Is the Bond Market Crashing?

The data don't support that severe a conclusion.

The Federal Reserve’s Federal Open Market Committee met on Dec. 13 and 14, with bond markets fully expecting the group to raise short-term interest rates by 0.25% to a targeted range of 0.50% to 0.75%, and that's exactly what it did.

The committee also signaled, however, that it anticipated raising that target three times in 2017, a more aggressive pace than many observers had been expecting. The bond market reacted by driving up near-term Treasury yields--the widely followed two-year maturity spiked to its highest yield in several years--but, while longer-dated yields bumped around a bit, they ultimately moved little on Wednesday.

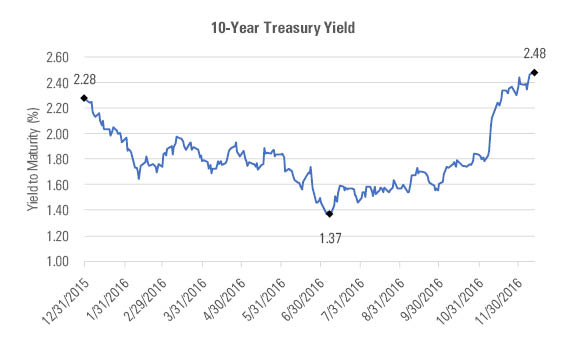

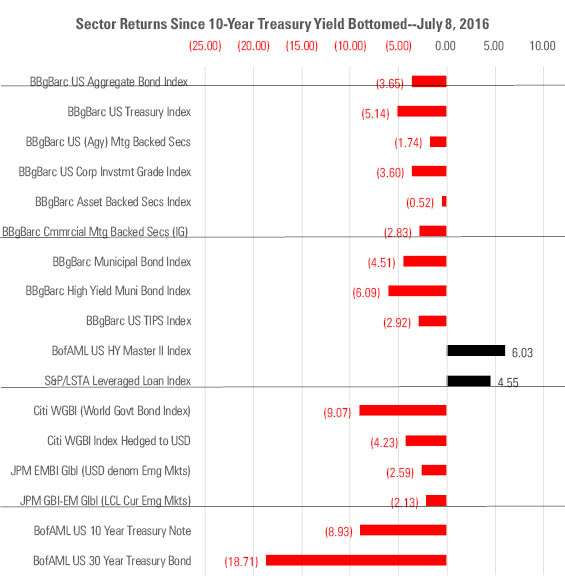

As important as that outcome may be, it is worth stepping back and taking a look at what has happened over the past year. While equity markets have hit a few bumps, the S&P 500 was still up nearly 13% for the year as of Dec. 12--a healthy chunk of that coming during the second half of the year. By contrast, bond markets have generally been suffering. Yields on 10-year U.S. Treasuries have risen since midyear, producing losses of nearly 9% since their July 8 trough.

There are a few interesting things to see below that surface. One is that despite that painful sell-off--and the degree to which it has been described by many as the market rout that’s been waiting in the wings for several years--yields aren’t very far from where they were at the beginning of 2016. The 10-year Treasury, for example, began the year with a 2.28% yield, and it registered at a modestly higher 2.48% as of Dec. 12.

- source: Morningstar Analysts

In fact, despite all of the noise that’s been made about that shift and the stock market exuberance that has followed the U.S. presidential election, bond markets are still not signaling expectations of runaway inflation or soaring yields.

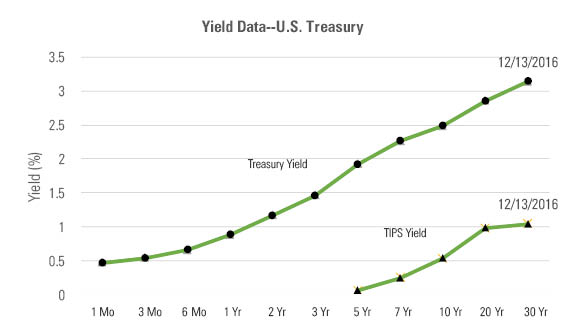

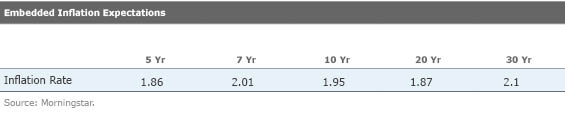

Inflation expectations embedded in the Treasury market, for example, are tame. The chart and table below show yields for both conventional Treasuries and Treasury Inflation-Protected Securities. The differences between them approximate the bond market’s expectation for inflation across the time of each maturity. Despite chatter suggesting that economic growth could be turbocharged under the new presidential administration, for example, five-year maturity conventional Treasuries and TIPS’ yields belie very modest inflation expectations well below 2% on average for the next five years. They’re a little higher for the seven- and 10-year periods, but not by much.

- source: Morningstar Analysts

- source: Morningstar Analysts

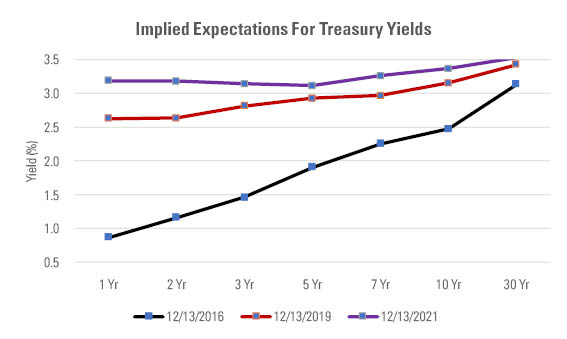

Bond prices can also be used to impute expectations for yields in the future, otherwise known as forward bond yields. And in that case, as well, the market is signaling change, but not as much as you might expect given the talk of the past few months. Investors are clearly expecting the Fed to continue raising short-term rates and for longer-term yields to also ratchet up. As of right now, though, that translates to expectations that three years from now, for example, five-year Treasury yields will be approximately 2.9%, up from a recent 1.9%. Likewise, expectations are for 10-year Treasury yields to hit roughly 3.2% three years from now, up from the latest 2.5% level. Meaningful changes, to be sure, but not the stuff of a crisis and certainly not when spread over three years.

- source: Morningstar Analysts

Against that backdrop, keeping money in the bond market doesn’t seem as foolhardy as it might if one were otherwise anticipating Armageddon. Meanwhile, the sell-off of the past several months has left a number of bond market sectors priced meaningfully lower than they were six months ago. That’s not true for the most credit-sensitive areas of U.S. corporate high-yield bonds and leveraged loans, but nearly every other corner of the bond market has felt some degree of pain.

- source: Morningstar Analysts

A few caveats. One is that it is important to note that forward rate expectations have a relatively weak record of accuracy. Those of a year ago were uncannily accurate when looked at from today, but over longer stretches the market has often proved earlier expectations both excessive and understated. That said, they do offer a window onto expectations in the marketplace that may otherwise be obfuscated by the financial press and punditry.

There’s also a difference between saying that something has been beaten down and saying that it is cheap. Government-agency-backed mortgages, for example, have lost around 1.75% of their value since 10-year Treasuries bottomed in July, and their yields have widened, on average, to 2.9% from 2% over that stretch. By some estimates, though, the sector’s so-called option-adjusted spread has shrunk by two thirds. In other words, the sector has lost value and its yields are higher, but when the value of its refinancing optionality is taken into account, mortgages look less attractive compared with Treasuries now than they did at midyear.

In other words, none of this should be construed as a buy signal for bonds or as a statement that they couldn’t be blindsided by any number of political or economic developments. As it stands right now, however, investors are signaling a lot less fear in the way that they are pricing bonds than otherwise seems to be floating around in the news.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)