High-Quality Dividend-Payers: What's Cheap, What's Not?

We take a closer look at valuations among stocks in the Morningstar Dividend Yield Focus Index and highlight a few of the most undervalued stocks.

Dividend stocks have enjoyed a strong run in recent years, especially as investors have sought income in the equity market that they are not getting from bonds or cash.

If you are concerned that current valuations may cast a shadow over the future returns of equity-income strategies, you're not alone. There's no telling how long dividend stocks' recent run of outperformance will continue. But there are plenty of reasons to think that investing in steady dividend-paying stocks, particularly high-quality stocks that are healthy enough to not only sustain but possibly even increase their dividend, won't go out of style completely. Investors still have need for income, and although interest rates are likely to rise, they are still very low by historical standards and are not expected to shoot up dramatically anytime soon.

To get a better sense of how over- or undervalued dividend-paying stocks are today, we applied Morningstar equity analysts’ price/fair value estimates to the constituents of the Morningstar Dividend Yield Focus Index. By these metrics, the Dividend Yield Focus Index has a median P/FV of 1.04, indicating that the typical stock in the index is 4% overvalued. By contrast, the median stock in our entire global coverage universe is trading at a P/FV of 1.03, indicating it's about 3% overvalued. So although both groups are a bit overvalued in aggregate, there are certainly bargains to be found. Investors just need to pick their spots wisely.

The Morningstar Dividend Yield Focus Index The Dividend Yield Focus strategy looks at both backward-looking and qualitative forward-looking measures to find high-yielding stocks that are financially healthy enough to sustain their dividend.

We first screen the Morningstar US Market Index for dividend-payers. (The dividend must come from qualified income, so real estate investment trusts are not included.) We then apply the quality screens: We search the high-yielders for companies that have Morningstar Economic Moat Ratings of wide or narrow, meaning that we think they have competitive advantages that will allow them to continue to earn above-average profits and sustain their dividends for 20 or 10 years, respectively. We also consider a company's Morningstar Distance to Default ratio, which is a metric that uses market information and accounting data to determine how likely a firm is to default on its liabilities.

The 75 highest-yielding stocks that make it through the quality screen are then included in the index. The index is dividend dollar-weighted (constituents are weighted according to the total dividends paid by the company to investors). Click here to see the current holdings.

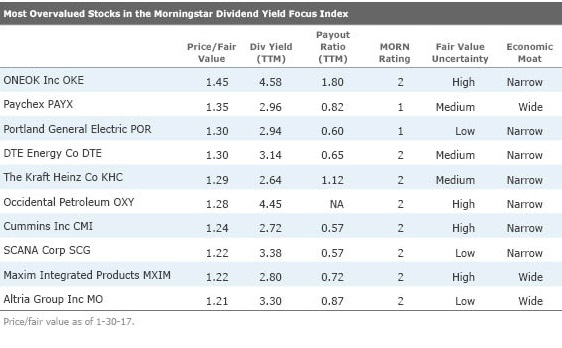

Which Dividend-Payers are Bargains (and Which Are Not)? In the table below, we show the most expensive stocks in the index, ranked by highest price/fair value ratio. (Note that the dividend yields listed below are backward-looking and could change.)

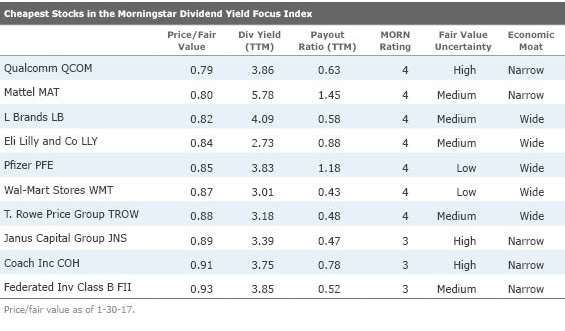

And here are the cheapest 10 stocks in the index, ranked by lowest P/FV. We take a deeper dive into our analysts' insights on three of the undervalued companies.

L Brands

LB

Our wide-moat rating for L Brands stems from the Victoria’s Secret and Bath & Body Works brands, which account for over 90% of total L Brands sales. Senior equity analyst Bridget Weishaar thinks these two brands can command a relatively sustainable pricing power. Bath & Body Works has been able to maintain its lead over its nearest competitor, The Body Shop, and Weishaar doesn't see this changing. She also thinks new entrants would be at a pricing disadvantage given Victoria's Secret's economy of scale advantages, the lower cost of marketing owing to word of mouth, the massive well-positioned store fleet, and social media strength as well as all of the press surrounding the Victoria's Secret fashion show and the "angels." "We think returns on invested capital will outpace our 8% weighted average cost of capital over a significant period. Our explicit model forecasts an average adjusted ROIC of 20% during a five-year time horizon," Weishaar said.

Eli Lilly

LLY

Like most pharmaceutical companies, patents play a crucial role in Eli Lilly's competitive advantage. But economies of scale and a powerful distribution network also support Eli Lilly's wide economic moat, says sector director Damien Conover. He believes the company's innovative culture and strong financial commitment to developing the next generation of drugs set it apart from peers and fuel its long-term growth. For example, recently approved diabetes drugs Tradjenta and Jardiance hold the highest sales potential of Lilly's new drugs, in Conover's opinion. He also believes several of Lilly's late-stage cancer drugs such as Cyramza and necitumumab have the potential to develop into blockbusters if additional clinical data holds up. Though the company faces risk from patent losses as well as generic and brand-name competition, Lilly's strong entrenchment in insulin production can protect its profitability. Unlike traditional drugs, Lilly's insulin drugs are very hard to copy by generics and create barriers to entry for noninsulin producers because of the large up-front investments needed to create scale efficiencies. Further, Lilly's longer-acting biosimilar insulin should help the company secure its market share, said Conover.

Wal-Mart Stores

WMT

Though competitive headwinds abound, sector head Erin Lash believes Wal-Mart can continue to benefit from its vast scale and cost edge. The company is the largest retailer in the world with around $485 billion in annual global sales, of which more than $300 billion is generated in the U.S. Thus, relative to other retailers, Wal-Mart has tremendous leverage to extract the most favorable terms possible from consumer goods suppliers, vendors, and manufacturers. But Wal-Mart faces challenges, namely from competitors such as dollar stores and Amazon, which offer low prices and convenience. In response, Wal-Mart has increasingly invested in e-commerce capabilities (organically and through the acquisition of Jet.com) and expanded its footprint by opening smaller-format Neighborhood Market stores (basic grocery and pharmacy) to serve all trip types (stock-ups at existing Supercenters and basic food/fill-in trips at Neighborhood Markets). "We believe Wal-Mart's scale will allow the firm to operate in all channels, but it could take time for sales to catch up to investments," Lash said.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)