Fickle Investors Have Missed Out on This ETF's Momentum Strategy

Momentum is not a factor for the faint of heart.

The article was published in the September 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

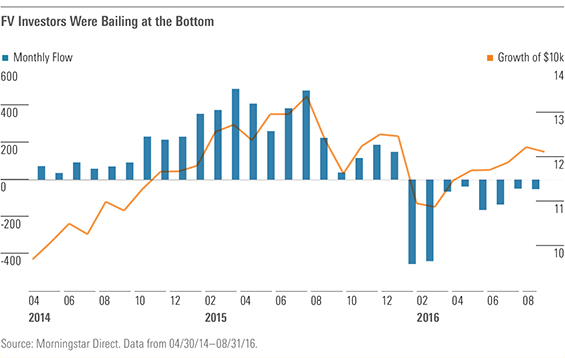

There are a number of behavioral biases that could explain the existence of momentum in financial markets. One of these biases, herding, could also explain why investors have such a seemingly difficult time sticking with momentum strategies. A perfect case in point is the pattern of investor behavior we’ve observed in

FV offers exposure to a sector-momentum strategy. The fund’s underlying benchmark, the Dorsey Wright Focus Five Index, selects five First Trust sector and/or industry exchange-traded funds on the basis of their recent price momentum relative to other ETFs in the selection universe. Those ETFs registering the highest scores based on Dorsey Wright Associates’ proprietary relative strength methodology will be added to the index. The five funds are equally weighted. This same analysis takes place twice monthly. Funds that lose steam are dropped, those that have gained steam are added, and the index is rebalanced so that each fund is again equally weighted.

The fund, which now has about $3 billion in assets under management, has been on a wild ride since its inception. From March 31, 2014, through Aug. 31, 2016, FV’s annualized total return was 8.95%, marginally higher than that experienced by

- source: Morningstar Analysts

What’s the net result? While FV returned nearly 9% annualized, its investor return over the period in question was actually negative 2.3%! While FV kept pace with the S&P 500, the average dollar invested in the fund actually lost money. Momentum strategies have merit, but investors’ ability to effectively harness this fickle factor correlates directly with their intestinal fortitude.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)