Will the Fed Raise Rates in March?

Upcoming inflation, consumption, auto, and employment reports will be key factors in the decision.

Recently released U.S. Federal Reserve minutes and a number of more hawkish-sounding Fed speakers raised the prospects of more rate increases in 2017, perhaps beginning as early as the Fed's March 15 meeting. Before this week, the probability of a Fed rate increase in March was nil. By the close of the week, the probability was a much higher 22%.

The minutes suggested that the Fed would be raising rates "fairly soon." Since then inflation and employment both checked in higher than expected. This week one governor suggested that a rate increase was on the table in March, a sentiment echoed by another Fed governor earlier in the week.

Before the Fed's March meeting is adjourned, a new round of inflation and employment data will be available. Year-over-year inflation is likely to accelerate with the next release, while the month-to-month number for February will look much less worrisome than the January data. However, if we are wrong and inflation accelerates in February, the Fed's hand may be forced.

Still, as we noted last week, a likely very weak consumption report for January, especially the inflation-adjusted version, will give the Fed pause, in our opinion. We also expect a reversion to mean for February employment data following unusually strong employment data in January. Softer employment data would likely keep the Fed on the sidelines. Auto industry results for February, which are a wild card at the moment, could also influence the Fed's thinking. January auto sales were a disappointment.

The path to a March Fed rate increase would include another strong employment report, booming auto sales, another rough inflation report, and statistical magic that boosts the January consumption report. If all or even most of these events come to fruition (not likely, but possible) brace yourself for a March rate increase.

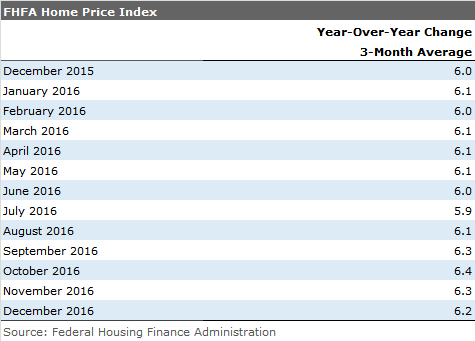

This week's economic data was sparse, inconclusive, and bottom-tier in terms of importance. Home price growth moderated a bit in data released this week for the month of December. Still, a 6.2% price increase doesn't square with much wage growth that's running considerably lower, continuing to pressure affordability. Existing-home sales were nothing special on our year-over-year measures, even as newspapers breathlessly trumpeted a new recovery high in seasonally adjusted unit sales in January.

Most of the interesting economic news this week was out of Europe. The news included strong auto sales data for January, another improving reading on the Markit Purchasing Manager survey for Europe, and upwardly revised forecasts for eurozone economic growth from the European Commission.

Just two other quick tidbits: first, the employment report for February will be released on March 10, not the typical first Friday of the month (March 3, next week). Second, some fraud prevention implemented this year by the Treasury Department (as many readers kindly pointed out) has dramatically slowed the flow of tax refunds, which will likely hurt February consumption data. Through Feb. 22, just $57 billion in refunds have been disbursed compared with $97 billion a year ago. We think most of those missing refunds are delayed, but as much as $5 billion-$10 billion could relate to reduced fraud. At a minimum, February consumption-related data could be under some temporary pressure.

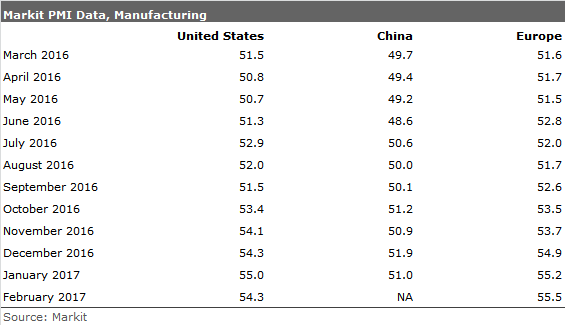

World Purchasing Manager Survey Confirms European Economic Turn In this week's video we highlighted the relatively unexpected turn in European economic activity. The purchasing manager survey predicted this, perhaps a bit early, way back in June. Recent data seems to confirm a real-world turn, with higher GDP growth, higher inflation, and lower unemployment reports all turning up in the past week or two.

Looking backward, full-year GDP growth in Europe was 1.7% in 2016. While nothing special, the eurozone GDP growth did exceed the paltry 1.6% growth rate experienced in the U.S. over the same period. The European Commission just raised its growth estimates for 2017 and 2018 from 1.5% and 1.7% to 1.6% and 1.8%.

While hardly a huge move, reports from government agencies and private forecasters throughout 2016 always allowed that recent results might have been OK, but doom was always just around the corner. First, a slowing China was going to kill the recovery. Then it was Brexit, and most recently the new U.S. presidential administration.

The disaster du jour never showed up. A cheap euro and better export markets, especially in China, seem to have gotten both real-world and sentiment indicators moving in the right direction and appeared to have ended all the gnashing of teeth. Even with major elections scheduled in France, Germany, the Netherlands, and potentially Italy, sentiment seems to be getting better and even feeding on itself. Some extra hiring at

(

)-related facilities at year-end certainly helped, too.

The Markit Flash Purchasing Manager Survey on manufacturing released this week showed another improvement for February (even as the U.S. slipped a bit).

The commentary section was interesting, too. In fall 2016, Markit was leading the doom-and-gloom squad despite the fact that its own numbers were improving. The past several months of its commentary have turned downright sunny with just a small touch of gloom buried at the very end of the report.

It noted that the European economy moved "up a gear" in February and the composite PMI was at its highest level since 2011. It described new-order books as "surging" and businesses "firmly focused on expansion." This out-of-character optimism suggests the potential for real improvement if optimism can begin to feed on itself. And if activity continues to improve, it may be just the tonic to prevent another pro-populist, anti-euro candidate from producing yet another Election Day surprise.

A stronger European Union is both a positive and a negative for the United States. Certainly, better economic conditions in Europe will aid U.S. exporters and U.S. multinationals operating in Europe. The bad news is the lowly valued euro, which is helping the European revival, will also make U.S. exports less competitive in other parts of the world.

Existing-Home Sales Good--but Not Necessarily Great Existing-home sales aren't as helpful to the economy as a new home sale but remain an important factor in the GDP forecast via broker commissions. They also help drive things like furniture sales, remodeling expenses, and moving/relocation activity.

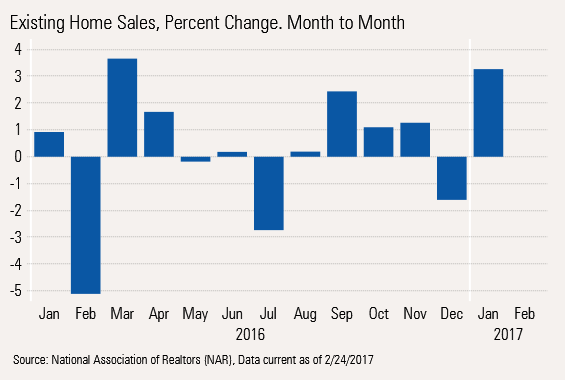

Weather and paperwork glitches have made it difficult to make a lot of sense of the numbers. The conclusions from the sequential month-to-month data, our usually favored three-month moving average methodology and a rolling 12-month data set are all modestly different. Each method has its own faults. The month-to-month data seems to be showing some improvement with four of the past five months showing positive results and the current reading being the second-best of the past year. However, weather jerks the data set around with some regularity. Also, January and February results include huge seasonal adjustment factors that amplify even small weather issues. In the giant scheme of things, sales in January and February are only a tiny portion of full-year sales. July sales, before seasonal adjustment, can be twice as high as in a typical January. Still, we admit to liking the trend.

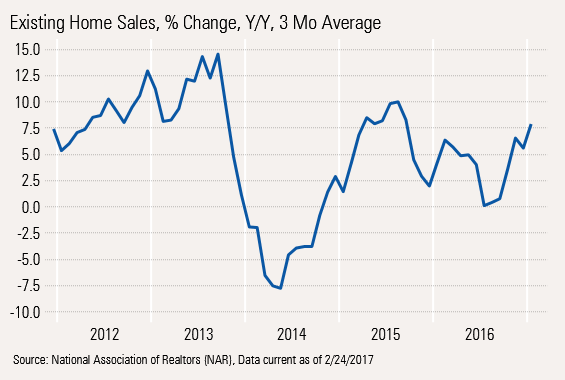

Year-Over-Year, Averaged Data Looks Relatively Strong

Our preferred year-over-year averaged data looks relatively strong, too, and appears to be accelerating. After dipping close to zero in June, year-over-year growth rates have accelerated to over 7%.

Still, this data set is helped along by new paperwork requirements implemented in fall 2015 that put monthly sales on a yo-yo between October and February. Sales came to a screeching halt one month, followed by a huge surge the following month as the current problem was resolved. Then more problems arose, creating another round of ups and downs. By our count it took five months to work through this, a wider problem than contemplated by our three-month averaging technique.

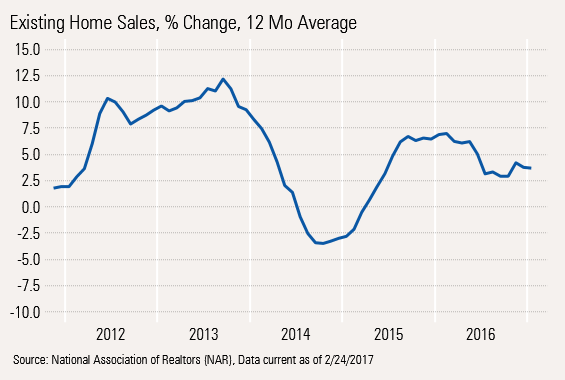

12-Month Sales Growth Looks More Lethargic and Trendless The 12-month data set that dampens down weather, seasonal factors, and paperwork issues has remained relatively trendless for all of 2016 and shows growth in the 3% range.

This exercise was not meant to confuse readers, but to demonstrate how seemingly smart economists can interpret the very same data sets in very different rates. To us, the underlying growth rate seems to be somewhere between 3% and 7%. And our guess is the data is relatively stable, with no giant change in trend in either direction. So we would be counting on neither a boom from the expansion of existing-home sales nor for the bottom to fall out. We are a bit concerned that pending home sales data suggests a bit of weakening in the months ahead, but the next reading on this key metric will not be available until next week. Stay tuned.

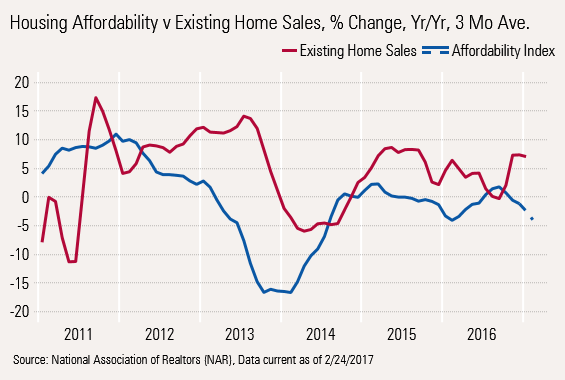

Affordability Data Suggesting More Housing Issues Ahead Housing affordability has been slipping since September (driven by newly rising interest rates combined with continued strong home-price increases). Affordability generally leads existing-home sales by as much as seven months. That would suggest that existing-home sales could slow by April unless home prices or interest rates reverse course quickly. As it stands now we are forecasting affordability to be down 5% February to February, and that assumes interest rates don't move higher.

Markets seem quite capable of enduring no improvement in affordability but 5% declines in affordability seem to pull market momentum down.

Homes Prices No Longer Accelerating, Potentially Aiding Affordability Home prices, after stabilizing over the summer, accelerated again in fall, according to the FHFA. Now we have two months in a row where the three-month average is again dropping.

With total wages growing at about a 4% rate currently, we would prefer to see home prices grow closer to that 4% rate, otherwise affordability will continue to slip away. Still, the current 6.2% price inflation that we are witnessing is below the 7.5% rate that caused the last major swoon in existing home sales (in 2014).

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)