How Do You Grade a Company's Sustainability?

Morningstar's Jon Hale explores how Sustainalytics does the firm-level research that underpins our sustainability rating for funds.

This week, I'm answering a question from a Sustainability Matters reader: "How can I learn more about the actual measures that Sustainalytics uses for its company assessments? ESG, yes, but what specifically does it measure and how?"

Company-level environmental, social, and governance research forms the basis of the Morningstar Sustainability Rating for funds. We get that research from Sustainalytics, a top global provider of ESG information and analysis. We roll up Sustainalytics’ ESG scores of individual companies on an asset-weighted basis to get a portfolio Sustainability Score; we then assign a rating based on how well a fund’s score stacks up with its Morningstar Category peers.

Sustainalytics' research tells us what companies are the best sustainability performers within an industry. It does not tell us to avoid entire industries for sustainability reasons. Likewise, in our fund ratings, a fund that excludes traditional “sin” stocks, such as tobacco or gaming, or excludes entire industries, such as mining or oil-and-gas producers, is not advantaged. The Sustainability Rating for funds depends on how well the companies that are actually held in a portfolio are managing ESG issues relative to their industry peers.

Sustainalytics evaluates company sustainability performance based on an assessment of the environmental, social, and governance issues that a company faces in its business. Companies that do well on this evaluation are considered to be those that are proactively managing the ESG issues that are the most material to their business, and doing so better than their peers.

This is obviously relevant to investors who are concerned about the long-term impact that large multinational companies, in particular, have on global environmental and societal problems, not only as problem-causers but also as problem-solvers. Sustainability performance measures help investors who want to focus on companies that are leading the way to a more sustainable global economy and avoid those that aren’t.

Beyond that is the key issue of materiality that should concern all investors. Put simply, ESG issues can be relevant to a company’s financial success, but because they are nonfinancial metrics, they may be overlooked or undervalued by analysts.

Research is starting to suggest a connection between corporate sustainability performance and financial performance. A 2014 Harvard study, for example, found that “High Sustainability” companies significantly outperformed “Low Sustainability” companies over the long term. The researchers identified companies that had already adopted best-in-class sustainability practices by 1993 and paired them with companies that had not done so, then compared their stock market performance through 2010. The High Sustainability companies significantly outperformed the Low Sustainability firms, suggesting to the authors that:

The integration of [sustainability] issues into a company's business model and strategy may be a source of competitive advantage for a company in the long-run. A more engaged workforce, greater transparency, a more collaborative community, and a better ability to innovate may all be contributing factors ... .*

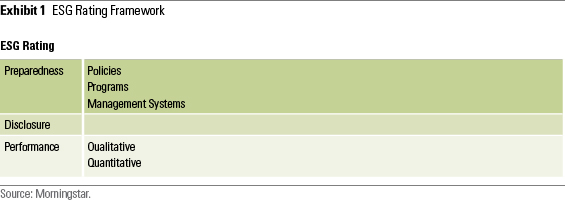

Sustainalytics measures company sustainability performance by identifying the most relevant ESG issues, industry by industry. Within each of the three E, S, and G pillars, a company is assessed on three dimensions: preparedness, disclosure, and performance. Preparedness measures a company’s commitment to managing ESG risks through stated policies, programs, or systems. Disclosure measures transparency about ESG-related activities and the extent to which a company’s ESG reporting reflects best practices. Performance is measured through various quantitative and qualitative indicators.

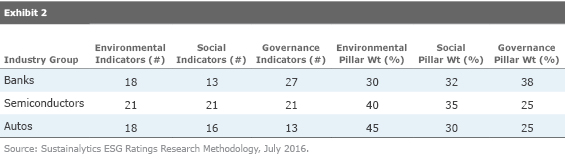

Sustainalytics has developed more than 70 indicators to measure these issues, which are weighted according to their level of importance within each of 42 industry groups. The three pillars are also weighted according to their level of importance to the industry, in terms of both overall environmental and societal impact and financial materiality, as shown in the three-industry example below.

The resulting company ESG score is on a 1-100 scale, which is accompanied by a percentile ranking relative to the company’s industry peers. Pillar scores are rendered in the same way. Analysts oversee the entire process and also provide a qualitative assessment. Company scores are updated on an annual basis.

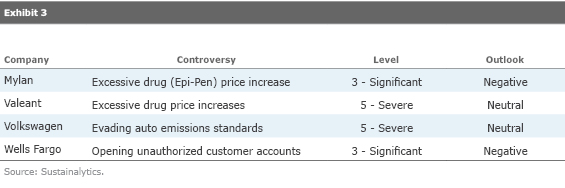

Sustainalytics also evaluates ESG-related controversies in which companies may find themselves embroiled. These incidents are collected via a daily news screen on more than 10,000 companies and processed by analysts within 48 hours. If an incident is determined to have serious-enough ESG relevance, it is categorized as a Controversy and rated from 1 to 5, with those rated 3, 4, and 5 being the most serious. Serious Controversies have significant-to-severe impact and risk to the stakeholders for the companies involved. They are followed on an ongoing basis and carry an analyst outlook on the likelihood of the rating being upgraded or downgraded over the next 12 to 24 months.

For the Morningstar Sustainability Rating for funds, we start with a company’s ESG score and deduct points for Controversies. The resulting fund metrics give investors a way to look at how well the companies held in a particular portfolio are managing their ESG risks and opportunities.

-------------------------------

*Eccles, R.G., Ioannou, I., and Serafeim, G. 2014. "The Impact of Corporate Sustainability on Organizational Processes and Performance." Management Science, Vol. 60, No. 11, P. 2835-2857. Accessible at: http://www.hbs.edu/faculty/Publication%20Files/SSRN-id1964011_6791edac-7daa-4603-a220-4a0c6c7a3f7a.pdf

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)