gao.gov/assets/680/673888.pdf

[ii] Phillips, K.W. 2017. "How Diversity Makes Us Smarter." Scientific American, Jan. 30, 2017.

[iii] Credit Suisse Research Institute. 2016. "The CS Gender 3000: Reward for Change." September 2016; RobecoSAM. 2015. "Does corporate gender equality lead to outperformance?"; Morgan Stanley. 2016. "Gender Diversity is a Competitive Advantage," May 12, 2016. These studies summarized in: Gorte, J. "The Business Case for Gender Equality." Pax World Investments, February 2017.

[iv] Joy, L. et al. 2011. "The Bottom Line: Corporate Performance and Women's Representation on Boards (2004-2008)." Catalyst, March 1, 2011.

Jon Hale has a position in PXWIX.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3J75DKCBIZCTJMRFWSSJSHHCJ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)