Our Take on the Fourth Quarter

U.S. stocks ended 2016 on a high note as Trump’s election, a rate hike, and the OPEC production cut deal were eyed.

U.S. stocks continued their climb in the fourth quarter. The broad-based Morningstar US Market Index rose 4% in the quarter, is up over 12% for the year, and has gained nearly 15% a year for the past five years.

The biggest story of the quarter was likely the election of Donald Trump. Although the futures market briefly sunk on the news, the market quickly turned around and rallied through the end of the year. Investors have bet that the new administration will spend heavily on infrastructure, cut taxes, and reduce regulations. Interest rates rose, too, as the bond market priced in higher expectations for inflation and growth.

Seeing an uptick in inflation expectations, signs of emerging services inflation, and a stable job market, the Fed raised rates by 25 basis points in December, the first increase in a year. The boost was widely expected and greeted by the market with a yawn.

The OPEC deal to cut crude oil production sent prices higher in the quarter, ending north of $53 a barrel WTI, a far cry from the sub-$30 range seen in early 2016. Our analysts think the benefits of the cuts will be short lived as higher prices will stimulate U.S. shale production, adding more supply to the market, and sending prices lower once again.

Morningstar’s analysts have provided an in-depth review and outlooks across equity sector, fund categories, and the broader economy. Their takes are below along with quarter-end fund category and index data.

Morningstar's Quarter-End Coverage

Economic Outlook More of the Same Anemic Growth Despite high hopes, we believe 1.9% GDP growth will prove closer to the mark in 2017.

Stock Market Outlook New Expectations Set the Tone for 2017 Following the Trump victory, the market has incorporated expectations for stimulus, higher inflation, and higher interest rates.

Sector Outlooks Basic Materials: China-Led Rally of 2016 Rests on a Shaky Foundation Commodity price gains are likely to prove temporary as stimulus exacerbates China's underlying problems and sets the stage for lower long-term growth.

Consumer Cyclical: Poised (and Priced) for a Strong 2017 Discretionary companies have benefited from decreased uncertainty post-election as consumer expectations are set with the new administration.

Consumer Defensive: Cooking Up a Bit More Value Despite tepid near-term growth prospects amid an intensely competitive landscape, pockets of value remain.

Energy: OPEC Adds a Plot Twist, but Ending Is Unchanged Improved near-term fundamentals come at a cost.

Financials: What Will Really Drive Interest Rates? Investors' attentions are often focused on Fed actions, missing the larger picture.

Healthcare: What Does a Trump Administration Mean for Healthcare Stocks? We don't see any major shifts in U.S. drug prices over the next several years, but we expect changes to the Affordable Care Act.

Industrials: Baking In Too Much Optimism Sector fundamentals are unexciting and valuations are elevated, but a few names show promise.

Real Estate: Through the Noise, Opportunities Exist To navigate the choppy waters ahead, keep it simple and focus on the fundamentals.

Technology: This Firm Is the Newest Software Empire The force is with Salesforce, which is one of the most advantageously positioned companies in software.

Utilities: Still High Even After Bonds' Withdrawal The utilities yield spread has turned much more bearish after bonds collapsed at the end of the year.

Credit Market Insights Global Rates on the Rise Global interest rates continued to climb as investors priced in expectations that the global economy is entering a reflationary environment.

Fund Spy The Year in U.S. Equity Funds: Resilient in a Tumultuous 2016 In a year of unexpected events, U.S. stocks rose again with small caps outperforming for the first time since 2013.

Bond Funds Year in Review: A Tale of Many Markets 2016 was anything but a quiet year for bond-fund investors.

The Year in Alternative Funds: A Bumpy Road With Some Bright Spots Some of the luster has dulled from the once-booming liquid alts category.

Data Report

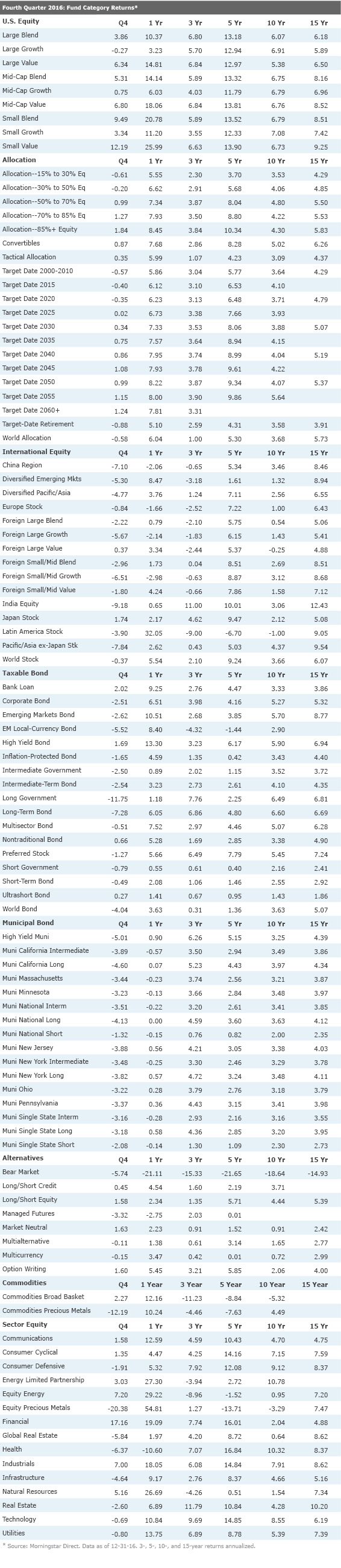

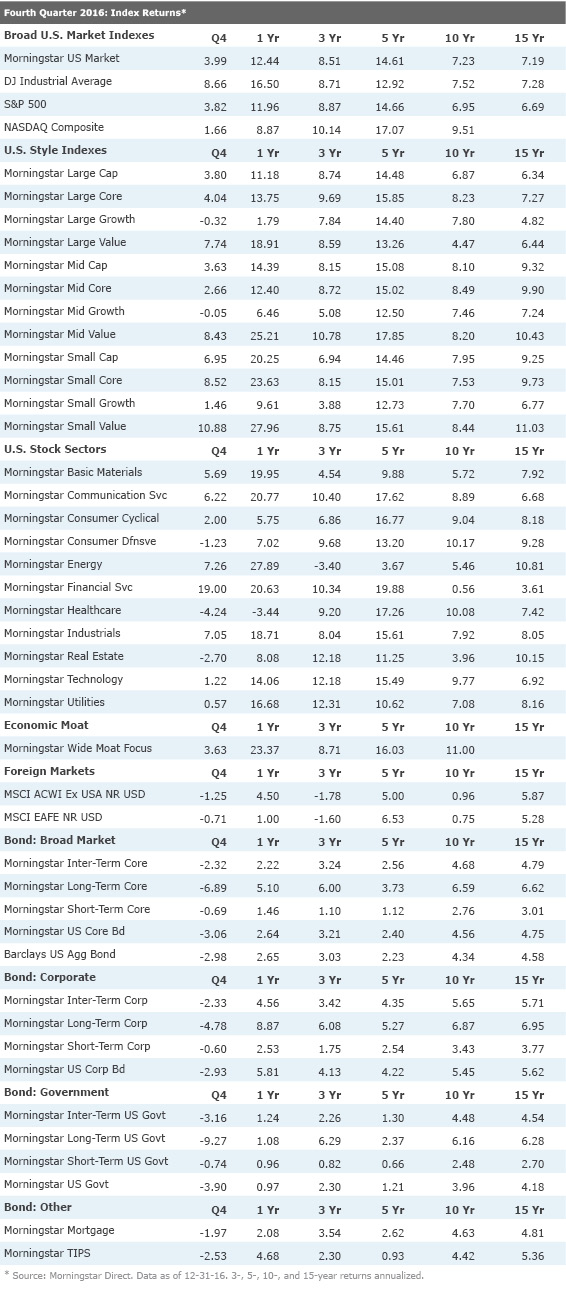

Open-End Fund Category Returns Index Returns Download Data (Excel)

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)