Lord Abbett Continues to Grow and Improve

Overall, the firm earns a Positive Parent Pillar rating, largely for its strong manager ownership, reasonable fees, and shareholder-friendly practices.

Lord Abbett, founded in 1929, is a throwback in many ways to asset managers of decades ago. The firm is an independent partnership, owned by nearly 70 partners and led on a day-to-day basis by a managing partner (the equivalent of CEO) who eventually passes on the reins to a hand-picked successor. While many competitors these days have diversified their offerings to include passive options, Lord Abbett is solely devoted to active investment management. This could pose a challenge for the firm in a post-fiduciary-rule world, especially because they are also largely focused on the retail channel. That said, the firm continues to build out its institutional business.

After some disruption and turnover following the naming of Daria Foster as managing partner in 2007, the firm has enjoyed a period of relative stability. Under Foster, the firm has implemented significant changes to the structure of the investment organization and some funds. Management team turnover has since slowed dramatically, though the firm continues to add head count as it expands its global equity and multiasset offerings.

While there has been significant performance improvement within the firm’s equity team, it remains a work in progress. As such, the firm has experienced significant outflows from its domestic-equity funds: $30 billion in net outflows between 2006 and 2016.

The firm’s taxable-bond lineup, however, has seen stronger interest from investors. After Foster took over, the team shifted its focus from government securities to credit-sensitive securities, relying more heavily on quantitative tools and fundamental bottom-up analysis. For example, the firm retooled

In June 2016, longtime CIO Bob Gerber retired and was replaced by Rob Lee. Lee was named deputy CIO in late 2015 and formerly was head of taxable fixed income. That’s not cause for concern. Lee joined Lord Abbett in 1997 and helped build the firm's fixed-income investment platforms; he has been instrumental in the growth and success of that side of the business.

Overall, the firm earns a Positive Parent Pillar rating, largely for its strong manager ownership, reasonable fees, and shareholder-friendly practices.

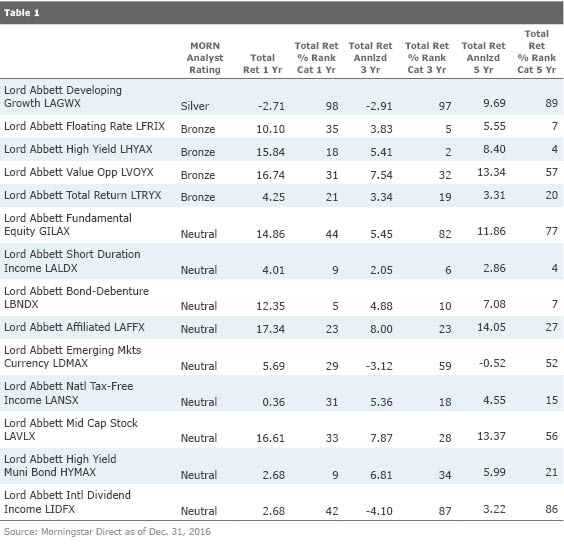

Below is a table of all Lord Abbett Funds receiving a Morningstar Analyst Rating with recent performance data.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)