WisdomTree Working to Balance Its Growth

A closer look at one of the fastest-growing ETF providers.

It's no secret that the popularity of the exchange-traded fund structure has risen tremendously. ETF assets measured $2.4 trillion at the end of October 2016 and have grown by nearly 20% annually from $400 billion in assets just 10 years prior.

The largest providers receive the most attention, and ETF lineups that immediately come to mind belong to behemoths Vanguard and BlackRock's iShares unit. Other household names include ETF pioneer State Street, Schwab, and Fidelity.

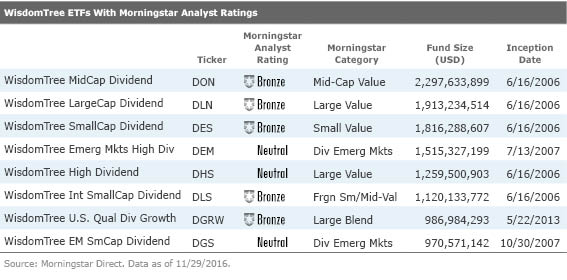

While those firms share the bulk of ETF assets, plenty of others, such as WisdomTree, have enjoyed significant organic growth through product proliferation. Recently, we launched Morningstar Analyst Ratings on a number of WisdomTree funds. (See table below.) The Analyst Rating comprises five pillars: Process, People, Price, Performance, and Parent. Here, we examine WisdomTree as an ETF sponsor and explain its Parent Pillar rating of Neutral.

At the heart of WisdomTree's Neutral rating is a balance of concerns surrounding aggressive growth goals and strong investment stewardship attributes. As a publicly traded asset manager, WisdomTree WETF is challenged to weigh fundholders' interests with those of its public stockholders, which may hold a short-term outlook. WisdomTree's redeeming qualities include its experienced and stable management team, ETF industry expertise, and its commitment to its research team and investor education.

We Have Lift Off WisdomTree is unabashedly focused on asset growth. The firm's goal is to increase its ETF inflow capture to between 5% and 7% of all ETF inflows by launching new funds, increasing its salesforce, and expanding geographically. Assets under management sat at $38 billion as of the end of October 2016, an impressive accumulation in a little over 10 years. WisdomTree's ETF journey started in June 2006, when it launched a suite of 20 fundamentally weighted dividend-oriented ETFs, including WisdomTree Japan Hedged Equity DXJ, which remains a flagship today with more than $7.5 billion in assets.

The firm has come a long way in terms of product development (and rationalization) in the past 10-plus years. Overall, it has launched 114 funds and closed 20. Nearly half of the fund launches have come in the past four years, but many of WisdomTree's funds use a similar dividend- or earnings-weighted approach, resulting in distinct collections of funds with slight variations. WisdomTree says it will close a fund when it loses faith in the product's underlying investment thesis. But all 20 closed funds either never gained meaningful assets or experienced significant outflows from their peak.

WisdomTree's more-recent barrage of fund launches was aimed at diversifying the firm's product lineup. At their peak in July 2015, WisdomTree Japan Hedged Equity and WisdomTree Europe Hedged Equity HEDJ jointly accounted for over 60% of the firm's assets. Such concentration is a risk for the firm because individual fund performance or flows can quickly change and significantly affect revenue. Since July 2015, DXJ and HEDJ have in fact lost nearly $11 billion and $13 billion, respectively, from outflows and price depreciation, reducing their portion of fund assets to a still-hefty 40%. In total, WisdomTree has lost $24.3 billion in assets over the past 16 months through the end of October 2016. This has led to a decline in revenue that could restrict resources and make it harder to retain talent.

Even in the face of declining revenues, WisdomTree is pressing on to expand in other ways besides fund launches. It is aggressively growing through acquisitions and partnerships. In January 2014, it purchased three fourths of Boost ETP, a European fund company that specializes in leveraged and inverse equity, commodity, and currency products. The acquired funds are designed as trading vehicles, not long-term investments, and fall out of WisdomTree's more fundamentally driven wheelhouse. It also announced partnerships with BetaShares, an Australian exchange-traded product sponsor that offers commodity- and currency-focused funds, and ICBC Credit Suisse to launch S&P China 500 index-tracking products.

WisdomTree's 2016 purchase of GreenHaven funds illustrates the challenges associated with a growth model outside the firm's core strengths. To enter the U.S. commodities fund market, WisdomTree purchased GreenHaven Continuous Commodity Index GCC and GreenHaven Coal Fund TONS in January 2016. In October 2016, WisdomTree inadvertently allowed GCC's new share creation registration to expire, preventing new share creation for nearly a month. And WisdomTree shuttered TONS less than a year after its purchase.

To keep pace with asset and product growth, WisdomTree has added significantly to personnel, particularly in sales and marketing. At the end of 2011, WisdomTree devoted 32 of its 65 full-time employees to sales. By the end of 2015, while the firm's research team had grown to 20 individuals from five, and its sales-focused head count increased to 95 of 177 total full-time employees. While the research team is not directly compensated for asset growth, half of all employees' compensation is determined by reaching net inflow targets, net market share of inflow targets, the firm's pretax margin, and WisdomTree's relative stock performance against its peers. The other half is at the board's discretion.

What's Good WisdomTree's aspirations mean that it's important for ETF investors to carefully consider whether its products are developed and marketed with fundholder interests in mind, but the firm also boasts some strengths.

Investment industry veterans compose WisdomTree's core management team. Founder and CEO Jonathan Steinberg has been at the helm through all of the firm's iterations, and when the firm recapitalized to become an ETF sponsor, lead investors included hedge fund pioneer Michael Steinhardt and Wharton finance professor Jeremy Siegel. Steinhardt is chairman of the board, and Siegel serves as a senior investment advisor. These investors along with Steinberg, chief investment strategist Luciano Siracusano, and director of research Jeremy Schwartz bring substantial expertise in investment management, fundamental indexing, and the ETF industry. This experienced and stable management core supports WisdomTree's research efforts and fund growth.

WisdomTree has invested in technology and its research team to support new products and to further investor education. The research team has grown to 20 individuals from five and is composed of Ph.D.s, CFAs, and MBAs from top business schools. Besides developing products' indexes, the research team regularly publishes white papers and articles to educate investors on their products' merits. The firm has also invested in portfolio analytics tools to enhance advisors' understanding of WisdomTree's products. This continued research and technology investment highlights the firm's commitment to fundholders' well-being.

The firm outsources the portfolio-management execution of all of its strategies. That makes WisdomTree's business model unique, but its principal subadvisor, Mellon Capital, is well-equipped for the task. Mellon has managed index funds since 1983, and seven portfolio managers work as a team to manage WisdomTree's funds. The team averages over 20 years of investment management experience and more than 15 years of experience with Mellon. And Mellon's team uses well-known third-party and proprietary systems to monitor risk and trade portfolios. It also commands a team of 11 traders. Each quarter, Mellon reports tracking error, share creation/redemption, and international trade-efficiency metrics to WisdomTree's fund board.

The Path Forward WisdomTree doesn't hide its focus on growth. But most of its funds are fundamentally weighted and built on sound in-house research. The firm's stable management core, ETF industry expertise, and investment in its research team and investor education mitigate some of the concern associated with an emphasis on sales and growth. We'll continue to monitor how the firm balances its growth plan and treatment of fundholders in the face of significant outflows, but all told, WisdomTree earns a Neutral Parent Pillar rating.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)