What You Can Learn From Your 1099 Forms

These forms can yield valuable information about your portfolio’s asset location and tax efficiency.

Editor’s Note: A version of this article was published in February 2023.

“Important tax documents.”

You’ve probably started to see items marked with that label pop up in your mailbox, and most likely your email inbox, too. They’re a harbinger of the tax season to come, and they’re worth paying attention to as you get organized.

Employers have just begun to issue W-2s, which report wages paid to employees. Other types of income, whether from contract work or investment income, get reported via a 1099 form. These 1099 forms start hitting your mailbox (and/or email inbox) in January (and even December of the year prior) and continue apace for the rest of the month and often beyond.

There are actually many separate 1099 forms. The unifying theme among them is that they document that you received some type of income during the preceding year; that income may or may not be taxable.

Most investors are familiar with the basic 1099-DIV and 1099-INT forms: The former reports dividends and capital gains from taxable investments during the prior year, and the latter depicts interest income received. Form 1099-B, meanwhile, depicts any capital gains or losses realized in taxable accounts. Some firms amalgamate all of this information into a single consolidated 1099. Independent contractors and small-business owners may receive a 1099-MISC, which documents income received from businesses or employment in the past year.

If you’re using some type of tax-preparation software or farm your tax prep out to an accountant, you may process these forms with barely a thought. But your investment-related 1099s can yield some valuable insights about your portfolio management and its tax efficiency.

Before you pop them into your tax file, ask yourself the following questions:

- Am I taking a tax-efficient approach to dividends?

- Have I considered whether it’s possible to minimize taxable capital gains?

- Have I taken steps to maximize income?

- Have I taken steps to maximize tax-free income?

- Do I understand how my foreign securities are taxed?

- Am I maxing out my tax-sheltered accounts?

- Am I minimizing taxes on retirement plan distributions and conversions?

- Is my portfolio as streamlined as it can be?

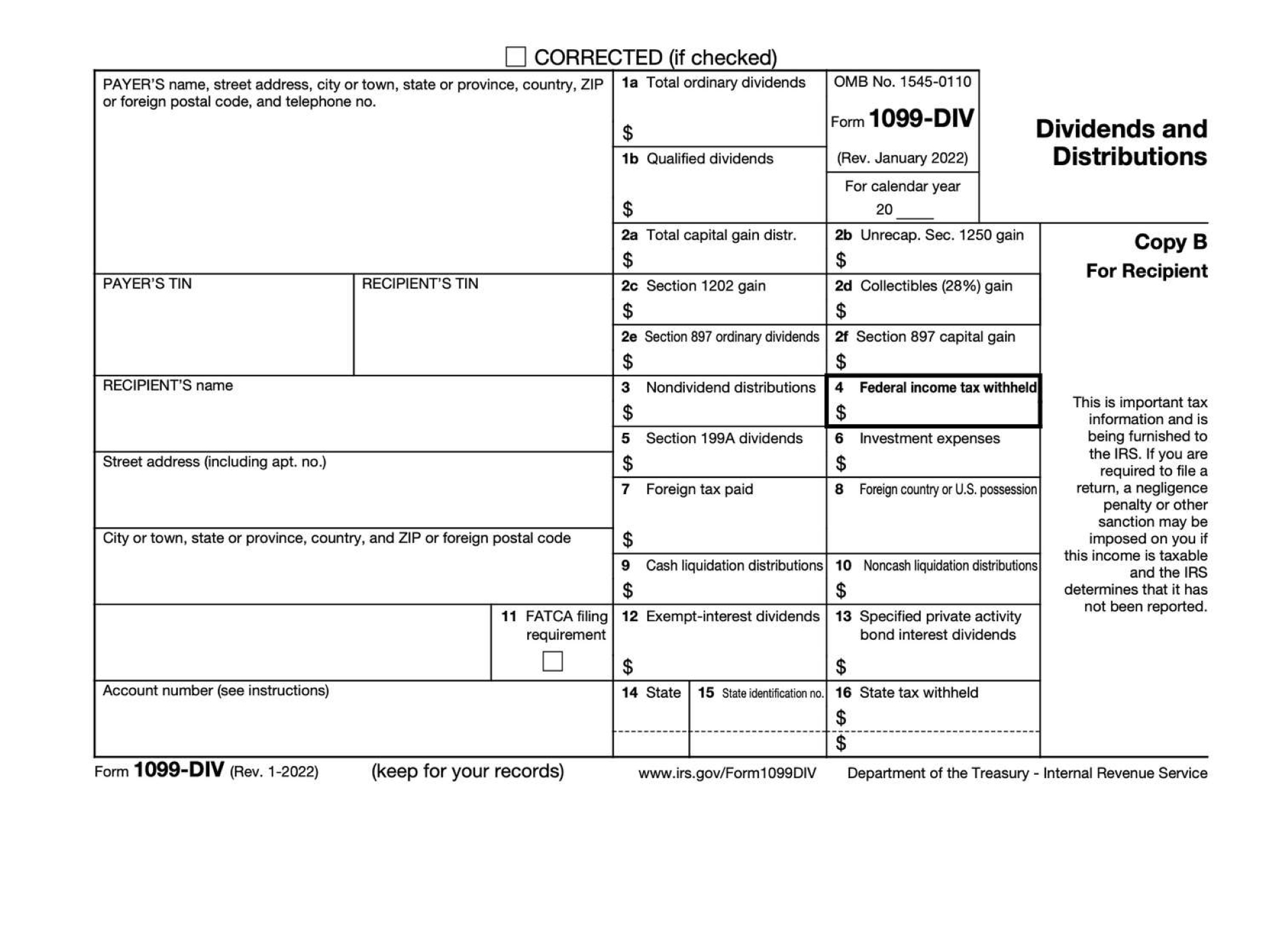

You can find answers to the questions above within the different sections of your 1099-DIV form.

1099-DIV

1. Am I taking a tax-efficient approach to dividends?

The first two boxes of 1099-DIV forms deal with dividends: Box 1a shows you the total ordinary dividends you received, and Box 1b shows you which of those were qualified. Ideally, all of your dividends will count as qualified, because they’re eligible for a lower tax rate than nonqualified ones. Dividends from most U.S. companies, as well as qualified foreign corporations, count as qualified, though there are holding-period requirements to obtained qualified dividend tax treatment. By contrast, nonqualified dividends, from REITs and some foreign stocks, for example, are subject to your ordinary income tax rate.

If the figure in Box 1a is much bigger than 1b, that’s a cue to assess asset location: If you’re holding securities that are kicking off nonqualified dividends in your taxable account, could you make room for that type of holding within your tax-sheltered accounts, while prioritizing qualified dividend-payers for your taxable? And if you have dividend-rich holdings—even if their dividends are qualified—and are reinvesting your dividends, it’s also worth considering whether such holdings might make more sense in your tax-sheltered accounts. That way, you won’t owe tax on your income distributions year after year.

2. Have I considered whether it’s possible to minimize taxable capital gains?

Box 2a shows whether your mutual fund holdings made capital gains distributions last year. (If you yourself made a sale, you’ll see that reflected on Form 1099-B, not 1099-DIV.) When funds have gains on their books, those gains must be distributed to shareholders when those appreciated securities are sold. Yet some funds, especially broad-market equity exchange-traded funds, traditional index funds, and tax-managed funds, do a better job minimizing those capital gains payouts than others. Some investors have put off ditching their serial capital gains distributors because of fear of triggering their own taxable capital gain on the sale, but that might not be as big a deal as they suspect.

3. Have I taken steps to maximize income?

It’s worth noting that you won’t receive any kind of 1099 if your earnings were less than $10. You’re still required to report those earnings to the IRS on your tax return, however. If you have substantial cash accounts but aren’t earning much income, that’s a wake-up call to seek out higher-yielding cash options. Brokerage sweep accounts often have rock-bottom yields, whereas you may be able to pick up a substantially higher payout with a money market mutual fund, online savings account, or CD.

4. Have I taken steps to maximize tax-free income?

Your 1099-DIV also depicts the amount of tax-exempt interest dividends that you received. If you’re in a higher tax bracket (say, the 24% tax bracket or above), the income you receive from a municipal bond (or bond fund) may well be higher than the aftertax income you receive from a taxable account.

5. Do I understand how my foreign securities are taxed?

If you hold foreign-stock funds in your account—or even U.S.-focused funds that dabble in foreign securities—Box 7 of 1099-DIV depicts any foreign taxes paid on those holdings for the year prior. Investors in foreign stocks have to pay taxes on their earnings in the company’s country of domicile, as well as to the United States. The key to not getting taxed twice is to claim a deduction or credit for foreign taxes already paid. In addition, the ability to deduct foreign taxes paid may make a taxable account a more attractive receptacle for foreign stocks than an IRA or 401(k). Investors should take care to not put the tax cart before the horse, however. Moreover, some dividends from foreign stocks aren’t qualified, so placing them within a taxable account may offset, at least in part, the value of the foreign tax credit.

6. Am I maxing out my tax-sheltered accounts?

You’ll only receive a 1099-DIV from a taxable (nonretirement) account; you won’t get them from your IRAs and 401(k)s, for example. That makes sense, when you think about it: Any income that these tax-sheltered accounts kick off from year to year isn’t taxable in the year in which you receive it; rather, when you pull the money out, you’re taxed on any income that hasn’t already been taxed. (You’ll receive a 1099-R instead when you take those distributions.)

There are several virtues to investing in a taxable account—flexibility and a lack of strictures on contributions and withdrawals, as well as fairly favorable tax treatment currently for dividends and capital gains. But investors who hold long-term assets within a taxable account are giving up the tax-deferred or tax-free compounding that comes along with traditional IRA and Roth IRA accounts, respectively. That’s the key reason I’d put them way down in the retirement-funding queue.

7. Am I minimizing taxes on retirement plan distributions and conversions?

You’ll receive a 1099-R form when you take a distribution from a retirement account; you’ll also receive a 1099-R if you convert a portion of your traditional IRA to a Roth IRA. If you’ve taken a distribution from a traditional tax-deferred account and your balance consists of pretax contributions and tax-deferred investment earnings, your withdrawal will be taxable. But if you’ve made nondeductible contributions to an IRA, documenting that those contributions were aftertax, by filing Form 8606 in the year in which you made the aftertax contributions, will help ensure that your contributions aren’t taxed again when you pull the money out in retirement. (You will owe on your investment earnings, though.)

Similarly, if you made charitable gifts via a qualified charitable distribution, you’ll receive a 1099-R. To help ensure that the amount of your QCD isn’t taxable, you’ll need to provide documentation of your contribution. (Most of the big investment providers allow investors to conduct their QCDs online, sending money from the account to the charity and generating the appropriate paperwork along the way.)

8. Is my portfolio as streamlined as it can be?

If you received many 1099s from different providers, that could be a signal that your portfolio is “busier” than it needs to be. Is there a way to consolidate your accounts with a single provider or two, rather than maintaining a lot of “onesie” accounts? If so, consider streamlining.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)