The Challenges That Funds Face in Valuing Private Companies

No industry standard exists, which can lead to different valuations across fund companies.

Morningstar recently examined mutual fund ownership of private firms and found that most funds limit such exposure or avoid it all together. That said, some prominent funds do own private companies, so it's worth examining the risks these positions court. (See the full paper. This report was compiled before Morningstar's acquisition of PitchBook, a data provider for private equity professionals, and does not utilize PitchBook data.)

One of the biggest challenges is that no industry standard exists for determining appropriate valuations for private companies in mutual funds. What's more, fund companies could have varying levels of access to a private company's management team, board, and financial information, which are helpful in estimating fair values, with bigger investors potentially having an advantage. Private-firm investments could come in the form of preferred stock, common stock, or convertible bonds, which could affect valuations, dividend payments, future upside or downside potential, and priority in the case of a default.

At the biggest fund companies, including Fidelity and T. Rowe Price, a committee composed of people with backgrounds in accounting, compliance, trading, equity, or fixed income sets and monitors the valuations for private companies. Portfolio managers or analysts who would have a vested interest in seeing such investments appreciate do not sit on the committee. At other fund companies, the fund board's pricing committee oversees this process.

A logical starting point is a company's valuation from its most recent funding round. Given that funding rounds can be infrequent, fund firms typically consider company-specific and market-based factors when monitoring these investments. For instance, the stock price movements of publicly traded peers or the market as a whole may trigger a markdown or markup. However, no industrywide consensus exists for making valuation changes, as evidenced by a look at some of the most popular private equity investments.

Morningstar data showed a wide range of valuations for Airbnb series D and E shares (all security types) as of 2016's second quarter: $88.44 per share on the low end (Delaware) to $130.39 (Wellington via Hartford and Vanguard funds), with an average price of $105.91 across nine fund companies. Fund companies' pricing changes for Airbnb were often directionally similar between June 2014 and June 2016. For instance, all fund company owners marked down their shares in 2014's third quarter and marked them up in 2015's second quarter. But divergences were evident at other points. Six fund firms lowered their Airbnb valuation to an average of $85.06 following a market pullback in 2016's first quarter, but Fidelity and Wellington-subadvised Hartford and Vanguard funds marked up their stakes to over $100. A variety of factors could contribute to the inconsistent pricing, including fund companies holding different types of equity, having access to varying levels of company-specific information, making a judgment call based on a longer investment time horizon, or weighing market and peer-group stock price movements differently.

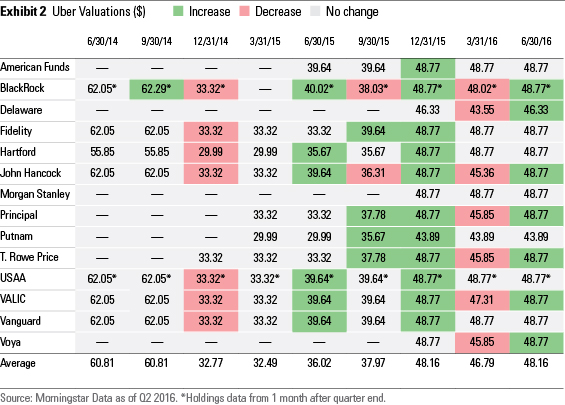

Uber's reported valuation showed more consistency. As of 2016's second quarter, 12 of the 14 fund-company owners in Morningstar's database valued it at $48.77 per share. (The two outliers valued it similarly, at $43.89 and $46.33.) Those prices were below the 2014 entry points for the earliest fund company owners. However, most fund companies later upped their stakes at even lower valuations.

When inconsistent pricing of private-firm equities occurs, this causes funds' net asset values to vary by the amount of the discrepancy. Thus, shareholders transacting at NAV when buying or selling fund shares could end up paying more or less for their proportional share of the same security depending on the particular fund's valuation approach. However, the direct impact to a fund owner is likely immaterial given the small role such investments play in virtually all fund portfolios at this time.

Conclusion While fluctuating valuations of private firms could affect a fund's short-term performance, particularly in cases where the stake is large, the biggest impact would likely occur if a private firm has an initial public offering or goes bankrupt. Fund owners should keep an eye on their funds' top holdings to gauge if the inclusion of private-firm equity is a concern, but most investors aren't greatly affected.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)