Putting Morningstar’s New Style Box to Work

Three ways investors can use the alternatives style box as part of their regular due diligence.

In October, we introduced the Morningstar Style Box for alternative funds, a new framework for analyzing alternative mutual funds. The October Fund Spy outlined why we think investors need a convenient way to view the diversification characteristics of liquid alternative mutual funds and the methodology behind the alternatives style box. The article can be found here, but to quickly recap: The appeal of alternative funds lies in their ability to provide diversification to a traditional portfolio of stocks and bonds. The funds can achieve that by either having a low correlation to traditional asset classes or offering exposure to traditional asset classes with lower volatility. Investors lack a convenient way to quickly assess those characteristics, however, which is why Morningstar has developed the alternatives style box.

Now that we’ve established the framework, we can move onto the more exciting part: looking at ways investors can use the concept to aid their due diligence process.

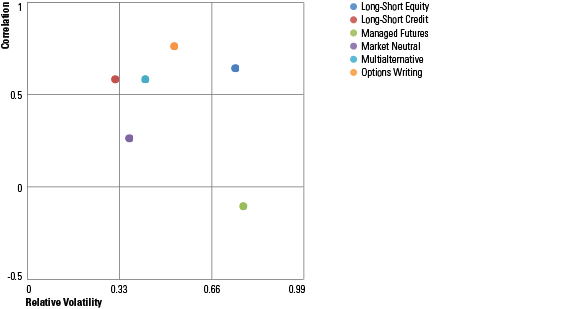

Use Case: Finding the Right Alternative for Your Portfolio Liquid alternative mutual funds tend to fall into one of two broad camps: strategies that take on equity market risk and hedge against the downside, and strategies that are generally uncorrelated to risky assets. Either of those broad strategies could be a way to damp down a portfolio's overall volatility, but investors would probably use each differently.

A strategy that is solely hedging equity market risk, like an options-writing fund or a long-short equity fund, is likely suitable only as a replacement for some portion of the long-only equity part of the portfolio. A strategy with low correlation is more likely to be funded from multiple asset classes in the portfolio. While there can be a lot of dispersion among funds within a Morningstar Category, the average position of each category within the alternatives style box gives a general starting point for selecting whichever alternative strategy type fits a portfolio best. Exhibit 1 shows the alternative categories' average positions in the style box.

- source: Morningstar Analysts

Funds in the options-writing category, but not all, make long investments in equities and buy put options for protection. In an equity market sell-off, those puts could have a positive return that offsets some of, but not all, of the losses in their long equity positions. Long-short equity funds generally have net long equity exposure of around 50% and short individual securities or ETFs as their hedge. Similar to the puts, these short positions could be positive contributors in an equity sell-off.

On the other end of the spectrum, market-neutral and managed-futures strategies tend to be the least correlated. Market-neutral funds generally make equal long and short bets on equities, which eliminates most equity beta. This should lead to returns that are based more on stock selection, that is, long positions outperforming short positions, than how the overall market is performing. Managed-futures funds follow trends and can go long and short a variety of asset classes. The ability to capture negative momentum in risk assets tends to make managed-futures funds outperformers when equity markets go south.

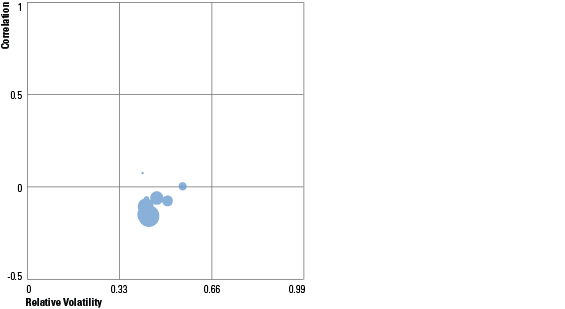

Use Case: Changing Risk Profiles It's important to note that a fund's correlation and volatility levels aren't likely to remain static over long periods. For one thing, managers of liquid alternative mutual funds can be very active in shifting the portfolio to alter exposure levels. For another, even if the portfolio holdings and exposures are stable, the ever-evolving market environment could cause the fund to react differently under various circumstances. What that means is that investors should consider how a fund's correlation and relative volatility characteristics have changed over time.

Exhibit 2 shows how the positioning of

- source: Morningstar Analysts

The alternatives style box shows that over the course of the fund's history, its correlation to global equities has been virtually zero. Management purposefully hedges out any residual equity market beta to keep the fund's correlation low.

The fund's relative volatility also has been fairly stable. For the most part, the fund has stayed between one third and two thirds as volatile as the index. Its target volatility level is approximately two thirds the long-term volatility of the global equity markets. This is more easily interpreted by a quick glance at the style box than it would be by looking at its historical returns.

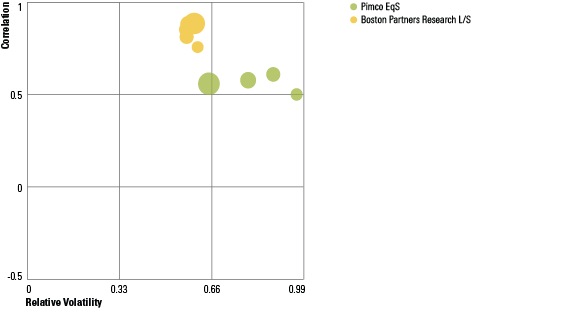

Use Case: Comparing Funds in the Same Category

In addition to viewing a fund's own history, it's also useful to compare funds against peers in the same category. Exhibit 3 shows

- source: Morningstar Analysts

PIMCO EqS Long/Short's former portfolio manager Geoffrey Johnson, who retired on Aug. 1, 2016, was very active in managing the fund's net exposure. It ranged from a high of 80% to a low of less than 10%. As a result, this fund has seen much more dramatic shifts in relative volatility. By contrast, Boston Partners Long/Short Research has much tighter guardrails around its exposure levels; net long exposure typically stays between 40% and 50%.

Investors can take away that for PIMCO EqS Long/Short under Johnson, both stock-picking and managing the net exposure were going to be key return drivers. For Boston Partners Long/Short Research, stock-picking alone typically drives returns. Both approaches can work, but to investors one might be more attractive than the other based on their personal preference. The style box dramatically illustrates the differences in approach.

Conclusion These are only a few examples of how an investor can use the alternatives style box to learn more about a liquid alternatives fund. Still, the alternative style box should not be considered a comprehensive tool for performing due diligence on alternative funds—rather, it is a starting point, useful for screening and making comparisons. Over time, we plan to publish additional papers making more intensive use of the style box, such as studies of alternative asset allocation and category deep dives. Eventually, the alternative style box will be a data point and tool within Morningstar products.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)