Air Products Spin-Off Worth Keeping an Eye On

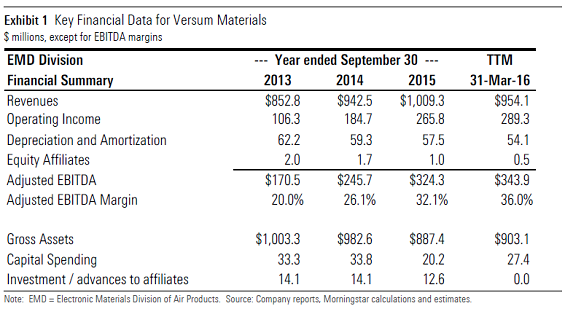

Shares of Versum began trading this month, allowing investors an opportunity to benefit from a newly independent, high-quality business.

Seifi Ghasemi's two-year tenure as

Another of his goals is to focus the company solely on industrial gases and to exit or divest unrelated or noncore assets. The final piece in this restructuring puzzle is the spin-off of the electronic materials division into

Shares of Versum began trading on Oct. 3, and we suspect that the spin-off could allow focused investors to capitalize on early underperformance by a newly independent, high-quality business since it may not appeal to a significant portion of its legacy shareholder base. Investors who seek temporary technically driven supply/demand imbalances in a stock can prepare now to exploit potential valuation discrepancies after the spin-off.

Versum boasts a narrow economic moat based on switching costs and intangible assets, including a proven ability to build strong relationships with blue-chip customers as well as a lengthy track record of enabling technological advances.

We estimate the value of Versum at $26 per share.

Versum's Moat Is Supported by Strong Customer Relationships and History of Innovation Versum's narrow moat is based primarily on high customer switching costs and meaningful intangible assets. Switching costs are high largely because Versum is a qualified supplier of products that perform critical tasks in its customers' manufacturing processes, yet typically make up a small portion of the cost of the end product. In most cases, the potential costs to a chipmaker of substandard chip performance, excessive failure rates, or a production halt tied to off-spec inputs or unreliable supply far outweigh the potential benefits of lower-cost materials.

We think that Versum's intangible assets are derived from its patented technologies and proprietary know-how, as well as a legacy of successful collaboration with leading chipmakers, mobile device manufacturers, and semiconductor equipment suppliers.

Supplying specialized electronic gases, process chemicals, and materials to major chip manufacturers and mobile device makers is a naturally moaty enterprise, in our view, in part since the demanding specification and qualifying steps required to adequately serve the often site-specific needs of multibillion-dollar production facilities typically limit competition. The goal of optimizing production of devices with layers sized in nanometers and tied to a short product life cycle that demands continuous innovation creates a natural intimacy between the supplier and customer. Recognizing the importance of this close relationship, each of Versum's six technology centers are specifically located near significant customers in the western U.S., Taiwan, and South Korea.

Versum's research and development spending averages 4%-5% of sales, though in practice, this spending is effectively multiplied, since the work is often carried out in collaboration with customers and equipment suppliers, a practice that aligns new materials requirements with customers' evolving needs and product technology cycles.

Continuous innovation is a prerequisite in Versum's industry to remain competitive. An estimated 80% of Versum’s portfolio is based on proprietary or patent-protected technologies and techniques, and 40% of its annual revenue is derived from products commercialized within the past five years.

A Concentrated Customer List Creates a Balance of Risks and Opportunities

High customer concentration and reputational risks argue against a wide economic moat, in our view. Versum nominally sells to a wide range of technology firms, original-equipment manufacturers, and global semiconductor manufacturers, including many smaller firms and niche customers. Its top 20 customers, however, account for roughly 85% of annual sales, and the top three,

Semiconductor industry concentration has risen steadily over the past two decades as a result of organic growth among leading manufacturers plus industry consolidation via mergers and acquisitions. We expect this trend toward serving larger and more powerful customers to continue indefinitely. Additionally, we think it could spur consolidation among materials suppliers as well.

On balance, customer concentration acts as a counterweight to future advantages. The loss of any major customer (especially the loss of confidence by that customer in Versum's ability to offer solutions) would constitute a significant blow that would immediately affect sales, margins, and long-term competitiveness. This tangible customer power is probably the single largest factor preventing us from considering a wide economic moat rating for Versum.

In addition, decades of global semiconductor growth at well above GDP rates has nurtured a proliferation of potential suppliers, especially for many workhorse products the industry has come to rely on. This includes bulk volumes of high-purity nitrogen gas for general environmental blanketing, as well as gases such as nitrogen trifluoride for chamber cleaning and various silanes for thin film deposition.

As a result, we agree with Versum that major chipmakers are more willing to mix and match suppliers of certain products than in the past. Ghasemi has said that he was willing to spin off Versum in part because he perceives minimal competitive advantage in bundling legacy Air Products bulk gases with Versum's specialty gases and materials to serve most electronics customers.

Versum's Leadership We assign Versum a Standard stewardship rating, recognizing its minimal tenure as a stand-alone company and senior leadership that lacks direct experience running a public company.

Versum will be led by Guillermo Novo, in his first stint as CEO. Since October 2014, Novo has been executive vice president in the materials technologies segment of Air Products. He joined Air Products in 2012 as senior vice president, electronics, performance materials, strategy, and technology.

Before joining Air Products, Novo worked 26 years for Dow Chemical and Rohm and Haas, which merged with Dow Chemical in 2009. At Dow Chemical, he served most recently as group vice president, Dow Coating Materials. He began his career in 1986 with Rohm and Haas and progressed through a variety of commercial, marketing, and general management roles.

Senior Vice President George G. Bitto will be CFO. Since October 2014, Bitto has been vice president, finance, of the materials technologies business of Air Products. Bitto joined Air Products in 1987 and has held a variety of analyst and management positions in both finance and operations. In 2007, Bitto became vice president and treasurer, and in 2010, he became vice president, treasurer, and chief risk officer.

Many of the senior management incentives for Versum are patterned after those in effect at Air Products. Key elements include a significant equity component to total compensation as well as performance incentives based on achieving specific financial targets, including profitability and cash flow growth.

While restructuring and reorganization efforts have dominated management’s attention for the past few years, capital allocation is likely to be an early priority for Novo and Bitto as they choose how to deploy their discretionary cash flow among growth, debt paydown, or dividends. We believe Novo’s top priority will initially be strategic growth.

Versum’s board of directors will be led by Air Products CEO Ghasemi as nonexecutive chairman. We consider this a logical and constructive step overall, albeit one with potential for conflicts of interests related to any lingering disputes between Versum and its former parent.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)