Credit Market Insights: Leaving Brexit Behind

After initial Brexit-induced volatility, corporate credit spreads resumed their tightening trend over the third quarter.

- During the third quarter, the corporate bond market quickly shook off uncertainty driven by the UK vote to exit the EU at the end of June.

- The corporate bond market performed well in the third quarter as tightening credit spreads have lifted bond prices.

- Global central banks maintained their easy monetary policies.

After quickly shaking off a brief bout of volatility spurred by the UK's vote to exit the EU at the end of June, corporate credit spreads resumed their tightening trend over the third quarter. As volatility subsided, the flight to safety abated, leading to a slight upward shift in interest rates for U.S. Treasury bonds. Global central banks have maintained their exceptionally easy monetary policies; however, the Bank of Japan has changed its focus to managing the shape of the yield curve from managing short-term interest rates and quantitative easing.

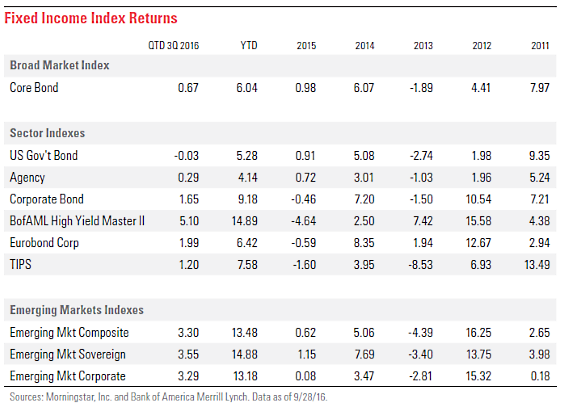

Shaking Off Brexit Induced Volatility, Corporate Credit Spreads Tighten in Third Quarter The fixed-income markets performed exceptionally well in the first half of 2016 as the combination of declining interest rates and tightening credit spreads lifted bond prices and generated returns well in excess of the amount of yield carry that bonds would have otherwise generated. Returns in the third quarter, however, have been suppressed (and in some cases resulted in declines) as interest rates on U.S. Treasury bonds have risen off their lows. For example, the yields on 2-year, 10-year, and 30-year Treasury bonds have risen by 18, 10, and 1 basis points, respectively. Among the Morningstar fixed-income indexes that are tied to U.S. Treasury bonds, the rise in interest rates has pushed bond prices down enough to result in a small loss.

Those fixed-income sectors that trade at a spread over the underlying Treasury bond market have been able overcome rising interest rates during the third quarter and have generated gains as the amount that credit spreads have tightened has more than offset the amount that interest rates have risen.

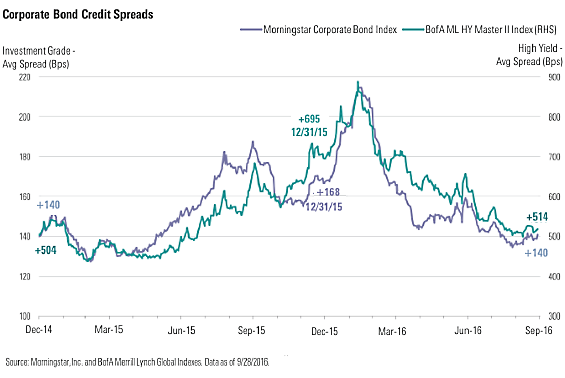

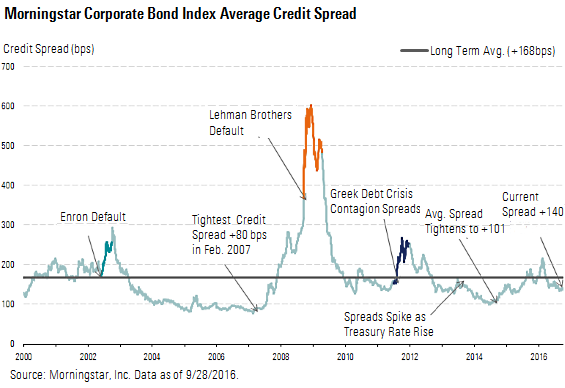

For example, within the corporate credit markets, the average credit spread of the Morningstar Corporate Bond Index has tightened 15 basis points to +140, and in the high yield sector, the average credit spread in the Bank of America Merrill Lynch High Yield Master Index has tightened 107 basis points to +514. Since the end of last year, the average spread in the investment-grade market has tightened a total of 28 basis points, and in the high yield market, the average spread has tightened 181 basis points.

Within the Morningstar Corporate Bond Index, during the third quarter the greatest amount of credit spread tightening occurred within the gas pipelines, basic industries, and telecom sectors, which tightened 41, 27, and 23 basis points, respectively. The sectors that have lagged the market in the third quarter are technology, finance, and manufacturing. The average spread in the technology sector widened 1 basis point, and within the finance and manufacturing sectors, credit spreads tightened by 5 and 7 basis points, respectively, trailing the overall market which tightened 15 basis points.

Year to date, the greatest amount of credit spread tightening has occurred within the basic industries, gas pipelines, and energy sectors, which tightened 171, 149, and 69 basis points, respectively. The sectors which lagged the market in the third quarter are the bank, insurance, and technology sectors, which widened 2 basis points, tightened 2 basis points, and tightened 5 basis points, respectively.

Despite a brief widening in corporate credit spreads following the UK vote to exit the European Union near the end of the second quarter, corporate credit spreads resumed their tightening trend over the third quarter as the market shook of this anxiety. Demand for corporate bonds has also been spurred by international investors who are attracted to the higher all-in yield provided by bonds denominated in the U.S. dollar compared with less lucrative yields elsewhere. Currently, the average credit spread of the Morningstar Corporate Bond Index is 28 basis points tighter than its long term average and the average spread of the Bank of America High Yield Master Index is 68 basis points tighter than its long-term average.

With corporate bonds trading at credit spreads that are tighter than their long-term averages, market appetite at these levels may be tested as corporations begin to release their third-quarter earnings reports over the next few weeks. According to a report published by Factset, the estimated earnings for the S&P 500 is forecast to decline by 2.3%. If this comes to fruition, that would mark six consecutive quarters of year-over-year earnings declines. Factset further reported that would be the longest-running consecutive decline in earnings since it began tracking the data in the third quarter of 2008.

Investors will also be focused on any changes to monetary policy by the major global central banks. The Federal Reserve held its monetary policy steady following its September meeting, but made changes to its meeting statement that seemed to telegraph that it is edging closer to raising the federal funds rate. Similarly, the ECB held its monetary policy steady, whereas the Fed is moving closer to tightening monetary policy, and the ECB reinforced its commitment to provide more stimulus if the European economy does not improve to the degree the ECB expects.

The Bank of Japan held the size of its asset purchase program steady for now but announced that it was changing the focus of its monetary policy. Moving forward, the BOJ will concentrate on managing the shape of the yield curve and lessen the reliance upon the size of its asset purchase program.

Morningstar Credit Ratings, LLC is a credit rating agency registered with the Securities and Exchange Commission as a nationally recognized statistical rating organizations (“NRSRO”). Under its NRSRO registration, Morningstar Credit Ratings issues credit ratings on financial institutions (e.g., banks), corporate issuers and asset-backed securities. While Morningstar Credit Ratings issues credit ratings on insurance companies, those ratings are not issued under its NRSRO registration. All Morningstar credit ratings and related analysis contained herein are solely statements of opinion and not statements of fact or recommendations to purchase, hold, or sell any securities or make any other investment decisions. Morningstar credit ratings and related analysis should not be considered without an understanding and review of our methodologies, disclaimers, disclosures and other important information found at https://ratingagency.morningstar.com.

More Quarter-End Insights

Stock Market Outlook: A Little Too Buoyant?

Basic Materials: China-Dependent Producers Largely Overvalued

Consumer Cyclical: Poised to Perform in the Second Half

Consumer Defensive: A Handful of Values in an Overheated Sector

Energy: Rally in the Works, but It Won't Last Long

Financial Services: Berkshire Is Bigger Than Buffett

Healthcare: We See Value in the Drug and Biotech Industries

Industrials: Weak Commodity Prices Weigh

Real Estate: Expect Some Choppy Waters Ahead

Tech & Telecom: Opportunities in Smartphones and IT Services

Utilities: How Long Can the Yield Paradox Survive?

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)