Morningstar's 5 Favorite Foreign-Stock ETFs

These are some of our favorite exchange-traded funds for investors seeking to add or augment their portfolio's international-stock exposure.

Reasonable minds could argue that U.S. stocks' valuations are getting a bit stretched as they enter their ninth year of gains. But while the S&P 500 TR has gained nearly 14% per year and 11% for the trailing five- and three-year periods, the MSCI World Ex USA NR LCL has returned about 10.5% and 6.7%, respectively. That has led some experts to be more sanguine about the prospects of foreign stocks vis-a-vis their U.S. counterparts.

And, as discussed in this video, now may be a good time to check up on your portfolio's allocations and rebalance if needed. Many investors who have let their winners ride may find that not only has their total equity allocation has risen above their target, but the foreign-stock percentage of their equity allocation may have declined. While it's not a bad idea to trim your exposure to equities if they have become overweight, you may actually want to bump up your foreign equity holdings or add exposure to foreign stocks if you don't already have it.

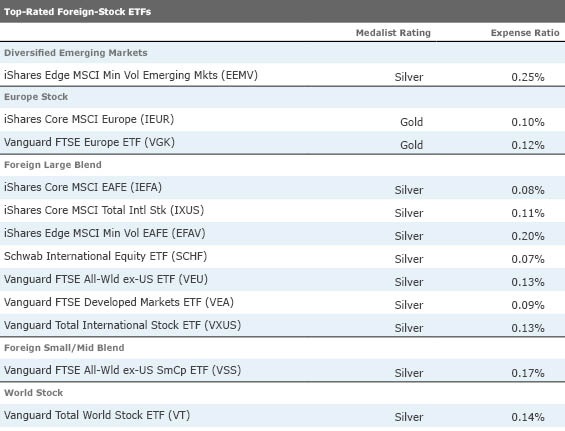

With that in mind, we are taking a look at our favorite exchange-traded funds in foreign-stock categories. Most investors know that exchange-traded funds are often competitively priced compared with their open-end peers. But prospective buyers would do well not to shop on price alone: Index construction also matters, as discussed in this article. Here are a few of our favorites.

(Due to space constraints, we only included Gold- and Silver-rated funds in the table. But the full list of medalist ETFs can be found

.)

If you are looking for a emerging-markets fund, this Silver-rated ETF is one to consider. It offers a well-diversified, low-cost portfolio that should provide a smoother ride and better risk/reward profile than most of its peers in the category. To achieve that, the fund uses an optimizer to construct the least-volatile portfolio possible using constituents of the MSCI Emerging Markets Index under a set of constraints. It also limits sector and country tilts relative to the MSCI Emerging Markets Index, exposure to individual names, and turnover, which reduces transaction costs. The resulting portfolio is well-diversified, with more than 250 holdings, and top holdings include companies with more stable fundamentals than the typical constituent of the MSCI Emerging Markets Index. Though investors should expect it to lag in strong market rallies, it will likely hold up better than peers in weaker markets.

--

Matthew Diamond

This Gold-rated ETF is one of the cheapest and best-diversified funds in the Europe stock Morningstar Category. The portfolio is made up of nearly 1,200 stocks across the market-cap spectrum from 16 developed countries in Europe, representing 98% of the investable market. The fund weights these holdings by market cap, which promotes low turnover and reflects the market's collective view about the relative value of each holding. Style purists should note that because the portfolio is tilted toward large multinational firms, such as

--

Alex Bryan, CFA

Silver-rated Schwab International Equity's 0.07% expense ratio makes it one of the cheapest ETFs in the foreign large-blend Morningstar Category. Its broad, market-cap-weighted exposure to large- and mid-cap stocks effectively diversifies company-specific risk and promotes low turnover. It's also well diversified in terms of country exposure, with stocks from 24 foreign developed markets (the inclusion of South Korea and Canada in the portfolio creates some notable differences in country exposure compared with funds that do not track a FTSE index as well as the category average). We believe the fund's sizable cost advantage should give it an edge over the long term: This advantage helped it outperform the category average by 10 basis points annualized from its inception in November 2009 through September 2016.

--

Matthew Diamond

This Silver-rated ETF is one to consider if you're on the lookout for a diversified international small-cap stock fund. VSS offers broad, market-cap-weighted exposure to more than 3,300 stocks listed in foreign developed and emerging markets. Though this approach skews the portfolio toward the larger-cap stocks in the small-cap segment, it also promotes low turnover, effectively diversifies company-specific risk, and accurately represents its target market. Its large emerging-markets exposure has recently been a drag on performance; however, it also improves the fund's diversification potential. Over the long term we believe this fund's cost advantage should give it an edge over its foreign small/mid blend Morningstar Category peers.

--

Matthew Diamond

With his Silver-rated fund, investors can get very low-cost global equity exposure. This ETF employs near full replication to track the FTSE Global All Cap Index: Its broad portfolio holds more than 7,500 stocks. This broad, market-cap-weighted index promotes low turnover, effectively diversifies risk, and accurately reflects the composition of its target market, which is the global stock market. Many of the fund's largest holdings are multinational firms that generate significant portions of their revenue and income abroad (such as

--

Matthew Diamond

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)