Job Growth: Strong Enough for a Rate Hike, Weak Enough to Frighten

The continued slowdown in year-over-year employment growth is no reason to panic, but it does mean consumption growth could also slow.

World markets generally didn't do very much this week after strong volatility in previous weeks because of the U.S. presidential election. However, almost all equity markets were down for the week as the excitement of potential Trump tax cuts and stimulus was tempered by economic data, especially a jobs report that was less than expected.

Auto sales were no gem, either, with increased incentives, fleet sales, and extra selling days unable to drive year-over-year growth any higher than 3.6%. Adjusting for the added selling days, sales were down 4.7% from a year ago.

Revised third-quarter GDP growth data (from 2.9% to 3.2%) was good news and bad news. The good news is the total GDP growth wasn't as bleak as we believed just a few weeks ago. Consumption was revised sharply upward, but a lot of business spending categories now look a little worse. The bad news is that growth will be more difficult to achieve in the fourth quarter. This is especially true since the consumption and employment data reported this week started the quarter off on a bad note. Employment data looked OK month to month, but was substantially below year-ago levels, which won't be great news for holiday sales.

Worries about stimulus, tax cuts, and a highly likely interest-rate increase by the Federal Reserve in December kept bond markets on their heels, especially at the beginning of the week (before some softer economic data rolled in on Thursday and Friday). The U.S. 10-year Treasury bond yield was almost unchanged for the week at roughly 2.4%, well off the 1.6% low of the year and much higher than the measly 0.25% rate increase the Fed is expected to make in two weeks. A lot of other bond markets, particularly municipals, fared a lot worse than the 10-year Treasury. Markets are now way out in front of the Fed, potentially blunting the impact of the actual rate increases, when and if they are announced. Obviously, markets believe the Fed's hand will be forced harder and faster than expected in 2017.

Commodities were the star of the week, gaining 3.4% in aggregate, driven by higher oil prices. Those in turn were driven by much higher oil prices that resulted from an oil producers' meeting that promised some substantial production cuts. While this may indeed help oil prices set a firmer floor, I still believe that with U.S. shale producers being the new swing producers, the days of setting oil prices between just a few countries in a smoke-filled room are behind us. Also, I don't think markets have figured out that demand is also an issue, with increased conservation measures really taking hold.

The revisions to GDP, consumption, and especially consumer incomes were large and comprehensive. They substantially changed the trajectory of economic growth that had begun to look very dismal. Unfortunately, there wasn't even time to heave a sigh of relief as the data for the rest of the week seemed to indicate that the bad prospects had merely been pushed out to a later date and not eliminated. Potentially compounding the weakness is the fact that sharply higher mortgage rates could stifle growth in the housing market. Higher rates in general will not be helpful for those businesses and individuals wishing to borrow more. We fear that the pain of higher rates and potential trade issues will begin to bite before any of the tax cuts or stimulus measures are even voted on.

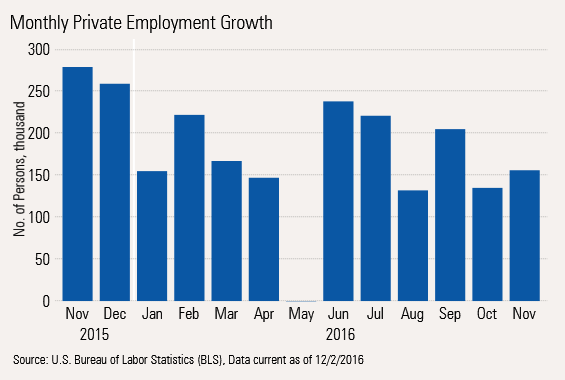

Employment Growth Fails to Accelerate Much Friday's employment report was a mixed bag. Total job growth of 178,000 was better than last month's total and in line with the average for the past 12 months. Other job-related reports this week (Challenger Gray lay-offs and ADP) had raised everyone's hopes for much better numbers. We certainly raised our expectations in this week's preview video, but cautioned that everyone's expectations were driven by high hopes for seasonal retail sales help, which failed to materialize.

Still, the number doesn't look horrible relative to recent months.

However, comparing this November to last November, things didn't look so great for private-sector employment. Last November, job growth was almost a 100,000 higher than this year, comparing the left most and right most bars of the graph above.

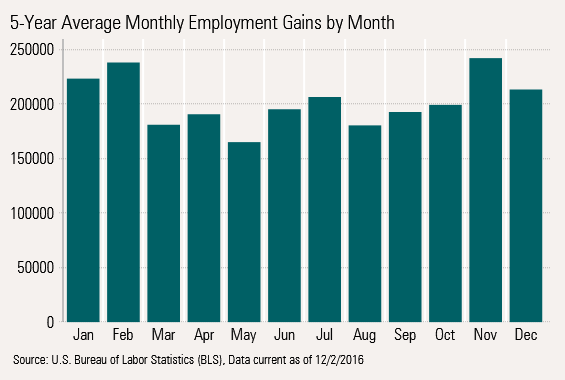

Historically, November has been one of the strongest months of the year for job growth.

In that context, the 156,000 private-sector jobs created last month (government kicked in another 22,000) seem like a cause for worry and not for cheering.

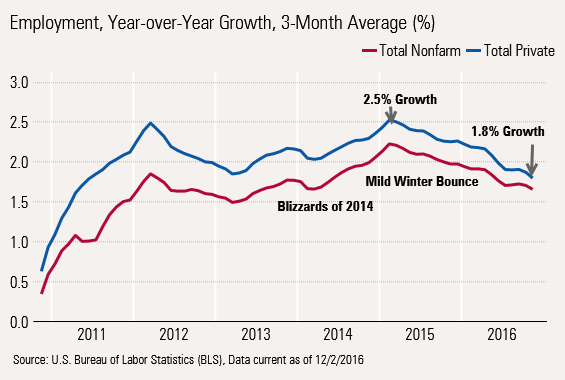

Year-Over-Year Averaged Data Continues to Slump We always prefer looking at the jobs data on a percentage basis, year over year and averaged. That eliminates a lot of the fluky month-to-month data that is so hard to rationalize.

Private-sector growth continues to drop, as shown by the blue line in the graph below. That rate has fallen from a high of 2.5% to 1.8%, a nontrivial drop. Still, we wouldn't panic, because strong 2015 results were partly due to an easy comp: winter 2014 was cold and stormy compared to a mild and tame 2015 winter.

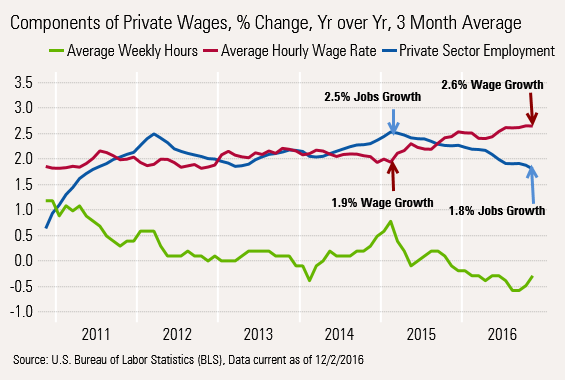

Components of Total Wage Growth Continue to Shift Normally, much slower job growth would be a reason for panic. However, hourly wage rates are just as critical, if not more, to total wage growth as the level of employment. The graph below shows that wage growth and employment growth have just about reversed places, cushioning the blow.

However, lower hours growth (actually a decline now) has moved total wage growth down a smidge. Perhaps the truncated scale makes it look like more than a smidge, but in the scheme of things this isn't much of a change, especially given the weather-related booms and busts.

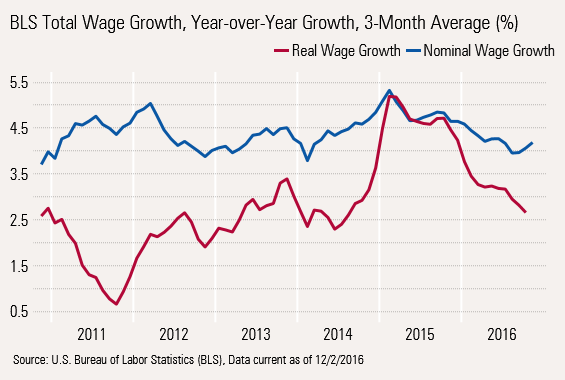

Nominal Wage Growth Acceptable, but Inflation-Adjusted Data, Not So Much We characterize the overall, nominal total wage shrinkage as a smidge, but inflation-adjusted data shows a dramatic drop, which won't be good news for the all-important consumption sector that makes up 70% of GDP.

Adjusted for much higher inflation today than a year ago, growth in total wages paid has been cut nearly in half from almost 5% to 2.5%.

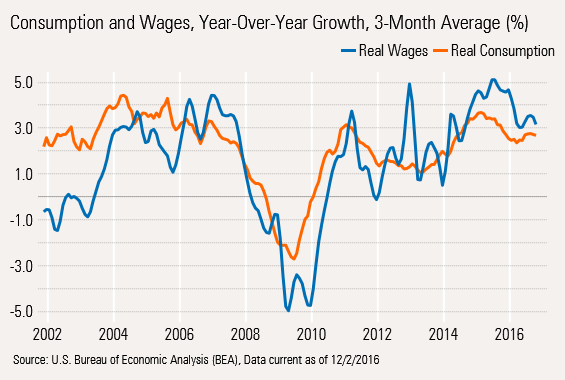

Consumption and Wages Generally Track Each Other Closely Most of the time, wage growth is very close to consumption. They move in tandem without one consistently leading the other. With wage growth now at about 2.5%, there is a very real possibility that consumption will fall from its current 2.7%.

Like employment growth, consumption rates have slowed, as reinforced by this week's consumption report. While the consumption moderation is not as severe as the wage data, it is still well below peak level.

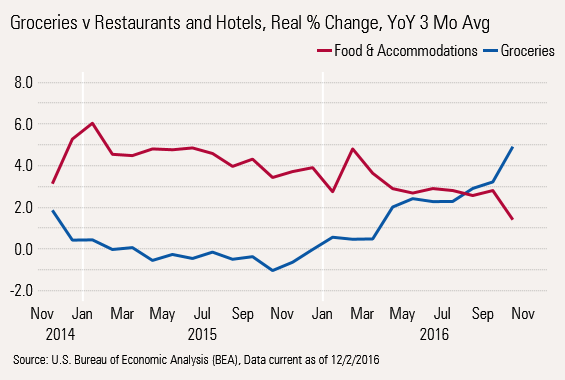

Still, there have been huge shifts in some of the underlying categories. Much cheaper grocery prices have driven up grocery store sales dramatically and put a real damper on restaurant sales, as shown below.

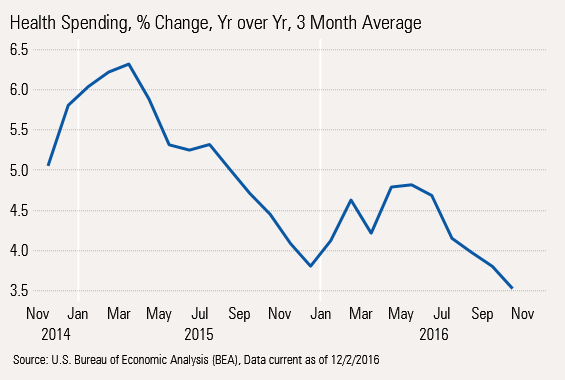

Healthcare Growth Diminishing As a lot of healthcare insurance programs have been fully implemented, expenditure growth has slowed dramatically in the second-largest consumption category behind only housing.

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)