Baby Boom Couple Assess Retirement Readiness

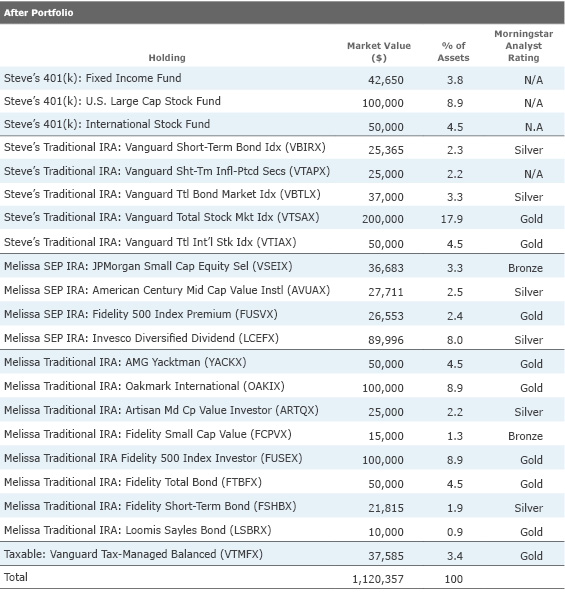

Our "after" portfolio is more streamlined, contains stable assets for early-retirement distributions.

Melissa and Steve, ages 60 and 63, respectively, are typical of many workers of their generation and younger. Rather than staying put with a single employer, they've each had numerous jobs in the healthcare industry. Melissa is currently working as a contractor for a pharmaceuticals firm. Steve moved out of the private sector in the late 1990s and has been an employee in their state's university system ever since.

As a result of their job-hopping, their $1.1 million portfolio features numerous accounts, each with at least a few, and sometimes several more, holdings.

"We have a mishmash of 401(k) and IRA accounts," Melissa said. She and Steve would like help streamlining their accounts, and assessing its positioning as retirement draws closer. While they've had success with their equity-heavy portfolio in the past, Melissa wonders whether their asset allocation is too aggressive.

"I feel like we are stock-heavy, but I don't see much reason to be in bonds right now," Melissa wrote. (Incidentally, many other Portfolio Makeover submissions we received echoed those same concerns.)

The couple is in the process of paying for college for their two children, ages 22 and 20; they expect to be through with tuition payments in two more years, at which time they'll start looking hard at retirement. Will their portfolio be sufficient to supply in-retirement expenses, they wonder? Steve will be able to rely on a generous pension and the couple will also have Social Security, but they live in a high-cost part of the country.

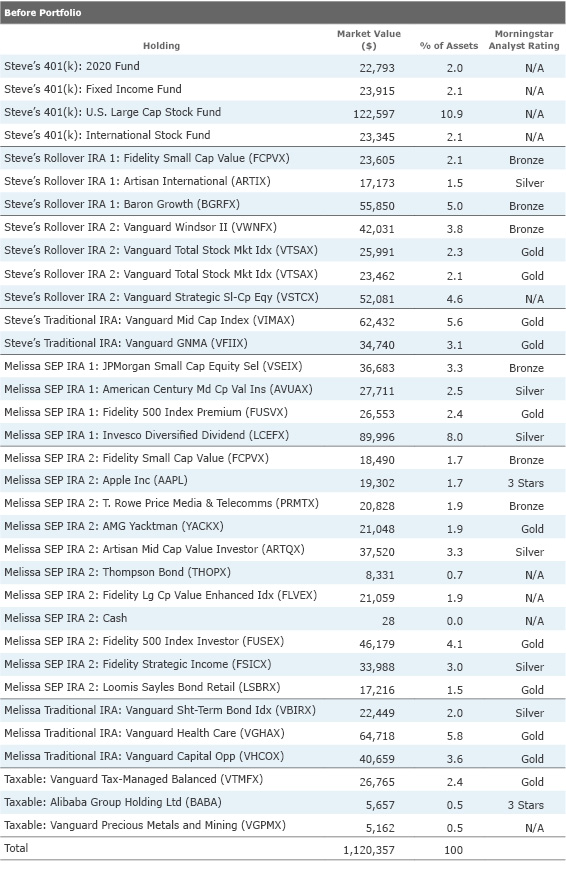

The Before Portfolio

Melissa and Steve currently have seven separate accounts and 34 holdings--a combination of 401(k)s, SEP-IRAs, rollover IRAs, and taxable assets. Their portfolio consists primarily of mutual funds, but they hold a few stocks in their taxable account. An X-Ray view of their portfolio shows an 82% weighting in stocks (74% U.S./8% foreign), 14% bonds, and 4% cash. Their equity portfolio is reasonably well dispersed across the style box, albeit with a slight bias toward small- and mid-caps than is the case with the broad market. The couple--and Melissa in particular--are Morningstar research enthusiasts and it shows: All 23 of their rated mutual funds are Medalists.

Steve holds assets in his current employer's 401(k) plan, which features low-cost investment options run by various managers. For example, BlackRock runs the target date lineup, while the International Stock fund relies on managers from BlackRock, Dodge & Cox, and Harding Loevner. (Steve's investment choices are a combination of mutual funds, separate accounts, and commingled funds.) Steve also has two rollover IRAs, one at Fidelity and one at Vanguard, and a traditional IRA. Within these accounts, Steve owns both actively managed funds (

Melissa has a traditional IRA, too. In addition, she has a SEP-IRA for her current employer, as well as a separate SEP-IRA from a previous employer. Her portfolio, too, features fine active funds alongside index products. She also owns a few sector-specific funds--

Finally, the pair holds a small taxable account that is anchored by the excellent

The After Portfolio

At first glance, Melissa and Steve's retirement assets look light relative to their current spending rate of roughly $100,000 a year. (That estimate doesn't include their recent hefty college outlays, which will, blessedly, cease in a few years.) The good news is that Steve will be bringing a substantial pension into retirement; that will supply roughly $45,000 in annual income, along with a 2% annual inflation adjustment. The couple's income from Social Security will bring in the rest of their desired expenses: Melissa will receive roughly $32,000 in annual income at age 66, while Steve will receive roughly $24,000 at full retirement age. Their Social Security payments will, of course, increase if they delay past their full retirement ages.

While their portfolio appears terribly aggressive, a heavy equity stake is warranted given their limited spending needs from it. However, because delaying Social Security delivers such a powerful payout--a roughly 8% pickup in benefits for each year they're able to delay to age 70--that argues for spending from their portfolio in their early retirement years in exchange for larger Social Security benefits and reduced withdrawals later on. Spending from their tax-deferred accounts would have the additional benefit of reducing the amount of their portfolio that will eventually be subject to required minimum distributions. My "after" portfolio, therefore, boosts safe assets in both spouses' tax-deferred portfolios. While Melissa holds some fine bonds in her SEP-IRA, they're lower-quality and unlikely to hold up well in an equity-market sell-off. I targeted roughly a fourth of the portfolio for cash and bonds, to improve diversification (and reduce the portfolio's susceptibility to an equity-market shock) and provide liquidity when retirement commences.

Many of my other changes are geared toward reducing this couple's number of accounts and holdings. For example, while I'm impressed with the quality of Steve's 401(k) and see no reason to upend it, I did remove his target-date fund, as distinct stock and bond holdings will give him the latitude to pick and choose which asset class he taps for withdrawals in retirement. I also boosted his bond stake a bit.

My "after" portfolio also combines his traditional and rollover IRAs into a single account. (Morningstar contributor Natalie Choate reviews the rules for combining various IRA types in

; the Cliffnotes version is that only people who are concerned about creditor protections should be wary of combining their rollover IRAs with their contributory IRAs, as the former enjoy better creditor protections.) Because the bulk of Steve's IRAs were already with Vanguard, I combined his holdings at that firm. I added

I didn't make any changes to the SEP that Melissa and her employer are currently contributing to, as she has made some solid picks from her plan's low-cost investment menu. For example, her plan's share class of the Silver-rated

Meanwhile, Melissa's other SEP-IRA assets can be combined with her traditional IRA assets. Because Melissa favors the Fidelity platform--both for the Fidelity-branded funds as well as the funds available on its platform without a transaction fee--I retained many of her choices, while boosting her high-quality fixed-income holdings. I added

Because Melissa and Steve's taxable portfolio is a fairly small piece of their portfolio, I reduced it to a single multiasset holding that's tax-efficient.

Melissa and Steve have a lot of assets in tax-deferred accounts, meaning that nearly all of their kitty will be subject to required minimum distributions (and in turn, ordinary income tax) once they pass age 70 1/2. That makes it all the more sensible that they draw upon those assets in their early retirement years--to reduce their future RMDs. Melissa and Steve should also explore converting some of their traditional IRA assets to Roth, especially after retirement commences and they have more control over their taxable income. They may be able to engage in partial conversions each year to avoid pushing themselves into a higher tax bracket.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)