Slower Healthcare Job Growth Raises New Concerns

Though the market was focused this week on Brexit and the Fed, we remain much more worried about slowing growth in the U.S.

Markets didn't move too far this week, reflecting the economic data that generally hit expectations, but was nevertheless lackluster. Developed-world equities were generally weaker as increased chatter of a U.S. Federal Reserve rate increase in December kept a lid on market activity. Renewed talk of a quicker Brexit and Prime Minister Theresa May's setting a date to commence the proceedings also hurt European markets. Emerging markets managed to show small gains, related to better economic data in some emerging-markets regions. Hurricane worries also helped along the commodities sector, moving up for the week after a dreadful performance for the third quarter.

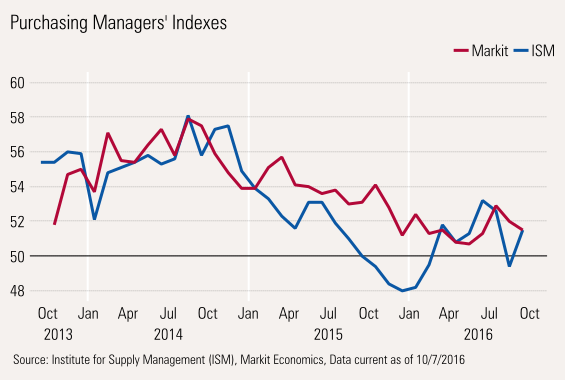

U.S economic news this week obviously wasn't great, as the Atlanta Fed's GDPNow forecast dropped to just 2.1% for the third quarter, not all that much better than the 1.4% rate in the second quarter. In the United States the week kicked off with weak auto sales that showed little growth from a year ago. Construction also continued its slump in August. However, on Tuesday, purchasing manager data from both the ISM and Markit registered a reading of 51.5, indicating modest growth. Still, the Markit index was down modestly in the United States, even as the ISM reading improved. The current low reading shows that U.S. manufacturing isn't moving very fast in either direction. Year-over-year U.S. auto sales growth rates also continued to fall to nearly zero as this pillar of U.S. economic growth continues to crumble.

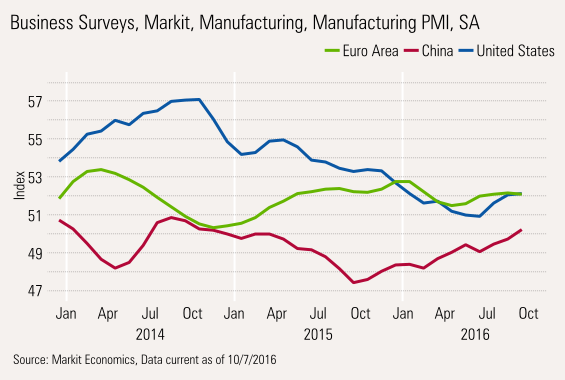

In more positive news, the Markit Manufacturing purchasing manager readings for Europe and China were both up. The European index improvement reflects the fact that Brexit impacts are likely to come later than sooner. However, that was before Prime Minister May announced that she would formally begin the Brexit process in March. China's improved data for September was a relief after an unexpected drop in August. However, a weak U.S. trade report on Thursday suggested that U.S. imports were every bit as anemic as export growth, despite the dollar's ups and downs. That certainly is great news for U.S. trading partners, though markets seemed to shrug it off.

Finally, the market topped off the week with a very dull employment report that showed low year-over-year growth levels, lower year-over-year hours worked, but strong hourly wage growth. Markets fear that higher wage growth may spur the Fed into action later this year. We were more worried about continued slow growth in retail employment, and now even the normally strong healthcare sector is showing signs of weakness. With most new potential Medicaid enrollees (under the Affordable Care Act beginning in 2014) signed up, healthcare spending and employment growth are likely to continue to diminish.

Although the market focus seems to be on the Fed and Brexit again, we remain much more worried about slowing growth in the United States. Sooner or later the market will realize that slow growth isn't such a great thing after all. Our full-year GDP growth expectation is now 1.6%, and our 3% forecast for the third quarter is looking a little rich at the moment. With autos, airlines, shale-related activity, and now healthcare, getting back to 2.0%-2.5% growth looks like a real challenge. However, workers and consumers may fare better than GDP and corporate profit growth as demographics continue to put workers in the catbird seat.

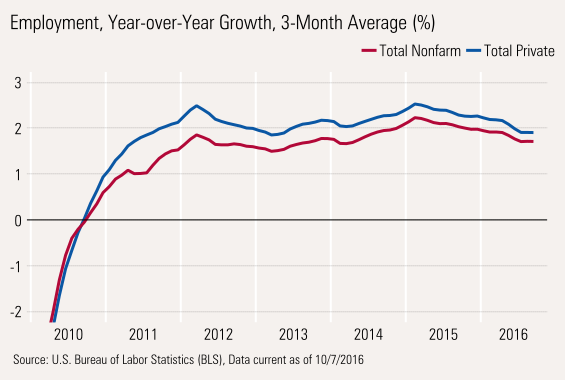

Employment Growth: More of the Same Slog Overall, employment data looked a little better month to month, as the private sector added 167,000 jobs, compared with August's 144,000. Hours worked, which were at a recovery low in August, sneaked up to 34.4 and wages were up 0.23% month to month, which annualizes to about 2.5%. Whether that is good or bad news depends on if you are an employer or an employee. The year-over-year, averaged data didn't look as good with employment growth and hours worked growth still near the lows of the past 12 months, as shown below.

Year-Over-Year Employment Growth Showing Some Strain

Overall employment growth has slumped from 2.1% in early 2015 to a more meager 1.7% currently. Rather than one big bang of a decline, this rate has slowly crept downward. We suspect that given strong employment levels last fall and soft GDP data, that rate is likely to fall under 1.5% by the end of the year.

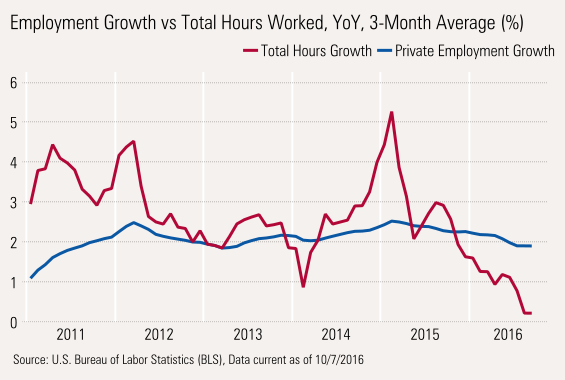

Declining Hours Worked Still a Problem Combining hours worked with employment levels, the deterioration looks quite a bit worse and is probably a truer reflection of reality. Given that it is so hard to find and train workers, employers continue to hold on to workers for dear life, even in weak sectors, and appear to be adjusting hours downward instead. This is particularly true in the retail sector.

However, hourly wages are a bright spot, at least for employees. Hourly wage growth continues to accelerate as employers are forced to pay up, either because of market demand or new minimum-wage levels. Higher wages may help the consumer do better than other sectors. However, higher wage rates come with a downside. If the rates go high enough, employers may engage in more labor-saving activities. Or they may choose to grow more slowly. Also, higher wage growth often results directly in more inflation, which could scare the Fed into action.

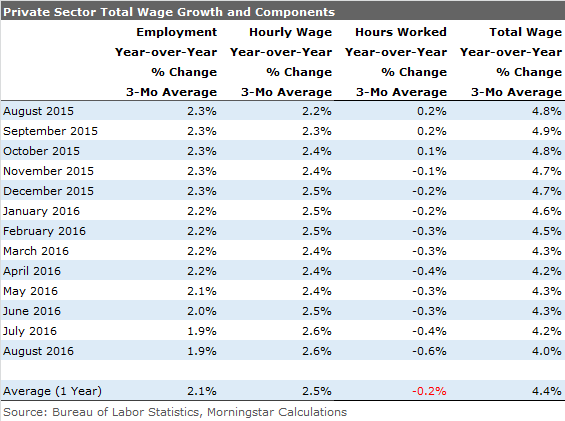

Rolling all of the statistics together, higher hourly wages are not going to offset fewer hours and lower employment growth rates. When we piece together the parts (which exclude bonuses and benefits), over the past year, total wage growth has fallen from 4.8% to 4.0%, enough to have some impact on consumer spending.

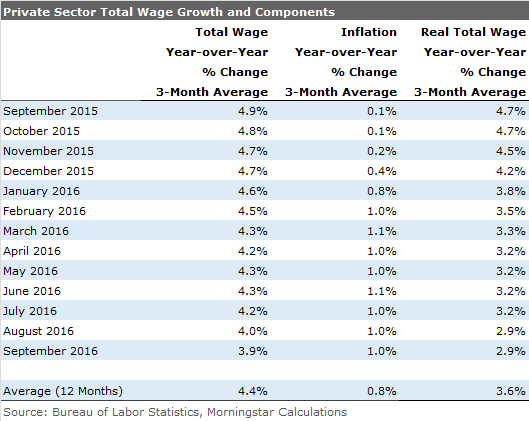

Adjusting for Inflation Wage Growth Is Looking More Problematic

As inflation rates have inched higher, real total wages have taken an even bigger hit, falling from 4.7% to just 3.2%. That situation is likely to worsen in the months ahead as energy inflation increases, potentially bringing headline inflation to over 2% as early as January or February.

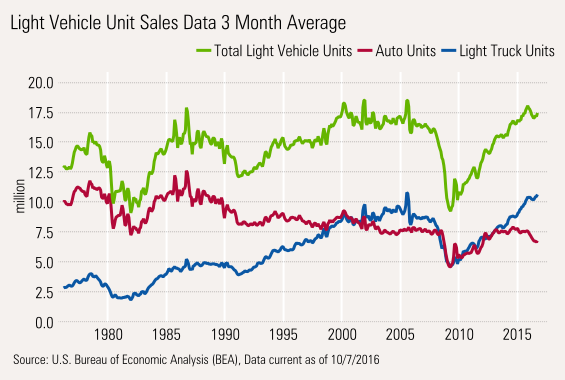

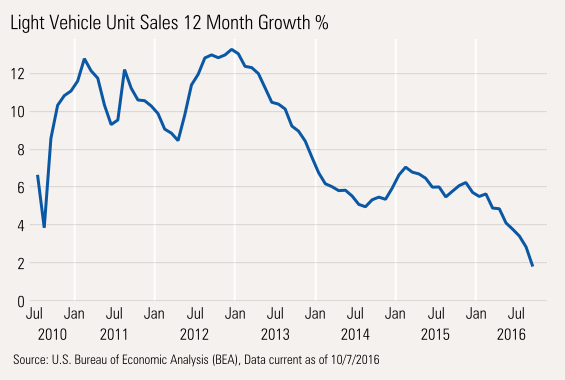

Auto Sales Clearly Peaking Out We have talked about peaking auto sales for a very long time. Recent data showed almost no growth in total auto sales in September. And to get to even those levels, incentives were higher than usual and fleet sales looked a bit high, too. It appears that auto sales are topping out very close to two other major tops in auto sales. The only good news is that higher-priced light trucks, with bigger sticker prices, greater U.S. content, and better profit margins, are still increasing as conventional sedans continue to take a pounding.

Although the unit data has topped out, the averaged growth rates are even more worrisome. After peaking at over 12% in 2013, unit growth rates have fallen to under 2% and are likely to approach zero as we lap last year's exceptionally strong autumn. Auto sales have been a regular contributor to GDP, adding 0.2%-0.4% to GDP growth over many years, which is no small potatoes in a world of 2%-2.5% growth.

World PMI Data a Rare Bright Spot

Manufacturing data around the world has been slumping for some time, as slowing commodity cycles halted growth in almost all regions of the world. The overall reading dropped to almost 50 this fall, the demarcation between growth and decline. With better news out of some markets recently, the overall world reading is finally improving again. More stimulus out of China and fewer worries about Brexit mean there is some hope for continued improvement, though no boom is in sight.

The improvements in the major markets look particularly good. China, still registering low numbers, has shown some improvement for almost a year. The European numbers looked better as everyone worried less about Brexit and realized that the impact won't be felt for a while. However, we caution that this was before this week's announcement of a formal Brexit negotiation date for March, which will set off the countdown.

ISM Data for the U.S. Up for Single Month of September, Markit Down; Both Now at Same Level We generally prefer ISM Data to Markit data, but they do tend to track each other. In August, the single-month gap was unusually wide, with Markit registering over 52 and ISM under 50. However, the data converged in September, as shown below.

I think that with the numbers finally tracking together, the odds of very modest growth have improved, and the recession risk suggested by the ISM number last month is now behind us. Still, the current low reading suggests little growth.

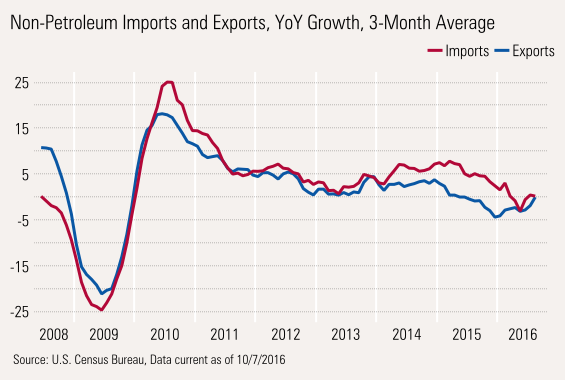

Imports Look as Bad as Exports, Limiting Damage to GDP Growth There were a lot worries that a stronger dollar, a potential Fed rate increase, and a relatively stronger U.S. economy would send the trade deficit wildly higher, with stronger imports and weaker exports. We got that half right. Year over year, nonpetroleum exports showed no growth, as we might have suspected. However, a recent surge in soybean sales might be providing a little bit of an artificial lift in exports. The big surprise has been limited import growth, which is up just 0.2%. The current trend of more interest in having experiences versus material goods is compounding import issues in capital goods, which was hit by issues in the oil and gas complex.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)