A Look at the Post-Election Markets Whipsaw

We explore the market’s reaction to the election through the lens of Morningstar Indexes.

See Morningstar's complete coverage of the 2016 election.

“Whipsawed” is an apt metaphor for investment market behavior surrounding US election results. Stocks fall as Trump’s prospects improve. Stocks rise after Trump wins. Let’s view market reaction through lenses powered by Morningstar Indexes.

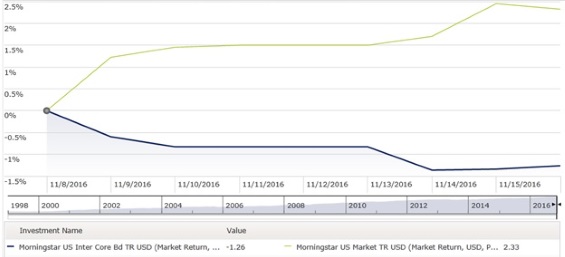

First, we have US stocks versus US bonds. How’s this for inverse correlation?

Common explanations for the bond market decline center around fiscal stimulus (higher infrastructure spending and lower taxes) causing inflation and interest rate hikes.

Though stocks and bonds are both up in 2016, this was not the first time they went in opposite directions during a period of market stress. Remember January?

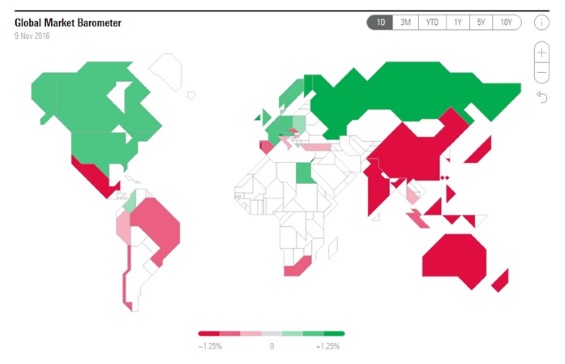

A look at the Morningstar Global Market Barometer shows that in the immediate aftermath of the election, US stocks were far from the only gainers. The Morningstar Russia Index climbed the highest among 45 developed and emerging markets. Meanwhile, Mexican equities plunged, and losses were sustained across the Asia Pacific region as investors anticipated the consequences of Trump’s anti-trade agenda. Remember, the Global Market Barometer depicts local currency returns. Declines in currencies like the Mexican peso, Japanese yen, and Indian rupee magnify equity market from the perspective of a US dollar investor.

It’s important to note that emerging markets have still had a pretty good year in 2016, reversing a multi-year trend of underperforming developed markets.

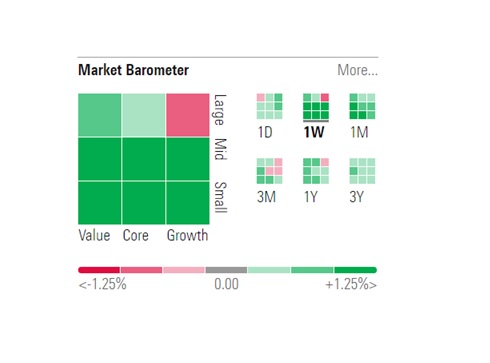

From a US Style Box perspective, mid and smaller-cap stocks have benefitted the most from the market’s upsurge in the week since the election results. Value has beaten growth.

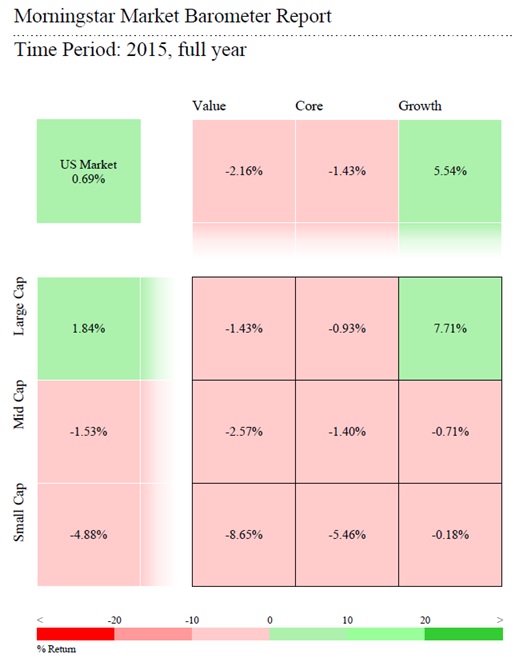

Large Growth is the only corner of the Style Box that is down since the election. It’s also roughly flat for the year to date. This is a reversal from calendar year 2015 when Large Growth was the only one of Morningstar’s nine US style box indexes in positive territory, powered by the “FANG” stocks—

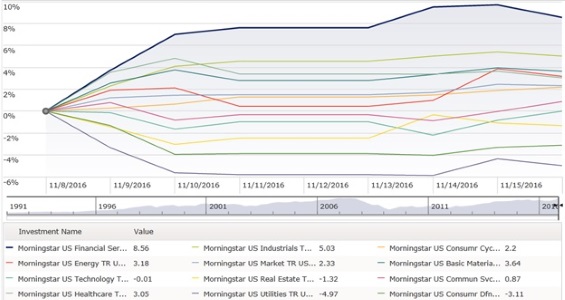

So if technology is not among the sectors anticipated to benefit most from the Trump administration, what are? Those would be Financials, Industrials, Energy, Materials, and Healthcare, likely seen as beneficiaries of infrastructure spending and regulatory rollback. Utilities have been the worst-performing sector due to interest rates worries.

Of course, in the end, this kind of short-term market volatility is often what creates opportunity for long-term investors.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)