A Smoother (But Still Bumpy) Emerging Markets Ride

Low-volatility emerging-markets ETF can reduce risk and still provide diversification benefits investors seek.

Emerging markets were in the midst of an impressive rally leading up to the U.S. presidential election, partially because of strengthening currencies and diminishing worries about China. From January 2016 through October 2016, the MSCI Emerging Markets Index had outperformed the S&P 500 and MSCI EAFE Index, which tracks foreign developed markets in Europe, Asia, and Australia, by 13.59 and 16.65 percentage points, respectively. Investors were quick to take notice. Through the first 10 months of the year, funds in the diversified emerging-markets Morningstar Category attracted more than $22 billion in net new inflows.

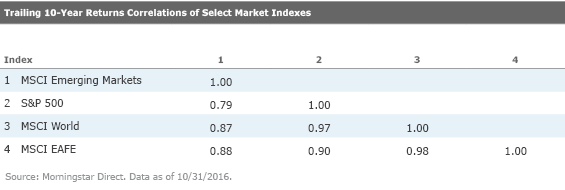

Emerging-markets stocks offer prospective diversification benefits, especially for portfolios with large allocations to U.S. equities. At present, they are also attractively valued--at least relative to developed-markets equities and bonds. Exhibit 1 shows the trailing 10-year return correlations of several popular indexes through September 2016. The MSCI Emerging Markets Index had a particularly low 0.79 correlation coefficient relative the S&P 500 over this period, which suggests a moderate diversification benefit. That said, emerging-markets stocks were laggards during this span, and, owing largely to that recent underperformance, Research Affiliates' current 10-year expected returns for emerging-markets stocks are significantly higher relative to those for U.S. stocks and modestly greater than the firm's return expectations for foreign developed-markets stocks.

However, investing in emerging markets carries unique economic, political, and currency risks that, historically, have significantly contributed to emerging-markets stocks’ relatively greater volatility compared with developed-markets equities. Exhibit 2 compares the standard deviations of the MSCI Emerging Markets, S&P 500, MSCI EAFE, and MSCI World indexes over the trailing one-, three-, five-, 10-, and 15-year periods through October 2016. Over every period, emerging-markets stocks consistently exhibited the greatest volatility.

An exchange-traded fund such as

Low Volatility in a Nutshell Conventional wisdom holds that riskier stocks should compensate investors with higher expected returns over the long run. However, in 1972, Fischer Black, Michael Jensen, and Myron Scholes provided evidence that the relationship between stocks' exposure to market risk (as measured by beta) and their subsequent returns wasn't as strong as expected1. They found that stocks with the lowest market risk offered the best risk-adjusted returns and those with the greatest risk offered the worst risk/reward profiles. Subsequent studies corroborated these the findings, and others also showed that, on average, stocks with the lowest volatility offered superior risk-adjusted returns relative to stocks with the highest volatility.

Academic researchers have offered several explanations for this low-volatility phenomenon, basing their theories on the behavioral tendencies of investors. In their paper, "Stocks as Lotteries: The Implications of Probability Weighting for Security Prices," Nicholas Barberis and Ming Huang, for example, argued that investors are willing to pay very high prices for stocks that offer a potentially large payoff because they underestimate their risk2. As a result, these stocks earn lower returns, on average.

Andrea Frazzini and Lasse Pedersen proposed another theory in their paper, "Betting Against Beta"3. They argued that investors attempting to achieve superior benchmark-relative performance will favor riskier stocks because they offer higher expected returns. This activity drives up the price of these risky stocks, therefore reducing their expected returns relative to their risk. Simultaneously, the lower-risk stocks become undervalued relative to their risk.

Low-Volatility Funds to Consider EEMV (0.25% expense ratio) and PowerShares S&P Emerging Markets Low Volatility ETF EELV (0.29% expense ratio) were launched in 2011 and 2012, respectively. Both funds attempt to capture this low-volatility effect, but they use different methodologies.

EELV uses a more straightforward and transparent approach. It simply targets the 200 stocks from its parent index (S&P BMI Emerging Plus Large MidCap Index) that have exhibited the lowest volatility over the past year and weights them by the inverse of their realized volatility. This gives the greatest weighting to the least volatile stocks.

EEMV uses an optimizer to construct the least volatile portfolio possible using constituents of the MSCI Emerging Markets Index, under a set of constraints. The optimizer considers each stock’s volatility in addition to how the correlation between stocks affects the portfolio’s volatility. It uses this information to select and weight stocks from the parent index. However, the fund keeps sector and country weights within 5% of the MSCI Emerging Markets Index, in addition to limiting exposure to individual names and turnover. This focus on portfolio volatility, instead of simply individual stock volatility, means more-volatile stocks are sometimes included in the portfolio if they have low correlations with the other stocks in the portfolio and help reduce its overall risk.

EEMV’s country and sector constraints limit its exposure to the low-volatility effect described in the academic literature but create a better diversified portfolio, which gives EEMV an edge over EELV. Market-cap-weighted emerging-markets funds typically have nearly 30% exposure to China, where many of the largest companies are state-owned enterprises that carry significant political risk. EELV has only 5% exposure to China, while the corresponding figure for EEMV is just above 20% because of its constraints. Thus, EELV must give a significant overweighting to other countries, such as Malaysia, Mexico, and Taiwan, which currently account for half of the portfolio’s assets, compared with only 30% for EEMV.

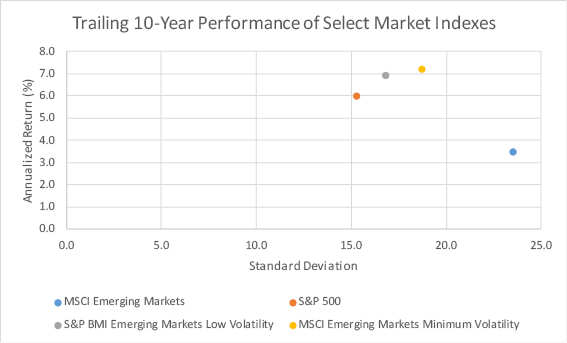

These funds have limited records, but the historical performance of their respective indexes are compelling. Exhibit 3 plots the total return and standard deviation of monthly returns of the MSCI Emerging Markets Minimum Volatility (EEMV’s benchmark), S&P BMI Emerging Markets Low Volatility (EELV’s benchmark), MSCI Emerging Markets Index, and the S&P 500 over the trailing 10-year period through October 2016. Both low-volatility emerging-markets indexes had returns that were nearly double that of the MSCI Emerging Markets Index. Meanwhile, their risk profiles were similar to that of the S&P 500. Over the same 10-year period, the S&P BMI Emerging Markets Low Volatility and MSCI Emerging Markets Minimum Volatility posted standard deviations of 16.82 and 18.72, respectively, compared with 15.25 for the S&P 500 and 23.53 for the MSCI Emerging Markets. The S&P BMI Emerging Markets Low Volatility and MSCI Emerging Markets Minimum Volatility Index also posted a downside capture ratio of 60% and 73% and upside capture ratio of 73% and 83%, respectively, over the same period, illustrating the defensive nature of these strategies.

The strong risk-adjusted performance of low-volatility emerging-markets stocks over the past several years has kept their valuations relatively high. As a result, the trailing 12-month P/E ratios of the MSCI Emerging Markets Minimum Volatility Index's holdings have been higher than the MSCI Emerging Markets. However, because of the strong performance of emerging markets for most of 2016 thus far, the valuation gap has shrunk.

Options for the Bulls

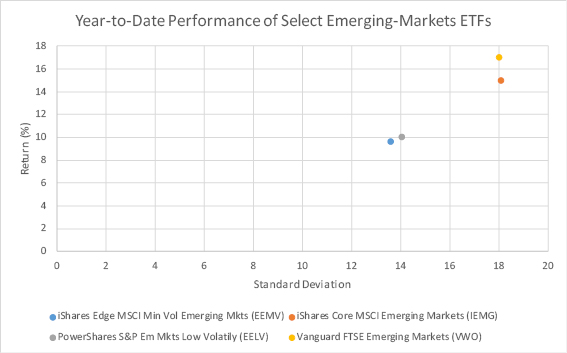

Low-volatility strategies often perform best, relative to market-cap-weighted peers, during market drawdowns, which has been the case for emerging markets over much of the past five years and caused low-volatility stocks to become more richly valued relative to the broad market. As emerging markets mounted an impressive rebound from January through October 2016, both EEMV and EELV significantly trailed market-cap-weighted peers, such as

Investors who would be disappointed missing out on some of the upside of any future emerging-markets rallies that may (or may not) occur might consider either IEMG or VWO, as they both offer well-diversified market-cap-weighted emerging-markets exposure for rock-bottom fees and carry Morningstar Analyst Ratings of Bronze. But investors with a long investment horizon and the conviction to hold an emerging-markets fund over at least a full market cycle could be well served by a low-volatility fund such as EEMV. Although low-volatility strategies may underperform market-cap-weighted funds, at times, they should offer better risk-adjusted performance over the long term.

References

1 Jensen, MC., Black, F., Scholes, MS. 1972. "The Capital Asset Pricing Model: Some Empirical Tests." In Michael C. Jensen (ed.), Studies in the Theory of Capital Markets,(New York), pp. 79-121.

2 Barberis, N., Huang, M. 2008. "Stocks as Lotteries: The Implications of Probability Weighting for Security Prices." The American Economic Review, Vol. 98, No. 5, P. 2066-2100.

3 Frazzini, A., Pedersen, LH. 2014. "Betting Against Beta." J. Financial Economics, Vol. 111, No. 1, P. 1-25.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)