4 Tech Firms Cheaper Than Apple

Apple may be fairly valued after hitting record highs, but we think these technology stocks are undervalued.

, as excitement brewed over anticipated features on the new iPhone.

Equity analyst Brian Colello thinks Apple's exponential growth in recent years has stemmed largely from the first-mover advantage it got from introducing the iPhone, which was the first truly revolutionary smartphone. Apple's first-mover advantage and "easy growth" from new smartphone adopters is over, Colello says, but he thinks the company has the ability to retain its existing premium customer base and could still attract some Android customers over time.

Despite our optimism, however, the firm is currently within striking distance of our fair value estimate (the price/fair value as of close of business Feb. 13 was 0.97).

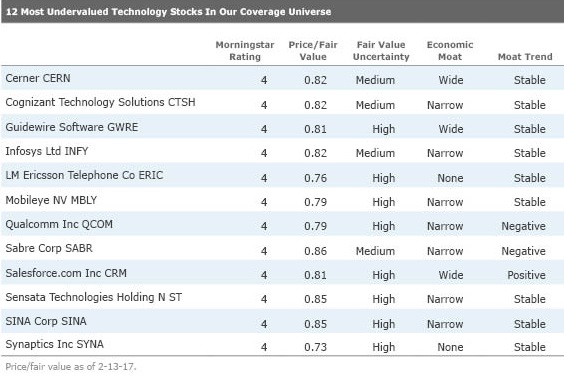

However, there are 12 firms in the tech sector that we think are undervalued relative to their future earnings potential. We give a brief overview in the table below, and then we take a deeper dive into four of our best ideas.

Cognizant Technology Solutions

CTSH

Cognizant is a U.S.-headquartered IT services firm that has exemplified industry-leading growth for many years, equity analyst Andrew Lange says. He believes Cognizant's narrow economic moat stems from customer switching costs: The firm's commitment to client satisfaction has led to the formation of critical long-term relationships and an intimate knowledge of customer business processes. Lange expects revenue growth to moderate from lofty historical levels as Cognizant becomes more mature. However, growing demand from clients for cost rationalization, regulation, and compliance (particularly in the healthcare and financial services segments), and digital-related services will underlie healthy long-term growth. Cognizant also has the ability to gain share in markets such as Latin America, continental Europe, and the public sector through both organic and acquisition-led endeavors, Lange said.

Guidewire Software

GWRE

The property and casualty insurance industry relies on clunky, decades-old proprietary legacy software systems that lack sophistication and often lead to overpayment on claims and customer attrition, writes equity analyst Rodney Nelson. As insurers look to shore up both operational efficiency and data integrity, IT spending on core software applications is set to grow to nearly $11 billion by 2020 from $8 billion in 2015, according to research firm Gartner. Guidewire has emerged as the global leader in replacing these legacy systems with its full-feature core application suite, which manages claims and the entire policy life cycle, Nelson says. We believe Guidewire has a wide moat because its robust products become ingrained in a customer's processes, which creates sticky relationships. Further, Guidewire is able to scale these products to reach a significant portion of the addressable market.

Qualcomm

QCOM

Equity analyst Abhinav Davuluri expects Qualcomm's licensing business, the driver of the firm's narrow moat rating, to see solid growth, thanks to our expectation of increased 3G and 4G device adoption. Qualcomm is first and foremost the steward of the digital communication technology known as CDMA, which is commonly referred to as a third-generation, or 3G, wireless communications standard. It allows devices to send/receive voice signals and wireless data, and has played a major role in the proliferation of mobile devices. Qualcomm's patents (with a monopoly in 3G and a significant portion of 4G) allows the firm to charge device-makers a royalty fee as a percentage of the price of each 3G and 4G device sold (as most 4G phones are backward-compatible with 3G). The firm also designs chips used in smartphones, but it's the firm's intangible assets and our outlook for the firm's ability to collect royalties over the next decade that underlies our narrow moat rating.

Salesforce.com

CRM

Since pioneering the software-as-a-service movement in the late 1990s, Salesforce.com has evolved into one of the world's true software powerhouses, says Nelson. The firm has created a product portfolio that spans all of the key verticals in customer relationship management delivered in a multitenant, public cloud environment that allows for rapid deployments, instant updates, and lower total cost of ownership for the firm's customers. Nelson believes enterprises will increasingly turn to cloud computing to eliminate costly IT infrastructure and maintenance costs, creating a long runway for growth in each of Salesforce's product verticals. The company's wide moat owes to its substantial customer switching costs and a network effect.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)