Climate-Aware Fund Investing

Three ways to incorporate climate concerns into your large-cap funds portfolio.

The 2016 election may have a galvanizing effect on climate-aware investing, given the new president’s stated doubts about climate change, push for environmental deregulation, and support for the fossil-fuel industry, especially coal. Most energy and utilities companies will continue their move away from fossil fuels and toward alternative energy because it increasingly makes economic sense to do so. Large companies throughout the global economy will continue to take steps to lower their carbon footprints, and regulators, stakeholders, and investors will continue to support the transition to a low-carbon economy. In the aftermath of the election, it’s not hard to imagine investors redoubling their commitment to investing in ways that take climate change into account.

There are several ways fund investors can do this. The most prominent is to get rid of funds with exposure to fossil fuels. Fossil-free funds generally exclude companies that own oil, natural gas, and coal reserves. Some fossil-free funds may also exclude companies involved in the refining and transport of fossil fuels, suppliers of oilfield equipment, and utilities that rely heavily on nonrenewable energy for their power generation.

Fossil-Free Funds Investors can search for fossil-free funds at a website called Fossil Free Funds, run by As You Sow, a not-for-profit that engages on behalf of shareholders with companies about environmental and social issues. Morningstar provides fund and industry data for the site. I searched U.S. large-cap funds by excluding the 200 global companies with the most carbon reserves, as well as coal companies. I limited my focus to U.S. large-cap funds because that tends to be the largest equity allocation for most U.S. fund investors and this is the place in a diversified portfolio where the most exposure to fossil fuels resides.

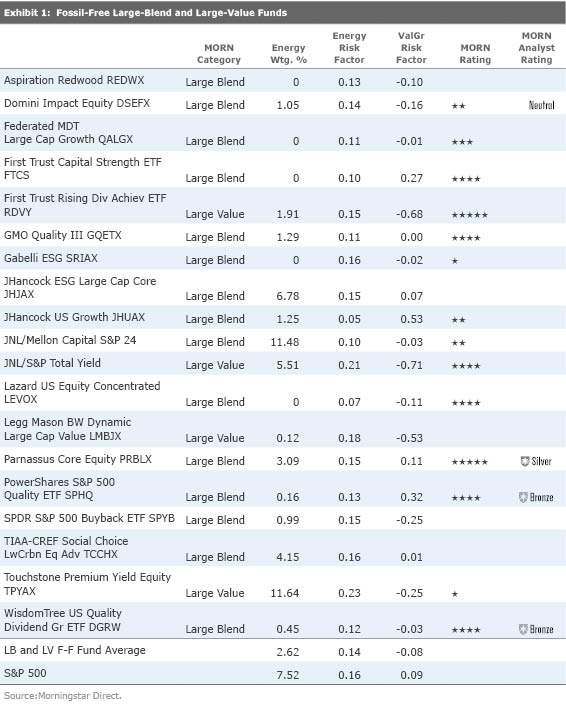

Most U.S. large-cap funds that are fossil-free by my measure are large-cap growth funds. Of the 71 fossil-free funds I found in my search, 52 are in the large-growth Morningstar Category, 15 are in large-blend, and only four are in large-value. This should come as no surprise: The energy sector has been traditionally a value sector. Energy takes up 12% of the Morningstar Large Value Index, for example, but only 4% of the Morningstar Large Growth Index. The real challenge in going fossil-free is with your large-blend and large-value funds.

The 19 fossil-free large-blend and large-value funds all have underweightings in energy, though some have significant exposure to energy-services companies and master limited partnerships. Aside from being fossil-free, the large-value and large-blend funds listed in Exhibit 1 do not differ much from the S&P 500 on other style characteristics and sector exposures. Running these funds through the Morningstar Global Risk Model, I found the fossil-free funds on average were stylistically similar to the S&P 500. Even though the energy factor premiums for fossil-free funds are lower, many are close to the S&P 500’s energy factor premium, and those of six funds are equal to or higher than that of the S&P 500. The biggest difference between fossil-free large-blend and large-value funds and the S&P 500 in our factor model is the value-growth factor. The fossil-free funds are slightly more value-oriented than the S&P 500 (remember, our comparison group does not include fossil-free large-growth funds).

Several of the fossil-free large-value and large-blend funds have good records based on their current Morningstar Ratings. Morningstar analysts cover only four on the list;

Low-Carbon Funds Investing in low-carbon funds is another possible approach for investors who want to express their concern about climate change in their portfolios. Such funds don't necessarily eschew fossil fuel exposure altogether, but instead invest in companies with lower carbon emissions and thus a low overall carbon footprint. Far from an exact science, carbon footprinting of portfolios is an attempt to quantify the greenhouse-gas emissions of companies a fund holds.

The Fossil Free Funds site also includes a fund carbon footprint measure, calculated by measuring--estimating in some cases--a company’s GHG emissions from its direct and indirect activities with data provided by South Pole Group. The emissions of each company in the portfolio are weighted by the investment amount to calculate a fund-level carbon footprint.

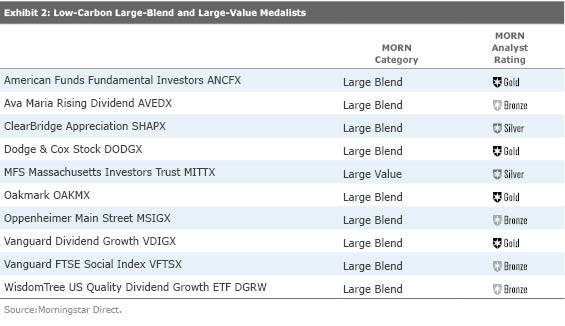

As we might expect, large-value funds have heavier carbon footprints than do large-growth funds. Large-blend funds are in the middle, but their carbon footprints are more like those of large-value than those of large-growth. I looked for funds with carbon footprints at least 50% lower than the S&P 500's. Similar to our findings for fossil-free funds, many more large-growth funds--167 to be exact--qualify as low-carbon portfolios by this measure, 38 large-blend funds, and six large-value funds. Among the low-carbon large-blend and large-value funds, 14 are covered by Morningstar analysts and 10 are Medalists.

Morningstar Environmental Pillar Scores A third option is to use the Environmental Pillar Rating, a component of the Morningstar Sustainability Rating for funds. The Morningstar Sustainability Rating is based on Sustainalytics' ESG ratings of companies in a fund's portfolio, with deductions taken for company involvement in ESG-related controversies. We also calculate separate Environmental, Social, and Governance scores and ratings.

While the Environmental Rating does not focus solely on climate change, its measurement of how well companies are managing environmental issues includes a range of relevant indicators. In addition to carbon emissions, these include evaluations of a firm’s environmental policies, management systems, reporting, and any environmental controversies in which a firm is involved. If a fund has an Environmental Rating of High, that means its portfolio places in the top 10% of its category based on how well the underlying holdings are handling various environmental issues, including those directly related to climate change. A High rating does not mean the fund is fossil-free or even low-carbon, but it does mean the fund’s holdings manage environmental issues relatively well compared with companies typically held in by funds in the same category.

By investing fossil-free, or low-carbon, or in an otherwise environmentally aware manner, you are adding your investment voice to those of other investors in support of the transition to a low-carbon economy. There are other ways to invest more directly in areas like alternative energy or in stocks of companies making cutting-edge products that will reduce reliance on fossil fuels. But using one of the methods outlined above, investors can incorporate their concerns about climate change into their core fund portfolios.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)