Economic Growth: Great for Everyone but Investors?

While it may be intuitive to presume strong economic growth translates into strong stock market performance, the evidence suggests otherwise.

By 2050 the world's population is projected to reach 9.7 billion, up from 7.4 billion today. Nearly all of that growth will come from emerging markets, where living standards are rapidly improving.

Although these markets have experienced large capital inflows, they still have a long way to go to match developed countries' levels of capital, productivity, and wages. Consequently, emerging markets will likely continue to grow faster than developed markets for the foreseeable future. While this growth may lift hundreds of millions out of poverty and spur investment and innovation, evidence suggests investors may be left behind.

Jay Ritter, a professor at the University of Florida, documented a negative relationship between economic growth and stock market returns in his seminal research paper, "Economic Growth and Equity Returns," published in 2005. Ritter's findings are no fluke.

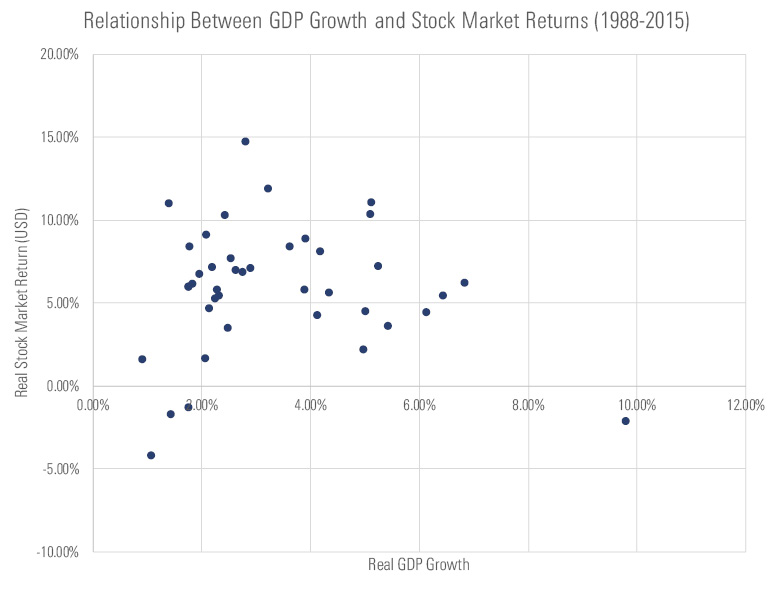

Using real gross domestic product data from the World Bank and the gross return version of each market's MSCI country index, I found a weak negative correlation between GDP growth and stock market returns across 41 countries from 1988 to 2015 [1]. This relationship is plotted in Exhibit 1, where each country represents a separate point. Excluding China—the outlier at the bottom right of the chart—results in a slightly positive, though still very weak, correlation between GDP growth and stock market performance.

- source: Morningstar Analysts

While the correlation between these two variables may change a little over time, the findings are fairly robust over long time horizons. It's clear that higher economic growth does not necessarily translate into superior stock market returns over the long run.

Reasonable Assumptions? This result should not be surprising given the strong assumptions that would be required to link GDP growth to stock market returns. In order for this relationship to hold, publicly traded stocks' valuations and earnings as a share of GDP would need to remain stable over time. This means that private and public companies would need to grow at the same rate, and there could be no new enterprises or IPOs. Second, there could be no dilution from new share issuance. Finally, all publicly listed companies would need to generate substantially all of their revenue and profits from the domestic economy.

The Link Between Economic Growth and Profitability In a closed economy, it would be reasonable to expect that corporate profits in aggregate would grow at a similar rate as the economy in the long run. Although the share of corporate profits relative to GDP fluctuates over time, it tends to revert to the mean. Profits cannot persistently grow faster than the economy because they would crowd out all other economic activity and attract new competitors. Similarly, total corporate profits should not grow slower than the economy in the long run, as firms exit unprofitable businesses, allowing those remaining to preserve margins.

But any country that U.S. investors can access is not closed. The largest companies listed in most countries tend to be multinational firms that generate a large portion of revenue and income outside their host country. For instance, in 2014 the constituents of the S&P 500 generated about 48% of their sales outside the United States, according to data from S&P Dow Jones indexes. This international exposure means that profits can grow at a different rate than the domestic economy, even in the long run.

Even if aggregate corporate profits grow in sync with GDP, dilution can prevent shareholders from enjoying the benefits of growth. Creative destruction is essential to economic growth. In aggregate all companies that are publicly listed today will grow slower than the economy because new entrants drive much of that growth. Between the time these new companies are launched and publicly listed, their growth dilutes most investors' ownership interest in the economy. Flagrant dilution of corporate earnings through employee stock grants and seasoned offerings is also a very real risk, particularly in developing countries with a tradition of poor corporate governance. Additionally, earnings growth can only create value if it allows firms to generate returns that exceed their cost of capital. High reinvestment rates may enhance both corporate and domestic economic growth but destroy shareholders' wealth through inefficient capital allocation.

Is Growth Already Priced In? Growth expectations influence stock market valuations. Valuations are rich when investors expect strong growth. However, as developing economies mature, their growth rates slow and valuations tend to decline. Consequently, even when countries realize their expected growth rates, their stock markets may not keep pace.

The impact of lofty growth expectations on valuations can create a treadmill effect, whereby fast-growing economies must realize high growth in order to generate a competitive rate of return. For example, in the mid-1980s the so-called "Asian tigers" had experienced two decades of rapid growth and investors had high expectations for future growth. In contrast, several countries in Latin America were facing severe inflation, a debt crisis, and low expectations for future growth. As a result, according to research published by Peter Blair Henry and Prakash Kannan in "Growth and Returns in Emerging Markets," in 1986 Latin American stock markets were trading at 3.5 times earnings, while the Asian markets were trading at 18.3 times earnings.

Over the next two decades, Latin American stock markets posted more than twice the annualized returns of the Asian markets, despite experiencing lower GDP growth over that horizon. Henry and Kannan persuasively argue that this was because Latin American countries implemented economic reforms that allowed them to exceed investors' low expectations. Conversely, the Asian markets performed in line with investors' high expectations, which were already priced in.

What's an Investor to Do?

In order to benefit from economic growth, investors must identify markets that have the potential to exceed expectations. Russia may fit the bill. At the end of September, the Russian equity market, as proxied by

Even if fast-growing emerging markets do not offer superior risk-adjusted stock market returns, they can provide good diversification benefits. Over the past 20 years, the MSCI Emerging Markets Index and S&P 500 were only 0.75 correlated. Emerging-markets equities may also offer a long-term hedge against a weakening U.S. dollar.

A version of this article was first published in December 2012.

References Vanguard research. "Investing in emerging markets: Evaluating the allure of rapid economic growth." April 2010.

MSCI Barra Research Bulletin. “Is There a Link Between GDP Growth and Equity Returns?” May 2010.

Ritter, Jay. "Economic Growth and Equity Returns." Pacific-Basin Finance Journal 13 (2005) 489-503.

Henry, Peter and Prakash Kannan. “Growth and Returns in Emerging Markets,” International Financial Issues in the Pacific Rim: Global Imbalances, Financial Liberalization, and Exchange Rate Policy (NBER-EASE Volume 17). The University of Chicago Press. July 2008. 241-265.

[1] Data for seven of these countries—China, Colombia, India, Israel, Peru, Poland, and South Africa—was not available until 1993, while data on Russia started in 1995.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)