Loving the Now While Being Realistic About an Age Gap

Our 'after' portfolio embraces a more aggressive asset allocation while jettisoning some quirky individual positions.

Editor's note: This article is part of Morningstar's 2016 Portfolio Makeover Week.

Jon and Michael have been together for 33 years and happily married for the past three. They have a comfortable nest egg of more than $2 million; their newly purchased home in a large metropolitan area is fully paid for. Having retired from his career in the technology industry a decade ago, Jon, 69, is enjoying both his leisure time and volunteering for charities in their community. Michael, 56, plans to seek out a new job now that the couple has settled into their new city.

Of his own portfolio and the investments he made for his nieces' and nephews' educations, Jon wrote, "I've seen the miracle of compound interest in my investment life." But he also regrets that he has been too conservative with his investment choices in the past. He'd like to ensure that their portfolio is optimized to deliver the cash flows that he and Michael need, while also maintaining enough growth potential for the future.

"Since there is a 13-year difference in our ages, it is important that there be enough assets left after I die to support my husband for another 15 years or so," Jon wrote.

Jon is also a fan of the bucket strategy, and would like to see that thinking reflected in their portfolio's positioning. He'd also like to streamline the portfolio, reducing the number of individual-stock and bond holdings in favor of broadly diversified, inexpensive products from the Vanguard lineup.

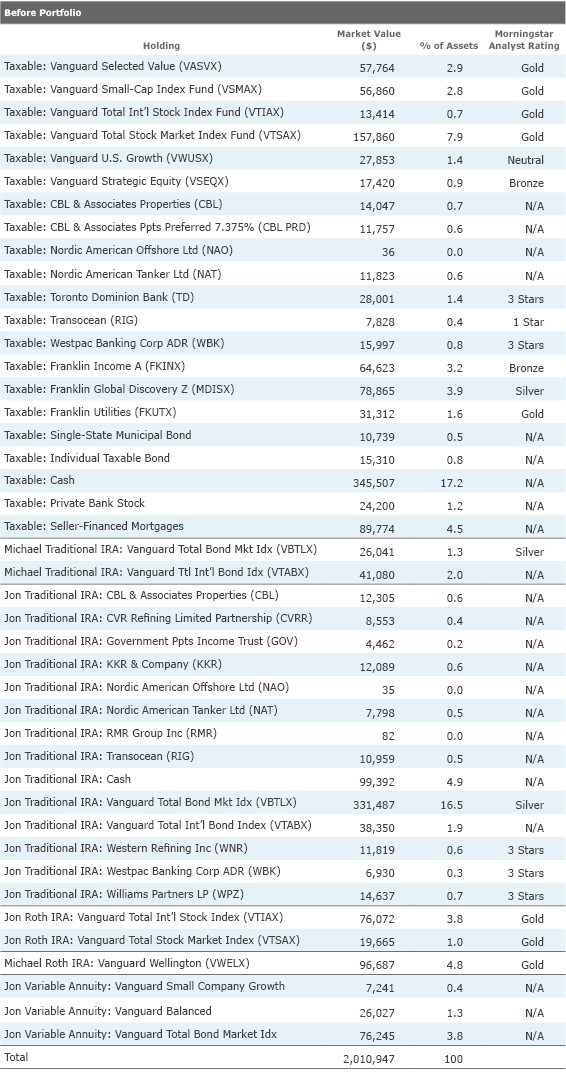

The Before Portfolio

Viewed through Morningstar's X-Ray (and using a few mutual fund proxies to stand in for holdings that aren't available on Morningstar.com), the total portfolio features 25% in cash, roughly 30% in bonds, and the remainder in equities.

The investment selections in Jon and Michael's portfolio are a study in contrasts. On the one hand, the portfolio includes heavy weightings in big, broad index funds. On the other, their portfolio features many small positions in individual stocks, many of them smaller-cap income producers hailing from the energy, financials, and real estate sectors.

Jon and Michael hold their assets in four major silos: a joint taxable account, traditional IRAs in each of their names, Roth IRAs in each of their names, and Jon's Vanguard variable annuity.

The taxable account is the largest of these kitties, at just over $1 million. It contains a large cash position--primarily the proceeds from the sale of the couple's former home. Additionally, Jon and Michael hold an assortment of mutual funds in this portion of the portfolio, including several fine offerings from Vanguard and the Franklin families. They also hold a smattering of smaller positions: a handful of individual bonds as well as some smaller-cap stocks and limited partnerships that Jon and Michael purchased in the name of generating income from their portfolios. Finally, Jon holds two seller-financed mortgages that generate very attractive rates of interest. Rather than paying interest and principal to the bank, the buyers of these properties pay directly to Jon, as discussed in this article.

Traditional IRAs form the next-largest pool of assets. Because Jon has been the family's primary earner, most of the couple's traditional IRA assets are in his name. Jon holds two core bond funds within his traditional IRA:

Roth IRAs and Jon's variable annuity are the last two pools of assets. In keeping with the long holding horizon typically associated with Roth accounts (because of the potential for tax-free compounding), this is an equity-heavy piece of their portfolio. Jon holds two equity-index funds in his Roth, while Michael holds

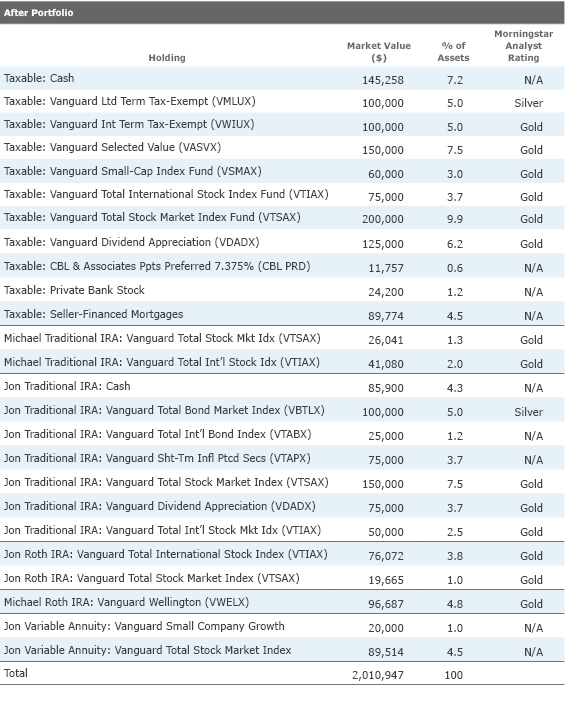

The After Portfolio

As with the other makeovers profiling people in or close to retirement, a portfolio review should focus on two key elements. First, how viable is the portfolio over the expected in-retirement time horizon (will the money last)? Second, how should those assets be positioned given time horizon, withdrawal sequencing considerations, and so on? The two issues are related, of course, but I think it makes sense to take them in that sequence.

Jon notes that their current annual spending rate is roughly $50,000 a year, though he'd like to use a $65,000 target for the future, to accommodate travel expenditures. Of their current $50,000 in income needs, Jon's Social Security supplies $14,000; income from Michael's job and the private mortgages have supplied the rest of the couple's income needs over the past few years.

While maintaining too much liquidity in the portfolio is obviously not necessary, holding some cash is a good idea. Jon notes that he's nervous about his private mortgages, as the mortgage-holders' jobs are on shaky footing. Moreover, Michael hasn't yet found a new position in the couple's new community. Thus, I think it's realistic to carve out enough liquidity in the portfolio to tide Jon and Michael through a disruption in the income from the private mortgages, Michael's working income, or both.

The good news is that even in a worst-case scenario and the couple have to spend more from their portfolio than they are currently doing, their retirement-portfolio plan looks sustainable, even factoring in Michael's very long time horizon.

Given their fairly modest spending rate, however, Jon and Michael's portfolio seems too meekly positioned today. Using my moderate bucket portfolio as a general blueprint, bucket 1 consists of two times their (worst-case scenario) annual spending needs in cash, or $100,000; per Jon's request, I added another $100,000 to the cash kitty because he'd like to do some opportunistic buying if and when stocks eventually sink. That brings their total cash holdings to roughly $230,000, or about 10% of their portfolio. I earmarked an additional eight years worth of living expenses, or $400,000, for high-quality bonds. The remainder of the portfolio can reasonably go into stocks of varying types, both U.S. and foreign, because they have at least a 10-year holding period for them. The total "After" portfolio's asset allocation is 14% cash, 28% bonds, and the remainder in stocks.

Given that Jon and Michael are most likely to dip into their taxable accounts when they need additional cash, it's only sensible that that account be positioned the most conservatively. Because their current cash holdings in their taxable account exceed my $200,000 target, I deployed the rest into municipal bond funds while retaining most of their fine Vanguard equity mutual funds. Jon and Michael's current tax bracket doesn't necessarily call out for municipal bonds, but a sell-off in the muni sector makes yields competitive with taxable bonds of comparable maturities on a pretax basis, and even better on an aftertax basis. Per Jon's request, I left some of his smaller, idiosyncratic positions in the taxable portfolio intact.

Michael is 15 years away from needing to take anything out of his traditional IRA, so those assets can be switched from bonds to stocks to pick up some growth in the intervening years. Because Jon's traditional IRA will need to be tapped for RMDs within a few years, however, I carved out some cash and retained some bonds in this account. (I also added a bit more cash to that account than I otherwise would be inclined to do in order to facilitate Jon's desire to engage in opportunistic buying in a down market.) I also added a position in Vanguard Short-Term Inflation-Protected Securities VTAPX to provide some cost-of-living protection to Jon's traditional IRA.

My goal for the equity exposure across all of the accounts was to keep the exposures well-diversified, high-quality, and inexpensive; I wanted to reduce some of the idiosyncratic risk that accompanied the individual stock holdings in the "Before" portfolio. I used total stock market index trackers and

True, my changes to the equity holdings reduce income that the portfolio kicks off. But the trade-off of switching to a bucket strategy is that the "after" portfolio is better diversified and more stable overall. As Jon and Michael spend down their cash holdings, they can replenish the money with income from their stocks and bonds, as well as rebalancing proceeds when they are available.

The rub, of course, is that the "After" portfolio calls for smaller stakes in cash and larger positions in stocks at a time when equities aren't especially cheap. For this reason, it makes sense for Jon and Michael to make any changes over a period of months rather than all at once, as they'll likely have better buying opportunities in both asset classes at some point down the line.

Because my changes to the taxable account require selling some long-held winners in which they have taxable capital gains, Jon, who has substantial expertise in tax matters, should move deliberately to do so. Jon notes that he and Michael should be able to stay below the 15% income tax bracket for 2016, which means they'll qualify for a 0% tax rate on long-term capital gains. For the winning positions they're hanging onto, they should consider tax-gain harvesting; if their tax bracket goes up for whatever reason in the future, they'll have lifted their cost basis.

Jon should also consider converting part of his traditional IRA to Roth in low-tax years. The big benefit in this situation is that any assets Jon can get over into the Roth column will escape RMDs and can pass to Michael without a federal tax burden. Michael could also consider converting some of his traditional IRA assets to Roth in low tax years; if he is making additional Roth IRA contributions once he secures employment, he could also make spousal contributions, provided his income is sufficient to cover the contribution amounts for him and Jon.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)