The Year in U.S. Equity Funds: Resilient in a Tumultuous 2016

In a year of unexpected events, U.S. stocks rose again with small caps outperforming for the first time since 2013.

From the fear-induced sell-off in January and February amid plunging oil prices, to the United Kingdom's Brexit vote in June, to the U.S. presidential election outcome in November, 2016 has been full of unexpected events. Still, U.S. stocks have proved resilient, as the S&P 500 was up 13.2% for the year to date through Dec. 23. For the first time since 2013, the small-cap-oriented Russell 2000 Index--which was up 22.5% for the year to date--is expected to outpace the S&P 500.

Energy and basic-materials stocks have led the way within the broad Russell 3000 Index in 2016, both climbing more than 23% after being the two worst-performing sectors from 2013 through 2015. Commodity prices fell sharply in recent years amid excess oil supply and global growth concerns, but they have trended upward since hitting their trough in early 2016.

Within energy, top performers include midstream oil firms

The financials sector is up 22% this year as investors have bet that a Donald Trump presidency will bring higher interest rates and a rollback of Dodd-Frank regulations. Banks such as

After being the best-performing sector from 2013-15, healthcare is the only one that has posted a loss this year--it was down 2.7% through Dec. 23. Biotech stocks such as

Morningstar Style Box Categories

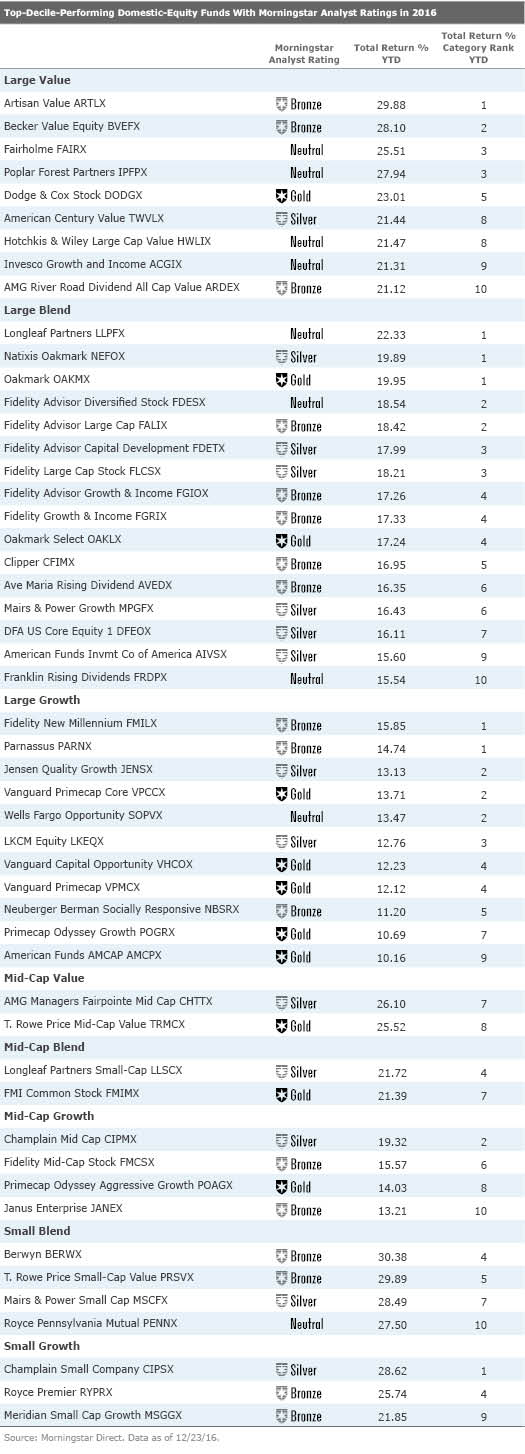

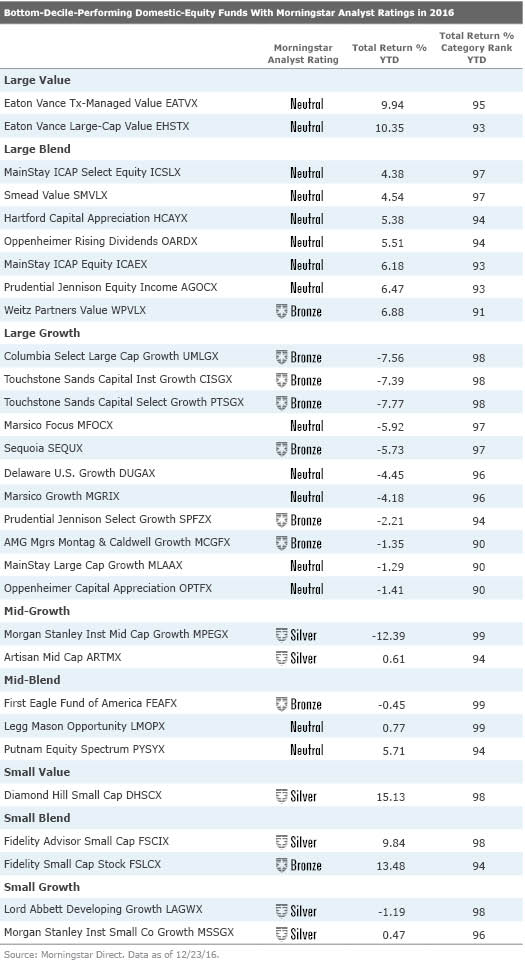

Historically, value stocks have tended to outperform growth stocks, and small-cap stocks have tended to outperform large-cap stocks. However, in recent years, growth stocks--particularly on the large-cap side--have posted better results, driven partly by investors' hunt for earnings growth in a sluggish economic recovery. This year marked a return to the historical norm: Small-cap stocks outperformed their larger-cap counterparts for the year to date through Dec. 23. Small-value was the top-performing category in the Morningstar Style Box for the first time since 2008, gaining 27%.

The small-blend category gained 22% in 2016. Silver-rated

The large-value category posted a gain of 16% for the year to date. Neutral-rated

Large growth was the worst-performing category for the year through Dec. 23, gaining just 4%. Bronze-rated

For additional details on Morningstar Categories, please click here.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)