Markets Mistake Statistical Noise for Accelerating GDP Growth

Contrary to the popular view, we believe the data this week showed a stable if not weakening economy.

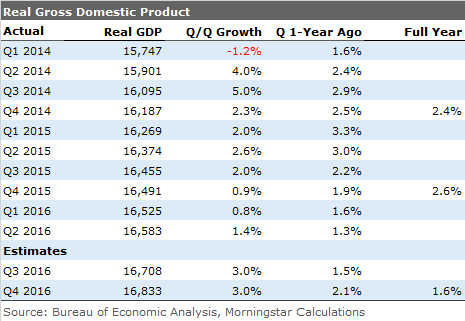

Seemingly stronger economic data in the middle of this week caused a brief panic in stock and bond prices as investors feared that the odds of a U.S. Federal Reserve rate increase sometime this year had increased dramatically. Markets focused on the first-quarter GDP increase, from 1.1% to 1.4%, some favorable trade data, and a renewed focus on a potential rebound in third-quarter GDP growth to 3% or more.

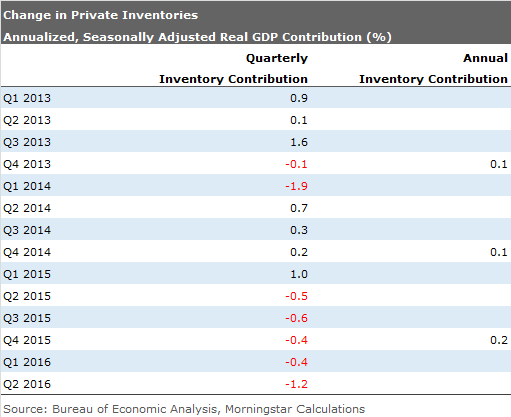

Although that potential was well-known among economists, the popular press doesn't focus on current-quarter GDP until the final data for the previous quarter is released. The final data for the second quarter was released on Thursday. Even the normally sedate Wall Street Journal chose to focus on third-quarter growth on the front page of Friday's edition, trumpeting the possible third-quarter 3% growth rate as the fastest growth in two years and substantially better than the sluggish first half. However, most of that rebound is related to the fact that inventories are unlikely to hurt GDP in the third quarter after subtracting 1.2% off of second-quarter growth. We view these quarterly ups and downs in inventories as statistical artifacts. We believe the real economy is likely growing 2% or so, with full-year GDP potentially being slightly lower at 1.5%-1.75% as first-half statistical anomalies prove difficult to fully overcome.

Contrary to the popular view, we believe the data this week showed a stable if not weakening economy. In fact, markets rallied sharply on Friday when some softer data was released (because that potentially means the Fed will be more reluctant to raise rates after all). Consumption data on Friday was particularly soft and worrisome when combined with weaker income data. Pending home sales fell both month to month and year over year, suggesting existing-home sales will detract from the GDP calculation in the third quarter. Durable goods orders, after subtracting out volatile transportation goods, showed that the manufacturing sector is still stuck in the mud, doing little to help or hurt the overall economy. In a rare bit of good news, home sales, while down month to month, showed a continuation of positive longer-term trends and healthy unit growth rates of 10%-12% annually.

Modest Upward GDP Revision Does Little to Change the Economic Story The GDP growth estimate for the second quarter was revised up from 1.1% to 1.4%, primarily because of business structures and net exports. The broad contours of the report were little changed, with consumers continuing to lead the way with a strong but unsustainable growth rate of 4.3%. On the other hand, inventories shrank yet again, subtracting 1.2% from the GDP calculation, though that was less than previously estimated.

Little else made much difference, but there were a lot more negative signs than we would like to see in the category detail. In a rare moment of weakness, housing subtracted 0.3% from GDP in the quarter, instead of its more typical 0.3%-0.5% contribution. A short-term weather-related February spurt in housing starts aided first-quarter results and killed the second quarter. We suspect that housing still won't be its strong self again in the third quarter, but it is unlikely to be a big subtractor, either. Improving new home sales are likely to be offset by lower commissions on existing-home sales.

Given Special Factors, We Suspect Second-Half Growth Will Be Substantially Stronger Better inventory and housing data in the second half could boost second-half growth to as much as 3% on the widely reported, seasonally adjusted annual rate basis. However, that won't be enough to overcome the weakness in the first half or keep the year-over-year GDP growth from shrinking to the lowest level of this recovery.

In addition to the slowing full-year over full-year growth, note that the likely quarter over the same quarter a year ago growth rates will also be relatively frail even with our relatively aggressive 3% sequential estimates for the third and fourth quarters. The ongoing slowing in GDP growth is one reason we are worried about employment growth and the consumer over the intermediate term.

Paradoxically, mechanically based forecasting systems started out the quarter forecasting very strong growth (Atlanta Fed GDPNow started at 3.6% in August), while the Blue Chip consensus forecast was much more muted at 2.5% at the same time. The GDPNow data has dropped considerably to 2.4% and the Blue Chip consensus is up to 2.8%. We are still hopeful that the third quarter will look better than those two forecasts and get very close to 3% growth. However, as noted above, the more important third-quarter over third-quarter growth rate is likely to remain well below 2%.

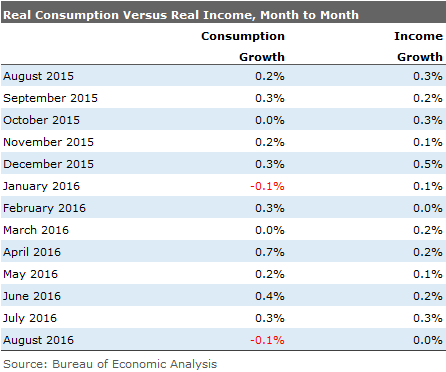

Consumption and Income Data Lost Some Momentum Real consumption and real income data for August was disappointing and below expectations, as consumption shrank by 0.1% and incomes showed no growth at all month to month. The weaker consumption data was driven by poor auto sales, and income growth was limited by poor employment growth.

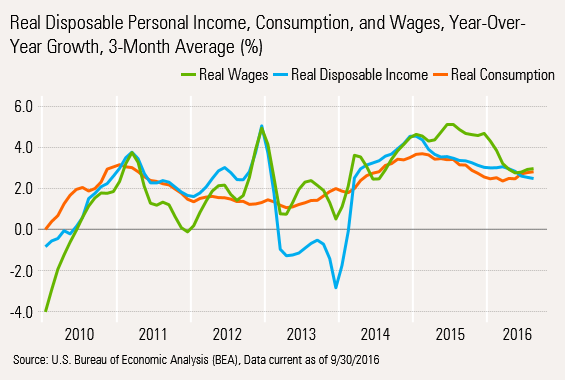

Consumption growth has been trending down for several months and income growth has been low, but trendless. Unfortunately, spending growth has been better than income growth in most months of 2016 following a period in 2015 when income growth generally exceeded spending growth. This leaves less dry powder of unspent funds to fuel more consumption growth in the months ahead.

While the monthly data does raise some cautionary flags, the year-over-year, averaged data doesn't look quite as bleak, though the slowdown in income and consumption growth is still quite apparent. On the plus side, wage and consumption data is showing signs of bottoming, though total income (which also includes small-business profits, rents, and investment income) continues to move in the wrong direction.

The good news is, with even modest growth in consumption in September, third-quarter consumption is still likely to be up close to 2.6%-2.9%. That's not as good as the second quarter's anomalous 4.3% but in line with recent averages. Because of the way consumption growth built throughout the second quarter, a strong performance in the third quarter was almost preordained. Anemic monthly data recently will not be enough to ruin the third quarter. However, the fourth quarter could be a different story, especially if auto sales falter.

With consumption driving 70% of GDP and incomes driving spending, this data set will be one of the key ones to watch in the months ahead. If employment growth remains sluggish, incomes and consumption will be blunted. However, consumption could still do slightly better if consumers feel confident enough to dip into savings or take out loans to leverage income gains. Sadly, consumers are showing little interest in motor vehicles, which are quite leverageable, and more interest in travel and health, which are harder items to borrow against.

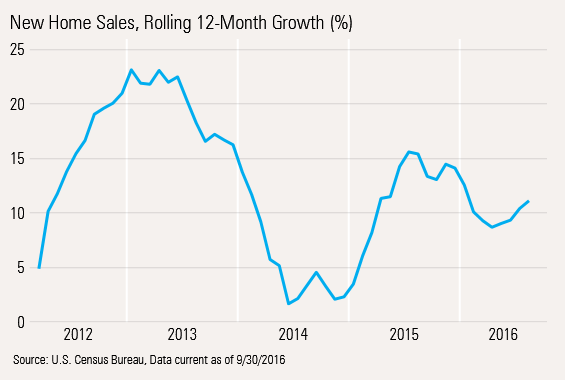

New Home Sales Trends Intact at Healthy Levels New home sales data this week seemed quite contradictory on the surface. Month-to-month sales dropped back to earth in August after a great July. However, year-over-year data was up a strong 22%. We believe the trend is best captured by the rolling 12-month sales data, which continue to show the same 10%-12% positive growth rate.

One side note: The dip in 2014 was due to sustained cold winter weather and higher mortgage rates, and the strong bump in early 2015 was due to better weather conditions. If you could visually smoosh those artificial bumps, a 10% trend line becomes more apparent.

There were some other interesting trends worth reporting, too. First, sales of new homes not yet started was the largest category of sales (versus homes under construction or finished), which is highly unusual. Usually homes under construction dominate the statistics. Year over year, homes bought sight unseen were up 33% year over year, and actually increased month to month even as sales in the other two categories dropped. We like to see this category do well because it will generate new housing starts in the months ahead. It's one of the more forward-looking housing indicators that we have.

Second, builders appear to be reacting to demands for additional lower-priced homes. With land supplies tight and demand strong at the high end, builders initially focused their efforts on that segment. Now, demand in the middle categories appears to be gaining strength and drove August sales results. Homes in the $200,000-$299,000 category surged to 37% of sales versus just 29% last August and 32% for all of 2015.

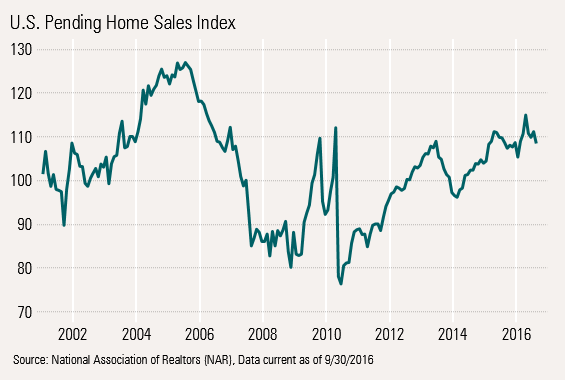

Strong New Home Results Offset by Faltering Pending Home Sales Regrettably, pending home sales, a great indicator of existing home sales, continues to stall out. After a great run since 2010, the Pending Home Sales Index (and existing-home sales, too) have stalled out and have showed little improvement in 2016. The index has vacillated around the 110 level for most of the year, suggesting little improvement ahead. That is consistent with the National Association of Realtors' forecast for little or no growth in existing-home sales in 2016. The good news is that existing-home sales are about half as important as new single-family home sales in the GDP calculation.

Existing-home sales are suffering from a lack of inventory with boomers staying in their homes longer (including their retirement years), and lower job mobility, which tends to generate more home sales. Higher prices have also affected affordability and new home prices are now more competitive with existing homes. Remodeling a current home has also become a more popular option, further cutting into existing-home sales.

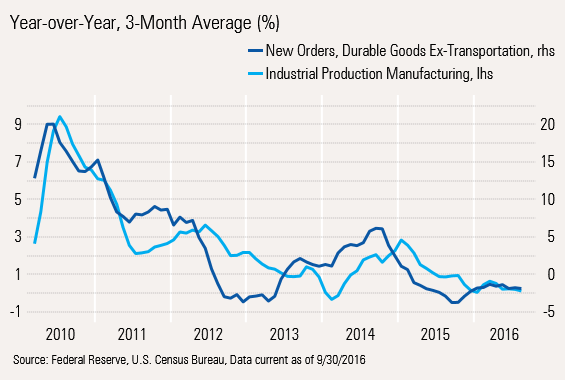

Durable Goods Orders Going Nowhere Fast Manufacturing can't seem to find a catalyst to help accelerate growth. New orders, excluding the volatile transportation sector (airliners and autos) generally lead industrial production, as shown in the chart below.

Because of price issues and the ability to cancel orders, the New Order Index is more volatile than IP and in downcycles tends to do worse than industrial production. We re-scaled the data so readers could better see the correlations and lag times between new orders and industrial production. Unfortunately, the chart shows more of the same with durable goods orders down just over 2% on a moving-average basis, about the same as the rest of 2016. That correlates to just about no growth in industrial production, which is what we have seen.

The details of the report weren't particularly bullish, either, with four of seven categories down for the month of August, and three of seven down on a year-over-year basis. Separately, the report also showed that shipments (not orders) of nondefense capital goods were down 0.4% in August and 0.7% in June. That information is used to calculate the equipment portion of GDP, providing a potential source of weakness in the third-quarter GDP calculation. It's also probably not great news for manufacturing employment or exports.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)