Is Private Company Ownership a Risk for Mutual Funds?

A recent Morningstar study shows most funds tread lightly in private-firm investments.

With high-profile private firms such as Uber and Airbnb appearing in some mutual fund portfolios in recent years, investors may be wondering what to make of such exposure. Mutual funds provide daily liquidity that allows investors to contribute or withdraw money each day, so the inclusion of less-liquid private firms has come under scrutiny.

There are other reasons this has become a more visible issue. First, private companies have delayed IPOs, opting to raise capital in the private market and build their businesses without the pressure that comes with being publicly traded. Second, private firms have increasingly become part of fund managers' due-diligence efforts, as some of these firms have changed the competitive dynamics in their industries and grown larger than even their publicly traded peers. Third, active managers, who have faced a picked-over public stock market and widespread underperformance against passive funds, have found appeal in the performance edge that private-firm equity investments can potentially offer.

This trend has not gone unnoticed in the media, which has questioned the risk mutual fund ownership of private firms could pose to investors. Morningstar recently examined the prevalence and magnitude of private-firm equity holdings in U.S.-domiciled open-end mutual funds to gauge whether these investments present risks or challenges not envisioned by the traditional mutual fund format. The study excluded exchange-traded funds, money market funds, fixed-income, alternatives, and funds of funds, and it used holdings data from Morningstar Direct as of 2016's second quarter. The screening list included 163 private companies, of which 133 had mutual fund ownership (see the full paper for more information on methodology). This report was compiled before Morningstar's acquisition of PitchBook, a data provider for private-equity professionals, and does not utilize PitchBook data.

Few Mutual Funds Invest in Private-Firm Equity As of 2016's second quarter, we found 194 funds that had some level of investment in 133 private companies on the screening list. Those 194 funds equate to 3.6% of the 5,378 equity and allocation funds in Morningstar's database and account for $11.48 billion in assets in aggregate, or about 0.13% of the industry's $8.6 trillion tally, as of June 2016. To put that $11.48 billion in perspective, U.S. equity and allocation funds had about $254 billion staked in publicly traded biotech stocks as of June 2016, or 22 times the sum invested in private-firm equity.

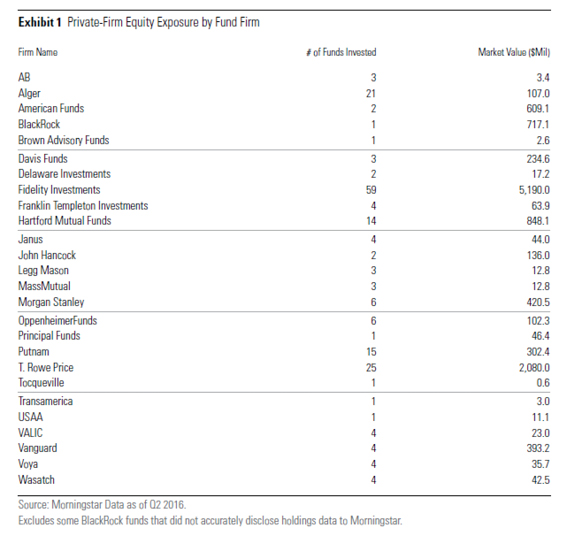

Overall, we found 26 fund companies offered funds that invest in private-firm equity, with Fidelity leading the way (59 mutual funds owned $5.19 billion in private-firm equity as of June 2016), followed by T. Rowe Price ($2.08 billion spread across 25 funds) and Hartford ($848 million invested in 14 Wellington-subadvised funds).

Fidelity and T. Rowe Price spread their investments across many funds run by different managers. Similarly, Alger and Putnam, while representing much smaller sums, had a relatively high number of funds on the list, at 21 and 15, respectively. By contrast, the bulk of Morgan Stanley's $420 million private-firm equity stake was claimed by funds run by a single management team led by Dennis Lynch.

While Fidelity and T. Rowe Price, the third and fourth biggest fund firms by U.S. mutual fund assets (excluding ETFs), may have deeper resources to evaluate private companies, there are plenty of bigger firms that have limited or avoided such investments. For example, Franklin Templeton, the fifth-biggest by U.S. mutual fund assets, invested just $64 million in private-firm equity across four mutual funds. J.P. Morgan and MFS, other top-10 firms by assets, were not on the list at all.

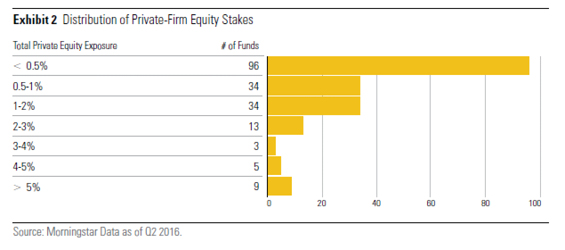

Most Funds Have Little Exposure to Private-Firm Equity Even among funds that held private-firm equity, total exposure was typically modest. The SEC has limited private-equity investments to 15% of a fund's assets at time of purchase, a level that few funds ever approach. We found that over 90% of the funds on the list had invested less than 3% of assets in private-firm equity as of 2016's second quarter. The median fund in the study invested in three privately held companies totaling 0.51% of overall fund assets.

Among larger funds that held private-firm equity, the dollar value of those investments can seem high.

These small position sizes aren't a coincidence. Given the limited size and liquidity of private companies, plus regulatory and prospectus limits on a fund's stake in such names, most funds must tread lightly, including smaller funds that in theory could make a larger allocation to private-firm equity.

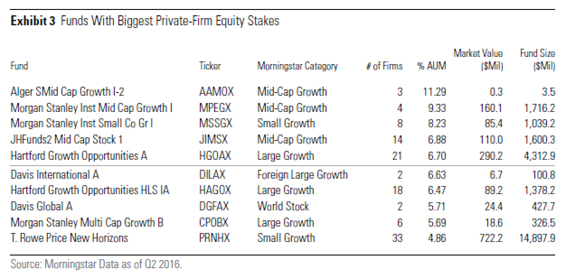

Exceptions to the Rule However, there are a few cases where funds have taken a larger stake in private-firm equity. As of June 2016, nine funds had invested over 5% of assets in such companies, with Alger SMid Cap Growth I-2 AAMOX sporting the largest stake at 11.3% of assets. The total market value of its investments in Palantir, Intarcia Therapeutics, and Prosetta Biosciences was relatively small, at $393,601, but the fund's tiny asset base of $3.5 million magnifies its private-firm stake in percentage terms.

However, the overall size of these bets has risen, as Morgan Stanley Institutional Mid Cap Growth had invested 2.1% across three private companies (

The rise in Morgan Stanley Institutional Mid Cap Growth's private-firm stake was not due to additional investments or appreciation of current holdings but rather a shrinking asset base fueled by a drop-off in performance. Fund assets decreased to $1.7 billion as of June 2016, down from a high of $8.5 billion in February 2014--coinciding with the time its performance peaked. With private-firm holdings lacking liquidity to help meet redemptions, the managers pared back all of the fund's public holdings in 2016's second quarter while adding just one new position.

This example highlights a risk of private-company ownership in an open-end structure. Investors can be fickle and may not stick around when the fund is going through a rough spell. Managers can be forced to trim or sell publicly traded stocks they may have preferred to keep. Portfolio construction can also appear out of whack, as the private, illiquid holdings soak up more of a fund's assets and drive more of the fund's performance than perhaps was initially intended.

While fund managers have shown greater inclination toward investing in private-firm equity over the past few years, the impact for most fund investors is minimal. A small percentage of funds invest in private-firm equities, and those that do tend to limit exposure to these investments, a wise move considering their illiquidity and company-specific risks. Private-firm equity investments should be monitored as part of routine fund due diligence to make sure such holdings are consistent with a fund's strategy, are not disrupting portfolio construction, and can withstand any challenge fund outflows might present. However, the inclusion of private-firm equity in the average investor's mutual funds--if it exists at all--is so marginal that it is of little concern.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)