Are Investors Getting Ahead of Themselves?

With the impacts of Trump's policies already priced in and current economic data going nowhere fast, the stock market is in no-man's land, writes Morningstar's Bob Johnson.

Markets didn't move much this week as the U.S. Federal Reserve's quarter-point interest rate increase was well anticipated. However, individual Fed governor forecasts seemed to suggest that three rate increases were in store for 2017 instead of the previous expectation of just two. I don't think that should have come as much of a surprise to anyone, but markets seemed to lose some steam after the Fed's announcement on Wednesday.

Markets are currently in no-man's land, largely having priced in possible positive impacts of Trump's potentially stimulative policies, but current economic data is going nowhere fast. A lot of the month-to-month economic data that looked so strong in September and October (which the Fed officially mentioned in its release) suddenly looked just OK in November. Month-to-month retail sales, housing starts, and industrial production, all released this week, faltered some and generally missed expectations. The year-over-year data in these three key reports was less worrisome but certainly didn't indicate a big boom ahead.

European and U.S. equity markets were little changed in terms of U.S. dollars. Emerging markets fared worse, suffering yet another 3% weekly loss. More tough talk from Trump, a stronger dollar, and higher interest rates in the U.S. are all weighing on emerging-markets indexes.

Rates were indeed higher this week, with the U.S. 10-year bond reaching a new 2016 high at 2.6%, notching another 0.11% increase over last week. Longer-term yields have jumped considerably more since the small increase in the Fed Funds rate. Commodities had an unusually quiet week, showing little change. We suspect that energy-related commodities will get another boost next week as another polar vortex settles in over the Midwest.

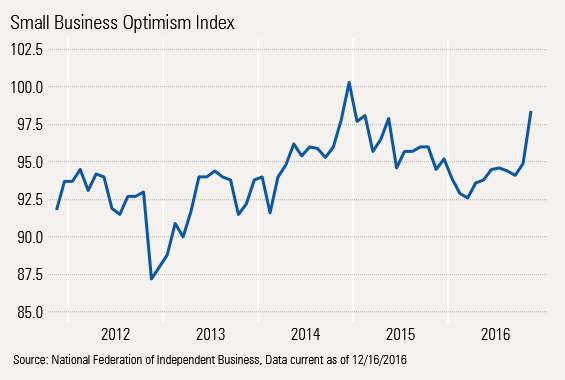

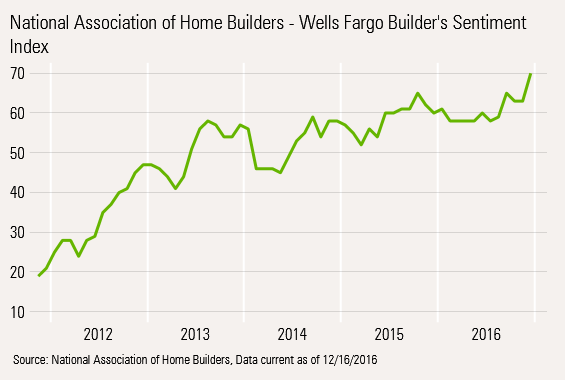

This week two sentiment indicators, the NFIB small business sentiment report and homebuilders sentiment, were strong. The builders sentiment scored a new recovery high, despite much higher mortgage rates over the past month. Small businesses felt a lot better, too, likely on hopes of less regulation, one of the key small-business concerns over the past couple of years.

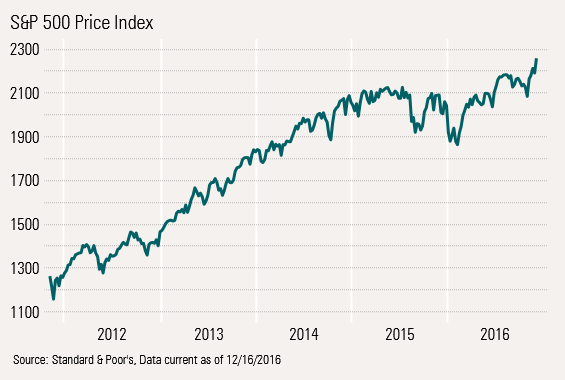

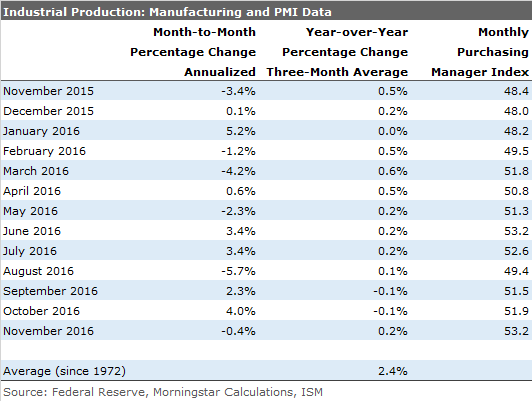

The stock market, though a bit slow this week, is very near a recovery high. So while the current economic data set is looking at least a little rocky, everyone seems excited about the future. On a cautionary note, we have never been a huge fan of any sentiment indicator. One of the more recent examples is the Purchasing Manager Index, which has been improving over the past several months even as industrial production data remains stuck in the mud.

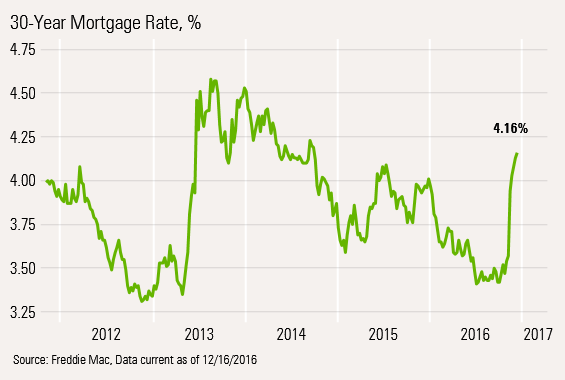

Fed Announcement Proves to Be a Nonevent The Fed did what it had to do this week and raised the Fed Funds rate from 0.25%-0.50% to a new range of 0.50%-0.75%. Reading individual federal governor forecasts, they are independently forecasting rates will move to 1.4% Fed Funds Rate by the end of 2017 and 2.1% by the end of 2018. While these appear to be large increases, considering inflation is moving higher, too, they may not be as restrictive as many assume. Given our inflation outlook of 2.0%-2.5% for 2017, the Fed rate still looks like a bargain. However, our biggest fear is what higher rates will do to the housing market.

Sentiment Indicators Picking Up Steam; We Remain Skeptical Over the past several weeks, we have seen many sentiment-related indicators gain momentum. Of course the granddaddy of them all is the stock market, which is sitting very near an all-time high after gaining a lot of momentum since Trump's election.

There are a lot of hopes for tax cuts, more fiscal stimulus, and less regulation built into current markets, with valuations looking increasingly stretched. We worry, too, that these new policies will take a lot more time to implement than anyone suspects. Meanwhile, the economy is already losing some momentum and interest rates will likely slow housing activity.

Small Businesses Are Fired Up The optimism was clearly visible in the normally skeptical small-business community where the composite sentiment index jumped sharply in November to its highest level since 2015, and not all that far from the recovery high.

We suspect that a lot of talk about decreased regulation was a reason for the renewed small-business optimism. Every month, the federation raged vigorously against a wide range of regulations. Even the hope of fewer new regulations would be reason for small-business optimism. Regulation, along with taxes, has been a key small-business concern for several years.

Even Homebuilders Optimistic We were a bit surprised by the strong rise in homebuilder sentiment given sharply rising interest rates. As we detail later in this report, we believe rising rates could have a dramatic impact on housing. I guess the potential for more growth and maybe an easier permitting process might explain some of the optimism, but we are a lot more skeptical.

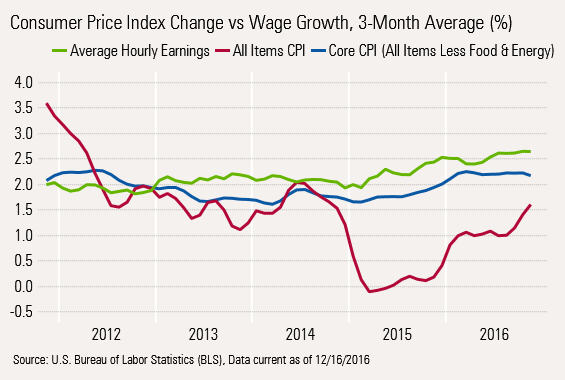

Headline Inflation Moves Higher, Potentially Pressuring the Consumer Wage growth is usually driven by core inflation, as corporations and individuals don't want to move wages up and down as food and oil commodities move up and down. Over long periods of time, core inflation, which excludes food and energy, and headline inflation usually converge. Still, over the short term core inflation (and wages) and headline inflation can differ widely. This creates risks and opportunities. The wide spread between wages and inflation, beginning in 2015, was a huge boon to the consumer. However, as that gap continues to narrow, consumers will likely feel the pressure. At 70% of the economy, that will not be great news for the GDP calculation.

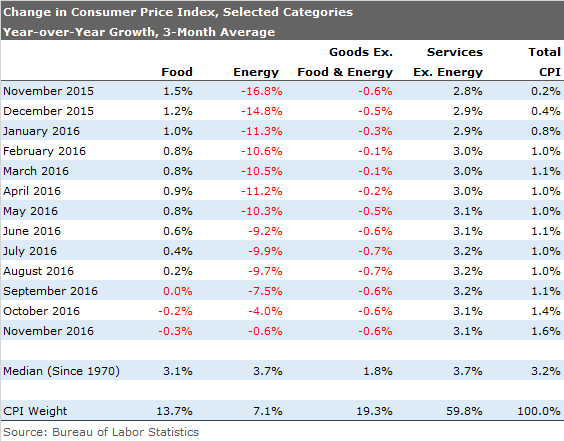

Energy Deflation Has Just About Run Its Course, Pushing Headline Inflation Sharply Higher Over the last year, total year-over-year inflation has moved from 0.2% to 1.6% on a year-over-year, averaged basis. Less energy-related inflation is responsible for most of that change, with lower food prices basically offsetting higher services prices.

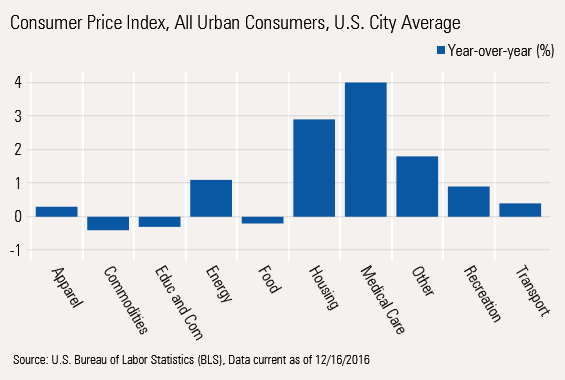

Higher Inflation Driven by a Few Categories, Not Pervasive Widespread Inflation Looking at the year-over-year data by major categories, high inflation is not pervasive. In fact three categories moved lower over the past year, including commodity (code for hard goods, such as cars and appliances), communication services, and food. Housing services, drive mainly by higher rents and limited availability has been an issue, as has medical care.

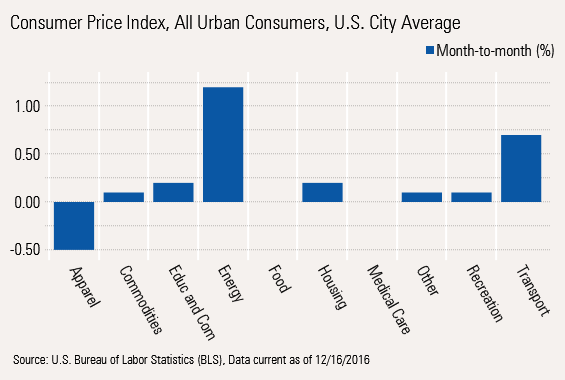

Even the monthly inflation data shows few real problems except the renewed energy inflation we have referenced earlier. Even healthcare is in one of those rare periods where there was no significant increase. The monthly medical data has been all over the place, but we would guess the year-over-year pattern continues to show relatively high growth.

A lot of funky-looking categories are special cases driven by quirks and not by too much money sloshing through the economy. Auto insurance rates are going through the roof, driving the transport category as new sensors embedded in many new car bumpers have dramatically increased the cost of a small bumper-related accident.

The point of this discussion is that inflation may not be as easy to stamp out as everyone thinks. Another crop failure somewhere, an energy producer deal that holds together, medical costs that resurge, or clothing prices that stabilize because weather returns to normal could all push inflation sharply higher, and the Fed would be powerless to do much about it in the short run. Consumers would likely suffer.

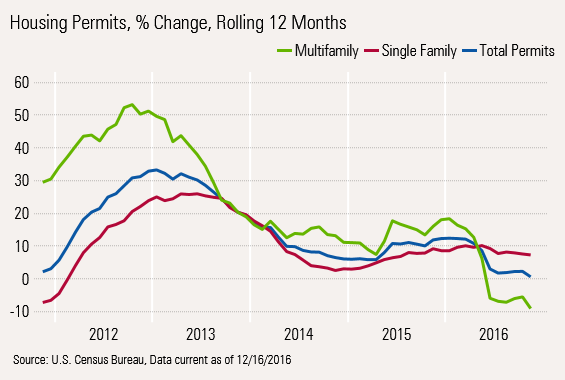

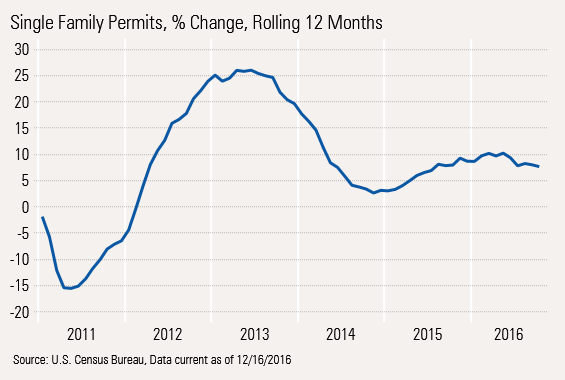

Single-Family Housing Data Looks OK for Now; Multifamily Erodes When we receive the monthly housing report, we generally toss out the starts portions of the report that most news stories focus on. Instead, we turn to permits data, which is less affected by weather. And looking at rolling 12-month growth rates makes the most sense, given the volatility of the data.

Single-family data--the red line below--is relatively stable-looking and is currently reading about 8% as it has for most of the past year and a half. Meanwhile, multifamily permits are still decreasing on our preferred metric, pulling permit growth down to about zero. Luckily, the multifamily market is less than half the size of the single-family market in terms of units. In addition, each multifamily unit costs much less than a single-family unit and utilizes less labor.

We have pulled out the single-family graph to show its relative stability.

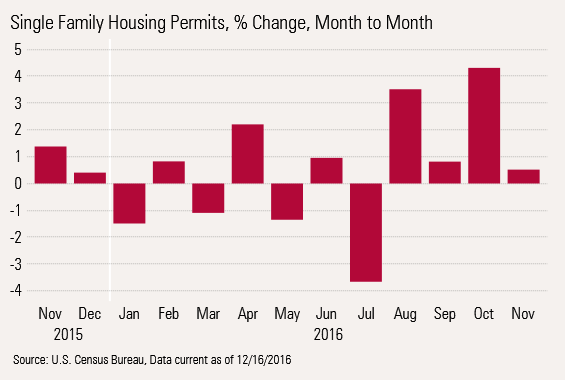

For those keeping score on industries doing well after the election, real-world housing data was not a winner in November.

Mortgage Rates Jump, Endangering the Housing Market Although stock markets may not have shown much reaction to the Fed announcement this week, mortgage rates soared even higher, following increases every week since Trump's election.

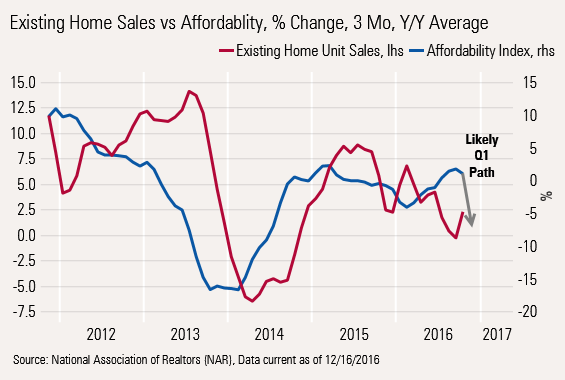

Higher Rates Will Dramatically Affect Affordability

Housing affordability indexes are a great forward indicator of existing-home sales. We anticipate that when housing affordability indexes for November are released, they will show a 5%-10% decline, as shown on the graph. That does not bode well for the housing market, a key component of economic growth.

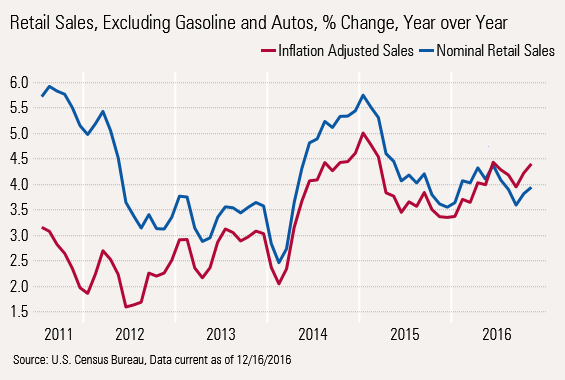

No Trump Rally in Retail Sales for November; Year-Over-Year Data Stable Inflation-adjusted retail sales data looked relatively stable on a year-over-year basis, though still clearly well below recovery highs (when the wage growth was well above headline inflation.)

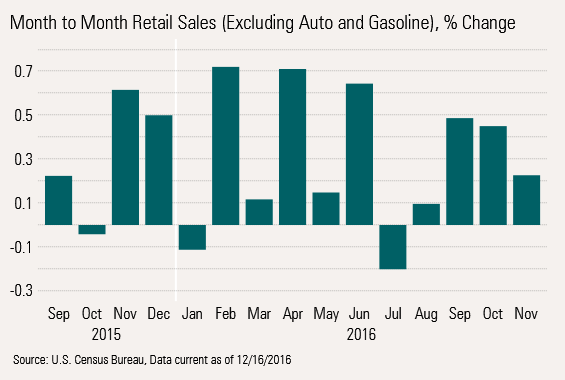

However, the month-to-month data slowed considerably from September and October.

Industrial Production Data Didn't Look so Great Either, Despite Strong Sentiment-Like Indicators

Industrial production data showed a monthly decline and almost no growth on a year-over-year basis, disappointing most economists. Most economists had hoped rising purchasing manager indexes would drive production higher in November.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)