(Re)introducing Capital Group's American Funds

More investors now have access to this strong active shop.

Capital Group recently made its entire American Funds open-end lineup available commission-free on Fidelity and Schwab's brokerage platforms, providing greater access to one of the industry's flagship firms. Investors who have avoided the lineup may want to reconsider it. Indeed, the firm's competitive advantages run deep, especially in equities. Below is a select overview of the firm and lineup. It elucidates American Funds' key competitive advantages and areas for improvement.

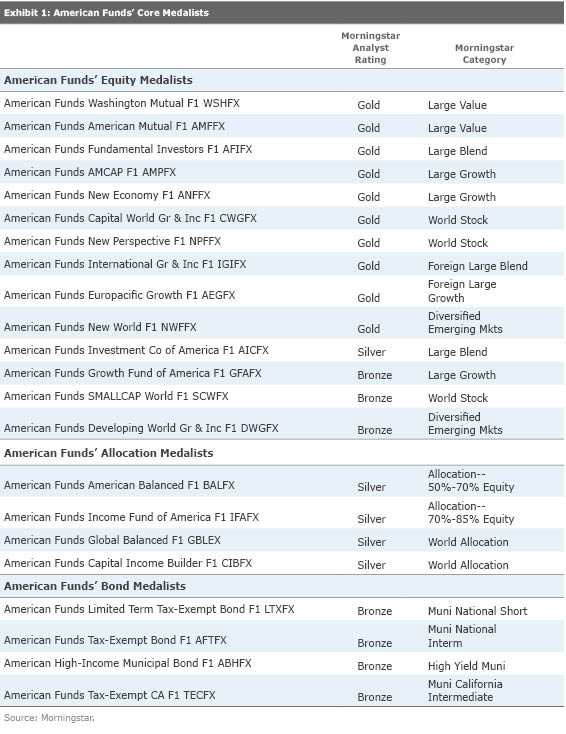

Lineup Overview American Funds' offerings come in several series, such as a target-date retirement series and a college target-date series. At the core, though, is a 35-fund lineup composed of 14 equity funds, four allocation funds, and 17 bond funds. Their scope is global and covers most asset classes, with some overlap. It's not exhaustive, however. The firm doesn't have a fund in the foreign large-value Morningstar Category, for example, and smaller-cap strategies are lacking. Of the 27 funds assigned a Morningstar Analyst Rating in American Funds' core lineup, 22 are Medalists, including all of its equity and allocation funds. Exhibit 1 lists the medalists by the tickers of their no-load F1 shares, newly available to retail investors at Fidelity and Schwab.

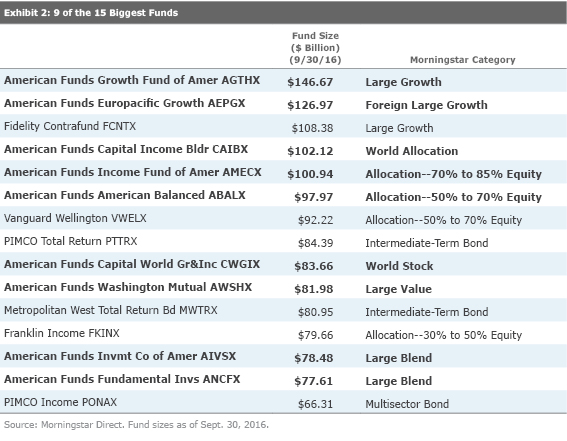

Multimanager System: Built for Scale, Diversity of Style, and Succession The first thing that stands out about American Funds' retail lineup is its size. As of August 2016, the firm's 35 U.S. open-end mutual funds, excluding money markets and funds of funds, held nearly $1.3 trillion in assets under management, which ranked second only to Vanguard's $2.7 trillion. American Funds' equity and allocation funds are some the industry's largest. Indeed, at the end of 2016's third quarter, they accounted for nine of the 15 biggest actively managed U.S. open-end funds.

American Funds' mammoth equity offerings are different from active peers of similar size led by a single manager or a team of managers. American Funds' multimanager system helps to handle their huge asset bases by blending the two approaches. It lets individuals invest in line with their conviction and according to their distinct styles while at the same time benefiting from collaboration, dialogue, and debate with their peers.

Unity in diversity is at the heart of the multimanager system. It divides each fund's portfolio into separately run sleeves. Managers oversee their own sleeves, and the analyst-run research portfolio collectively comprises another sleeve. High portfolio turnover is frowned upon, but managers have freedom and need meet only a fund's general mandate, such as an income target, in running their sleeves. They also benefit from consulting with analysts who are fellow investors. Indeed, the clearest indication of investment recommendations are the particular stocks and weighting of those stocks in analysts' own sector-focused sleeves of the portfolio. At the end of the day, though, managers and analysts make their own buy, sell, and sizing decisions. The result is a collection of high-conviction portfolios run in a variety of styles. It is the role of each fund's principal investment officer, in consultation with a senior oversight board, to ensure that the styles complement one another in service of the fund's mandate. When done well, the combination of separately managed sleeves mutes volatility but doesn't limit strong investment results over a full market cycle.

The multimanager system helps with succession. The opportunity to run sector-specific money facilitates analysts' transition into diversified portfolio management. That process is slow and deliberate. Analysts tapped to become portfolio managers start with small slivers of the portfolio. (Though, of course, even a 1% slice of gigantic funds such as

The multimanager system facilitates transitions out of management as well. The system allows for the grooming of one or more undisclosed managers to replace managers who are expected to retire soon. It can also help a fund overcome the unexpected loss of a manager. That happened in July 2015 when American Funds Growth Fund of America suffered the untimely death of its then longest-tenured manager James Rothenberg. As Rothenberg had been nearing retirement, he managed one of the portfolio's smaller sleeves. While that still added up to at least $5 billion, it was less than 4% of the fund's assets at the time. Plus, considerable overlap between Rothenberg's largest holdings and those of the fund's 11 remaining managers made it easier for them to absorb those holdings and minimize portfolio turnover.

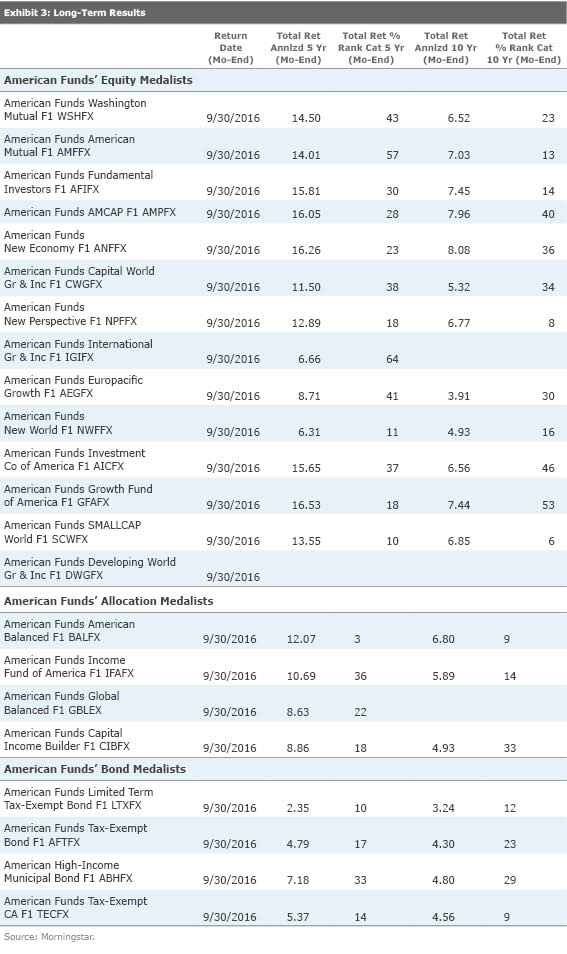

Competitive Long-Term Results for Equity and Allocation Funds The multimanager system has helped generate competitive long-term results for American Funds' equity and allocation funds, as well as several of its municipal offerings.

Nineteen of the firm's 22 medalists had a track record of at least a decade through September 2016, and 14 of them finished in their respective peer groups' top third or better in that period. Only American Funds Growth Fund of America had a bottom-half showing during that span. That fund's 7.4% annualized 10-year gain, however, fell only 16 basis points shy of its category's top half.

Some of the firm's top performers are especially strong. Take

Robust Investment Culture: Fees, Compensation, and Manager Investment The firm's robust investment culture helps instill confidence for the future. Indeed, looking at various metrics Morningstar compares across management firms, such as fees, compensation, and manager investment, Capital Group, the parent of American Funds, looks to be a good steward.

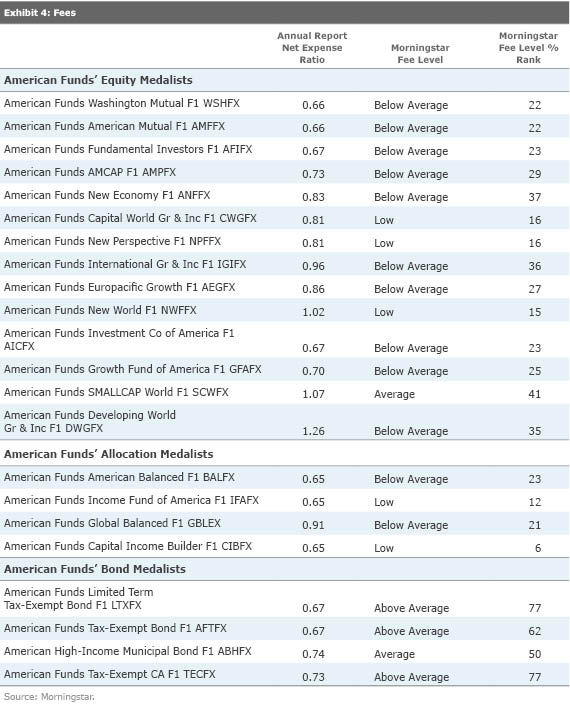

Fees are competitive for an active manager. As of September 2016, nearly two thirds of American Funds' share classes had Morningstar Fee Levels of Low, compared with similarly distributed peers, and another fifth were Below Average. This tilt toward the cheapest two quintiles is reflected the F1 shares' fee level scores for the 22 American Funds medalists.

Among the equity and allocation medalists, only

The firm's management compensation structure stands outs by giving managers incentive to take a long-term view. Bonuses are tied to investment results, not assets under management, and are based on comparisons of pretax performance of the managers' portfolio sleeves with relevant benchmarks during the most recent year, a four-year rolling average, and an eight-year rolling average, with more weight placed on the four- and eight-year averages. The greater weighting of the four-year--and especially eight-year--averages is unusual in an asset management industry that tends not to give incentives past the five-year mark.

Capital Group's managers also invest alongside shareholders. As of September 2016, 97% of the firm's assets were in funds that had at least one manager who invested more than $1 million. A closer look at the Statement of Additional Information disclosures highlights the degree to which managers eat their own cooking. Forty-three managers invest more than $1 million in at least one fund, 28 in at least two funds each, 12 in at least three funds each, and one in four funds each. Turning to the funds themselves, there are 14 in which at least half of the named managers invest more than $1 million each. That includes

Room for Improvement: Fixed Income, Capacity Monitoring, and Further Transparency Capital Group isn't perfect. For one, it needs to prove it can be effective with its fixed-income funds. There is a dearth of fixed-income medalists at American Funds, apart from its muni offerings, and the fixed-income sleeves keep the firm's allocation funds at Silver, as opposed to Gold.

Part of Capital Group's problem has been that the multimanager system was designed with equity investing in mind. The system originated in April 1958, but the firm didn't launch its first fixed-income fund,

Fixed-income offerings, like American Funds Bond Fund of America, performed poorly during the 2007-09 crisis and set the stage for an overhaul. Central to that overhaul is an attempt to foster greater coordination of the fixed-income managers' views through periodic portfolio strategy group meetings and a higher degree of focus and accountability from each fund's principal investment officer. New capabilities in derivatives and risk monitoring have been added, and the firm has been on a hiring binge the past few years. Senior-level additions include fixed-income head Mike Gitlin from T. Rowe Price and high-yield manager Tom Chow from Delaware Investments, both in 2015. More recently, core manager Pramod Atluri joined from Fidelity in February 2016. The changes are positive, but they're still too new to declare the overhaul a success.

Capacity monitoring is another area in which Capital Group could improve. The division of each fund into individual sleeves makes it easier to handle the funds' huge asset bases. There have been times, though, when the system appeared overwhelmed. American Funds Growth Fund of America's nearly $147 billion asset base may at present make it the biggest actively managed offering in the United States, but the fund is far short of its $202 billion peak in October 2007. In the three years prior to hitting that peak, the fund had an estimated $52.3 billion in inflows. For context, that's equivalent to absorbing what today would be the 21st-biggest actively managed offering in the U.S. At least one current manager who was on the fund then has conceded that putting that much new money to work was very difficult and may have hurt the fund, at least in the short term.

Finally, the firm could be more transparent. In recent years, Capital Group has provided details on managers' investment styles and how those styles are expressed in the sleeves, providing such details as three-year averages for turnover and the number of stocks held. These glimpses cumulatively build over time and enhance one's conviction in a fund, but Capital could do a better job of helping investors understand just who is at the helm during rough patches. The firm should scrap its vague practice of simply stating that a manager has been with a fund for X years, without providing an actual start date. The practice is especially problematic when a manager who had previously been on a fund returns years later and the two time periods are collapsed into one undifferentiated tenure number. That has occurred with Darcy Kopcho's two stints on

Issues like manager disclosure notwithstanding, Capital Group remains one of the industry's best stewards. Increased access to the firm's retail lineup is a welcome development.

Disclosure: Alec Lucas owns shares of a different class in American Funds Washington Mutual.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)