Better Stewardship Creates Opportunity for AIG

The market’s view of the insurer’s turnaround efforts is too skeptical.

Insurers have two potential sources of income: investment income and underwriting profits. Combined, these two streams determine the return on equity a company generates. The relative level of investment income for insurers depends on hard-to-predict capital market movements and is largely out of the company’s control; higher investment returns typically reflect higher risk taking as opposed to investing acumen, in our view. We do not believe any insurance company has a sustainable competitive advantage when it comes to investing float. (Warren Buffett and Berkshire Hathaway BRK.B would be the one exception to this rule.) As a result, we focus exclusively on underwriting profitability to distinguish quality companies in the sector.

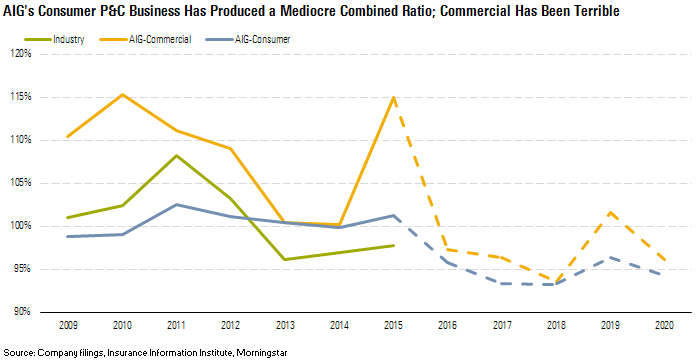

For property and casualty insurers, underwriting profitability is measured through the combined ratio, which is essentially a reversed underwriting operating margin. A ratio below 100% indicates an underwriting profit. Underwriting profits are not easy to come by, with the industry averaging a combined ratio of 100% over the past 10 years, leaving the average P&C insurer wholly dependent on investment income to generate returns. Therefore, in our opinion, franchises that sustainably produce material underwriting profits (an average combined ratio materially below 100%) deserve consideration for an economic moat. A secondary consideration is the volatility in combined ratio results, as consistency on this score raises confidence that a franchise can continue to produce strong underwriting profits.

AIG has fallen short of not only the mark necessary to earn a moat, but the mark set by its less advantaged peers. Over the past 10 years, AIG has generated one of the worst combined ratio results of any publicly traded P&C insurer and has posted significant underwriting losses. Further, AIG’s underwriting results have been quite volatile year to year. AIG has not demonstrated any sign of a material competitive advantage and in fact has a ways to go to just record mediocre results.

We generally believe that moats are more common in commercial lines. Personal insurance is largely commodified and homogeneous by comparison, making it difficult for personal lines insurers to differentiate themselves in terms of underwriting. Commercial lines contain more “specialty” lines. While the term is often used loosely and is not precisely defined, we would classify specialty lines as being characterized by strong customer relationships or somewhat unique risks that require extensive experience to underwrite effectively. This dynamic provides an opportunity for some commercial insurers that focus on specialty niches to shield themselves from competition.

AIG provides an example of how the greater complexity of commercial lines can also create downside risk for poorly managed companies. On the basis of combined ratios, the consumer segment has largely been an unremarkable but not particularly poor performer, with results over time roughly in line with industry averages. But AIG’s commercial results have been terrible, with this segment consistently reporting combined ratios well above industry averages. The company does potentially have some areas of strength: It is among the largest commercial P&C underwriters, which means that it should be able to leverage its proprietary database to better price and select risks than smaller peers. AIG also has one of the widest geographic reaches, which gives it an advantage in garnering business from global firms. But these dynamics have not translated into strong or even acceptable performance historically.

Management's Plan Should Move Underwriting Results In Line With Peers We believe underwriting discipline is the key factor in assessing stewardship in the insurance industry and that precrisis management's growth focus and lack of discipline is the root cause of AIG's poor historical performance. The current management team's focus on risk-adjusted returns and operational efficiency sets a course in the opposite direction. The magnitude and nature of the company's operational issues and the extended period of effective government control have delayed progress, and the inherent volatility of the industry could create bumps in the near term, but we think the stage is now set for real improvement.

In our view, AIG’s poor underwriting performance stems from two primary causes. First, previous management’s growth-focused strategy led the company into overly broad operations and generous terms in long-tail commercial casualty lines, which subsequently created reserve development issues and a bloated and ineffective corporate structure. Peter Hancock, who became CEO in 2014, has laid out a clear plan to address both of these issues.

In the years leading up to the financial crisis, AIG made a push into long-tail casualty lines, a decision that has resulted in over a decade of reserve development issues. As part of this push, AIG took on asbestos and environmental liabilities, which proved costly over time, and underestimated the claims it would ultimately pay in riskier areas such as excess workers’ compensation.

AIG has been dramatically out of line with industry trends when it comes to reserve development. Most P&C insurers have consistently recorded favorable development over the past decade as a result of low inflation, whereas AIG has consistently posted adverse development and taken a number of large reserve development hits. Most of its adverse reserve development in these years relates to policies underwritten before 2005.

These reserve development problems have materially affected reported profitability in the postcrisis period and are the primary reason for AIG’s underwriting underperformance over the past decade. We estimate that if AIG had posted no adverse development, its average combined ratio in P&C lines over the past five years would have been 3.7 percentage points lower and ROE excluding deferred tax assets and accumulated other comprehensive income would have been 110 basis points higher. If AIG had reported favorable development in line with its peers, its average combined ratio in P&C lines would have been 8.7 percentage points lower and ROE excluding DTAs and AOCI would have been 260 basis points higher.

Management has taken meaningful action to reduce its exposure to this problem. AIG has dramatically reduced its underwriting activity in domestic casualty lines, reducing net earned premiums about 60% from the peak in 2006. While AIG’s history highlights how reserve development problems can be annoyingly persistent, we believe it is just a matter of time for AIG to outrun this issue, given the reduced exposure.

Management appears confident enough that underwriting profitability will improve soon to lay out a clear target. AIG expects the accident year loss ratio to improve by 6 percentage points by 2017 as a result of a variety of actions, including exiting unprofitable lines, shedding customers who don’t bundle multiple polices, and narrowing its geographic footprint. An improvement of this magnitude would cover most of the gap in underwriting profitability against peers. We estimate that achieving this goal would improve overall ROE (excluding DTAs and AOCI) by about 110 basis points.

The fact that AIG took another $3.6 billion adverse development charge in the fourth quarter of 2015 is troubling. In our view, this is the biggest blot on current management’s record. Unlike previous hits, about 40% of this charge related to policies underwritten from 2011 to 2014, which raises questions about whether AIG is still underreserving. However, much of the development on more recent policies related to the severity of losses in commercial auto lines, and this issue has popped up for other insurers as well.

In our view, a more focused operation should lead to material improvement over time, as the main commonality among the narrow-moat insurers we cover is operations focused on areas where the companies enjoy a structural advantage. While we don’t believe AIG is headed for a moat, we believe exiting areas where it has underperformed should lead to underwriting profitability more in line with peers.

AIG Can Substantially Reduce Costs and Improve Effectiveness While there is an element of uncertainty to moving past reserving issues, AIG has some more straightforward opportunities to improve results. The company expects to reduce general operating expenses by $1.6 billion ($1.4 billion net of reinvestments) by 2017 by increasing utilization of shared services and outsourcing, moving operations to lower-cost locations, and increasing automation. We estimate this will improve overall ROE (excluding DTAs and AOCI) by about 130 basis points. So far, AIG is on track to reach this target. We believe the gains on this side will primarily show in the company's personal P&C operations.

But we believe there are some incremental opportunities to reduce expenses beyond this near-term goal. Asia-Pacific accounts for about half of the premiums generated in the personal P&C segment, and Japan is the dominant source of revenue in the region. AIG’s Japanese operations are inefficient; AIG purchased its Fuji operations as a fixer-upper in 2011 but has not been able to integrate these operations because of regulatory obstacles. AIG is working with regulators in that country to remedy this situation, but it can’t move forward until it has their approval. While the company is unwilling to give a specific timeline for regulatory approval or quantify the potential savings, we believe this could be a source of meaningful savings. We estimate that improving the international expense ratio to a level in line with domestic operations would improve overall ROE (excluding DTAs and AOCI) by about 25 basis points.

AIG Should Be Broken Up, but Not Just Yet Investor Carl Icahn has been management's greatest critic, publicly blasting management and calling for a full-scale breakup of the company. While the frustration over AIG's historical record is understandable, we disagree with Icahn's proposal to split up the company now. We have always believed that the combination of P&C and life operations under one roof does not create any material strategic benefits and that smaller, more focused operations would probably perform a bit better. Furthermore, the nonbank systemically important financial institution designation could create some regulatory obstacles for a company as large as AIG. However, some unique considerations are in play for AIG. Its diversified operations are necessary to fully and quickly use the company's tax assets. In addition, we think CEO Hancock deserves credit for the significant strides he has made toward simplifying the company and eliminating noncore operations. Over the past seven years, AIG has sold more than 90 businesses.

While we don’t necessarily agree with Icahn’s specific recommendations, we do think his involvement is a net positive for investors. We think scrutiny of management’s plans and progress is warranted at this point. More important, we think the presence of critical outsiders puts pressure on management to realize improvements quickly and puts something of a floor on the situation, as a change in management is now more likely if management doesn’t execute.

At the end of 2015, AIG had $32.6 billion in net operating loss carryovers that expire from 2028 to 2031. If fully used, these NOLs would reduce taxes paid by $11.4 billion. Additionally, AIG had $5.3 billion in foreign tax credit carryovers. Adding these two items together results in a deferred tax asset of $16.7 billion, which had fallen to a total of $15.6 billion by the end of the third quarter. This amount equals almost 25% of the company’s current market capitalization, making the ultimate disposition of the DTAs a material consideration. We think the relatively certain negative of a breakup (the impairment of the company’s DTAs) outweighs the fuzzier positives (smaller, potentially more manageable operations and the possible removal of the designation as a nonbank SIFI) at this point. In our view, it makes sense to delay a full-scale breakup until any impairment of the DTAs is reduced to a nonmaterial level, which is probably just a matter of a few years.

Nonbank SIFI Designation Not a Meaningful Near-Term Obstacle Along with MetLife MET and Prudential PRU, AIG has been tagged as a nonbank SIFI by the Financial Stability Oversight Council. We see no valid reason to place this designation on any insurer, as insurance activities do not create systemic risk, in our view. However, just because the nonbank SIFI designation for insurers is irrational does not mean that the three companies will be able to escape it, and it makes the ultimate outcome of this process more difficult to predict.

MetLife has actively fought the designation and earlier this year received a favorable judicial decision that could release it. However, the government has appealed the ruling, and the final outcome is still uncertain, although we expect the appeal ruling soon. AIG and Prudential have largely adopted a wait-and-see approach, and we believe both companies will follow MetLife’s example if it is successful in escaping the designation. From a political point of view, we think the government could put up more of a fight in AIG’s case, given that AIG was a systemic problem during the crisis (largely due to its financial products division, which is no longer relevant), whereas the other two were not. But it might be difficult to justify the designation for only one insurer, and MetLife’s judicial success shows that the FSOC does not have carte blanche.

A further point of uncertainty is the potential financial impact if the insurers can’t evade the designation. At this point, the government has released only a vague conceptual framework for determining the amount of capital nonbank SIFIs will have to hold. Unlike with banks, there is no existing framework from which we can form an educated estimate on required capital. Additionally, the potential costs of compliance are unknown, although we are skeptical that they will be material, given the intensity of existing regulation. AIG has estimated an annual run rate of $100 million-$150 million so far.

The situation creates uncertainty, but we believe the probability of the nonbank SIFI designation leading to a material negative impact on our valuation is slim. Even if that situation does develop, AIG could pursue a full-scale breakup that would make the nonbank SIFI designation superfluous.

We believe AIG’s plan to return $25 billion in capital to shareholders through 2017 shows that the nonbank SIFI designation is not a meaningful obstacle. We see the achievement of this target as critical for three reasons: (1) buying back large amounts of stock at a substantial discount to book value (we estimate about $21 billion-$22 billion of the $25 billion will be in the form of buybacks) will allow AIG to further leverage the value of the operational improvements we expect, (2) reducing excess capital could improve ROE, which could act as a catalyst for the stock, and (3) we believe hitting this target is the critical factor in maintaining management’s credibility. If management falls short of this goal, we would expect it to be replaced and Icahn’s plan to be adopted.

AIG is on track to hit this goal. Through the first six months of 2016, the company returned about $10 billion to investors. Divestitures are proceeding at a good pace, with AIG agreeing in recent months to sell its mortgage insurance operations for total consideration of $3.4 billion and its Ascot business for total consideration of $1.1 billion. At this point, we believe only a serious operational stumble (such as another large reserve development hit) will keep AIG from hitting this target.

Market Valuation Too Pessimistic, Given Opportunities for Improvement When AIG announced that it would be taking a $3.6 billion reserve development charge in January, the stock took a hit, and we think the market's confidence in management dimmed. The market continues to value the stock materially below book value, suggesting that the consensus view is that AIG will continue to generate subpar returns for an extended period. Given the shift in strategy and the opportunities for improvement, we think the market valuation is overly skeptical.

Our valuation equates to 0.9 times book value excluding AOCI. The slight discount arises mainly from the fact that the carrying value of the deferred tax assets is lower than their economic value, given the amount of time it will take AIG to realize them. Excluding DTAs, our valuation is at a slight premium to book value given that the DTAs do have meaningful economic value. We estimate the economic value of the DTAs at about $9 a share. If we completely exclude DTAs, our valuation is very close to book value excluding AOCI.

Our valuation is predicated on our view that AIG will improve returns to a level on par with our estimated cost of equity within the next two years and will continue to generate returns near the cost of equity thereafter. In essence, we assume that AIG will no longer underperform and is able to bring results in line with other no-moat insurers. This is a very achievable target, in our view. Our base-case valuation doesn’t require AIG to earn any material excess returns in the long term. The combined ratio in the company’s commercial and consumer P&C operations averages 97% and 95%, respectively, roughly in line with recent industry averages. An eventual bounce-back in interest rates leads to a less adverse operating environment for the company’s life insurance operations as well.

/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)