Consider Hedging Your Global Bond Currency Risk

Long-term investors haven't historically been rewarded for taking on currency risk.

On the heels of rate hikes in 2015 and 2016, the Federal Reserve has signaled that additional increases are likely. Rising rates could put a dent in U.S. bond returns, at least in the short term. But investors could reduce their U.S. interest-rate exposure by diversifying into international-bond funds. True, yields in most developed markets are low, but it is not prudent to ignore the diversification benefits international bonds can offer, especially if the actions of central banks around the world diverge. Investors who decide to take the plunge must determine whether to hedge their foreign-currency exposure. While the answer will not be the same for everyone, bond investors have historically not been compensated for taking currency risk in the long run, and this risk dramatically increases volatility. However, an investment in an unhedged bond fund allows investors to express a bullish view on the U.S. dollar.

Hedged Versus Unhedged Whether hedged or unhedged, investors would have earned similar returns from portfolios of international bonds in the long run. In other words, currency movements have not added substantial returns to international bond portfolios over long investment horizons. Any outperformance from appreciating currencies was inevitably followed by underperformance stemming from currency depreciation, erasing prior outperformance in the long haul.

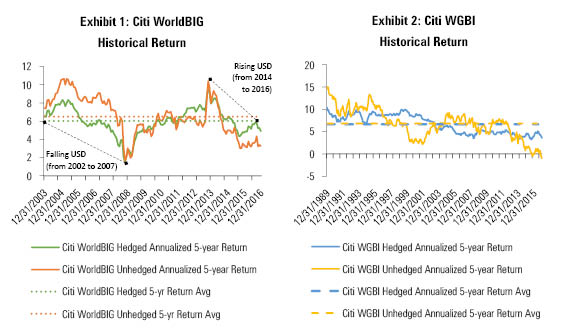

To investigate the effect of currency hedging in international-bond funds, I compared the historical performance of the hedged and unhedged versions of the Citi World Broad Investment-Grade Bond Index, or WorldBIG, and the Citi World Government Bond Index, or WGBI. Exhibit 1 illustrates the annualized five-year rolling returns of hedged and unhedged WorldBIG from January 1999 to December 2016. The dotted lines are the averages of these returns. On average, the unhedged broad index posted a five-year trailing annual return of 6.0%, outpacing its hedged counterpart by 0.4%. This return pattern persists in the global government market. Exhibit 2 shows that the unhedged WGBI has generated an average five-year rolling return of 6.8%, beating the hedged government index by 0.2% from January 1985 through December 2016.

There are many factors affecting the performance of international bonds. One of the biggest is the value of the U.S. dollar. For example, when the dollar depreciated against most major currencies from 2002 to 2007, the unhedged international bonds, represented by Citi WorldBIG Unhedged, outperformed its hedged counterpart (shown in the Falling USD line in Exhibit 1). To illustrate, assume $100 equal EUR 100 today. Now suppose the U.S. dollar loses half of its value against the euro in the following year. So, if an investor purchased widgets worth EUR 100 a year ago, now the widgets are worth twice that, or $200. Similarly, unhedged international bonds were worth more after the U.S. dollar depreciated. The same principle works in reverse when the dollar strengthens. From 2014 to 2016, the U.S. dollar appreciated against several major currencies, and the hedged international bonds, represented by Citi WorldBIG Hedged, outperformed its unhedged peer (shown in the Rising USD line in Exhibit 1). As economic conditions across different markets ebb and flow, currency values fluctuate, but over the long run the impact is largely washed out.

- Source: Morningstar Direct. Effective date Dec. 31, 2016.

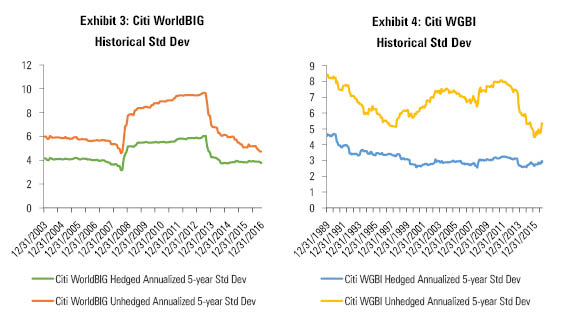

However, investors would experience significantly more volatility from unhedged international-bond portfolios than hedged portfolios. Exhibit 3 shows USD-hedged and unhedged WorldBIG’s historical volatilities measured by annualized five-year rolling standard deviation from January 1999 to December 2016. On average, the unhedged broad bond portfolio exhibited 50% larger fluctuations than the U.S. dollar-hedged fixed-income index. This risk is more pronounced in the global government market. From January 1985 through December 2016, the unhedged sovereign index’s volatility was twice the hedged WGBI’s, as shown in Exhibit 4. The sovereign bonds tend to have lower credit risk than the corporate bonds, and thus, fluctuations from foreign currencies are more accentuated.

- Source: Morningstar Direct. Effective date Dec. 31, 2016.

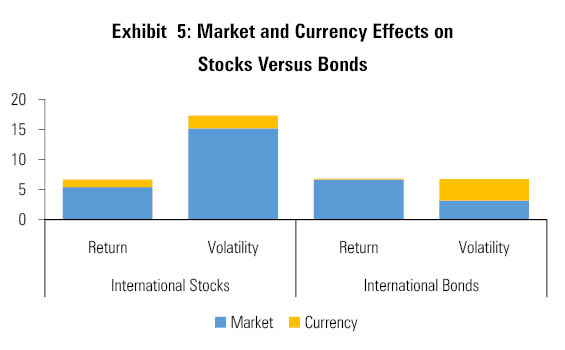

Currency fluctuations contribute more to the total risk of an unhedged bond portfolio than they do for an unhedged stock portfolio because bonds are much less volatile. Exhibit 5 illustrates how much market and currency each have contributed historically to five-year trailing returns and volatilities for both international stocks (measured by the MSCI EAFE Index) and bonds (measured by the WGBI) from 1985 to 2016. The graph shows that currency exposure has greatly contributed to international bonds’ risk without offering meaningful compensation. Currency risk looks more modest relative to international stocks’ volatility in their local currencies.

- Source: Morningstar Direct. Effective date Dec. 31, 2016.

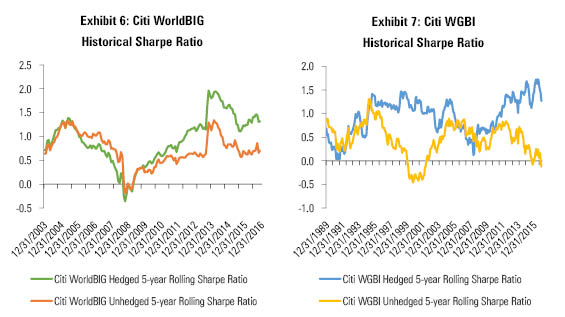

The currency-hedged global-bond index offers a more-favorable risk-adjusted outlook because currencies do not reward investors with higher returns despite their higher risk. This phenomenon is illustrated in Exhibits 6 and 7, which show the five-year rolling Sharpe ratios (a measure of risk-adjusted performance) for WorldBIG and WGBI, respectively, from January 1999 to year-end 2016 and January 1985 to year-end 2016. As shown above, the return figures were about the same for both hedged and unhedged portfolios, but the unhedged indexes had larger standard deviations. Therefore, the unhedged portfolios produced lower Sharpe ratios, supporting the view that long-term investors are probably better off with hedged global-bond portfolios.

- Source: Morningstar Direct. Effective date Dec. 31, 2016.

On the other hand, local-currency fixed-income funds could potentially be an efficient way to express a directional view on the U.S. dollar, especially a negative one. For example, WorldBIG Unhedged cumulatively returned 61.5% from 2002 to 2007, when the U.S. dollar declined, while WorldBIG Hedged gained 36.8% during the same period. This positive return was primarily driven by foreign currencies sharply appreciating against the U.S. dollar. There are other advantages of unhedged funds as well. Investors can avoid the cost of currency hedging altogether. Although the hedging cost has come down significantly in recent years, investors should expect to spend between 0.10% to 0.20% annually according to Vanguard. Although they are not explicitly included in fund fees, investors pay the cost with lower returns. Also, any gains from foreign exchange hedging activities could have unfavorable tax consequences for investors.

Investment Options

For long-term investors looking to diversify abroad, a currency-hedged global bond such as

Vanguard Total International Bond ETF

BNDX is worth considering. It carries a Morningstar Analyst Rating of Bronze and offers low-cost (expense ratio 0.15%) exposure to investment-grade bonds listed in developed markets outside the United States. BNDX fully hedges its foreign exchange exposure and has successfully tracked its benchmark. But this fund’s overweighting in lower-yielding government bonds gives it a lower yield than the world-bond Morningstar Category average. In addition, Japan, France, and Germany make up 40% of its portfolio, increasing concentration risk. This concentration is attributable to the fund’s market-cap-weighting approach, which skews to the most indebted countries.

PIMCO Foreign Bond (USD-Hedged)

PFORX (0.50 expense ratio) is a solid actively managed alternative; its Institutional share class carries a Morningstar Analyst Rating of Silver. It is run by PIMCO’s experienced team with significant analytical resources, and its low fee provides a durable edge. PIMCO’s firmwide top-down view guides the fund, and the team looks for the most attractive relative value opportunities across different sectors,

and positions on the yield curve. Its performance has been stellar in recent years. Its five-year trailing return through December 2016 of 6.0% handsomely beats its category average of 1.4%, placing the fund in the category’s top 3%. The fund’s risk-adjusted performance (measured by Sharpe ratio) for the same period ranked in the top 3%, too.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)