Sustainability-Focused Funds Garner Positive Flows in 2016

Parnassus Funds gained assets last year. Plus, new options make it easier to build SRI portfolios.

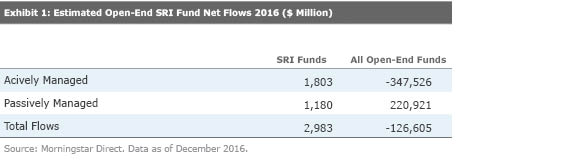

In the face of continued significant U.S. open-end fund industry outflows, sustainability-focused open-end funds experienced positive net flows in 2016, based on Morningstar estimates. While investors pulled more than $127 billion out of open-end funds last year overall, they put nearly $3 billion into funds with some type of sustainable, responsible, or impact mandate.

The list of SRI[1] funds continues to grow, with 17 fund launches in 2016. Several big conventional fund companies, including American Century, JPMorgan, Morgan Stanley, and PIMCO, added environmental, social, and governance, or ESG, criteria to the investment processes of some of their existing funds.

That brings the total to more than 150 U.S. open-end funds with an SRI mandate. Add to that the estimated $717 million that flowed into SRI-focused exchange-traded funds in 2016 and another 17 new ETF launches, bringing the total number of exchange-traded portfolios with an SRI mandate to 45.

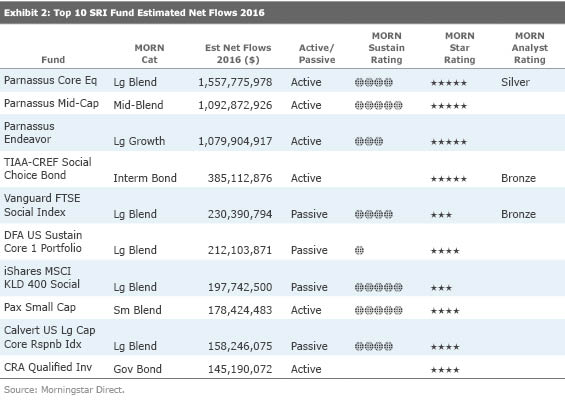

Despite all the big names entering the field, Parnassus Funds is the little engine that could when it comes to gathering assets. Parnassus funds ranked first, second, and third in terms of estimated net flows among U.S.-based open-end SRI funds in 2016.

In business since 1984, Parnassus labored for years as one of several small dedicated SRI shops until 2001, when Todd Ahlsten began managing Parnassus Core Equity. Under Ahlsten's guidance, the fund has an 8.9% annualized return during those 15-plus years compared with 5.9% for the S&P 500, and the fund has grown from $60 million in assets to more than $15 billion today. More recently, other Parnassus funds have followed suit in terms of performance, including Parnassus Endeavor, headed by firm founder Jerome Dodson, which focuses on firms with best ESG practices particularly related to workplace issues.

The remaining active funds on the top 10 flows list include

Sustainable investors have a number of passive options, including the four that made the top 10 flows list. All are competitive with conventional index funds. Although three of the four trailed the S&P 500 in 2016, three of the four have outperformed that index during the trailing five years. The DFA fund is more difficult to buy unless you are working with a DFA-affiliated advisor, and it has a low Morningstar Sustainability Rating. The Calvert index fund is a load fund, but, unlike the firms running the other three passive funds on the list, Calvert goes the extra mile by actively engaging with companies it holds around ESG issues.

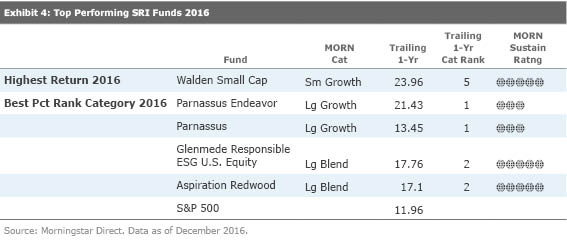

Overall performance of SRI funds in 2016 was competitive with, if not a bit better than, that of conventional funds. Among SRI funds, 26% finished in the top quartile of their Morningstar Categories, while only 13% finished in the bottom quartile. Two thirds of the top-quartile performers were diversified U.S. equity funds. The much smaller bottom-quartile group was spread across several fund types, with energy and biotech sector funds comprising more than one third of the year's underperformers.

With an increasing number of well-established funds across many categories and new entrants from larger firms, it is easier than ever for fund investors to put together portfolios of sustainable funds. You can use the portfolio-based Morningstar Sustainability Rating to assess how well an SRI fund's holdings are doing managing their ESG risks and opportunities. And where gaps exist in terms of available high-quality SRI funds, you can use the Sustainability Rating to find conventional funds that nonetheless have holdings that do well on ESG criteria.

[1]SRI traditionally stood for "socially responsible investing," but more and more, investors are using the terms "sustainable," "responsible," and "impact" to describe the field, leaving us with the same acronym.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)