Third-Quarter Winners and Losers Among U.S. Stock Funds

Domestic equities continued to reach new highs.

After a volatile, but positive, first half of 2016, U.S. stocks continued to climb during the third quarter through Sept. 22. The S&P 500 was up 4.2%, while the Russell 2000 Index was up 10.0%. U.S. employers added an average of approximately 232,000 jobs during June, July, and August, but that wasn't enough to push the Federal Reserve to raise short-term interest rates at its Sept. 21 policy meeting.

Technology stocks within the Russell 3000 Index have led the way thus far in the third quarter, climbing 13%. Top performers included hardware firms

After delivering very solid returns during the first half of 2016, the dividend-heavy utilities and consumer defensive sectors took a breather in the third quarter. Utilities fell 2%, led by declines in Aqua America WTR,

After gaining 30% during the first half of 2016, Brent crude prices were down 4.1% to $47.65 per barrel for the quarter to date. As a result, the energy sector was down 0.5% for the quarter;

Morningstar Style Box Categories

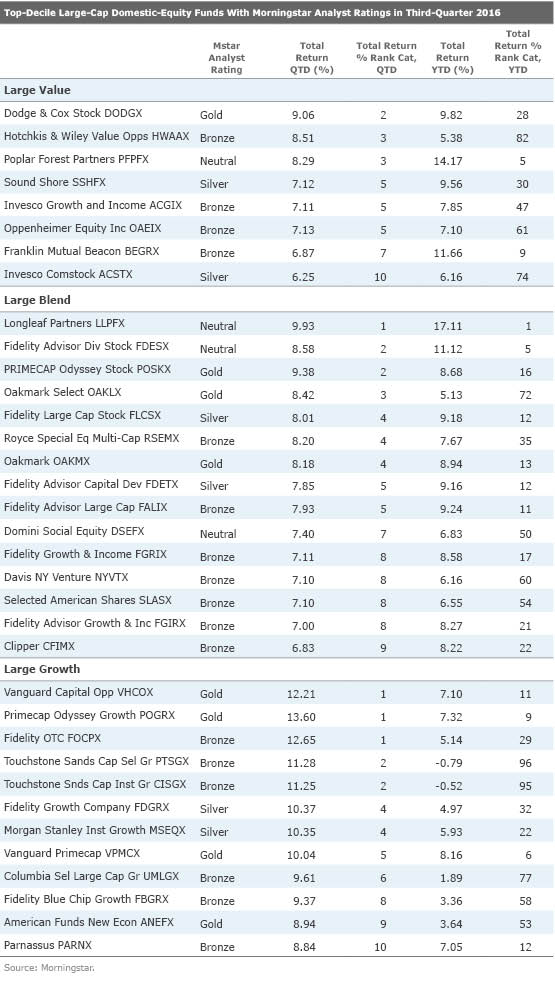

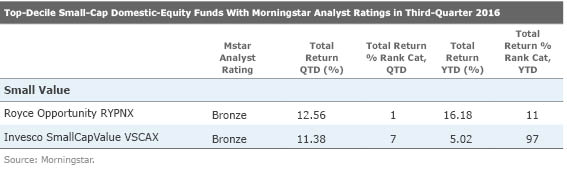

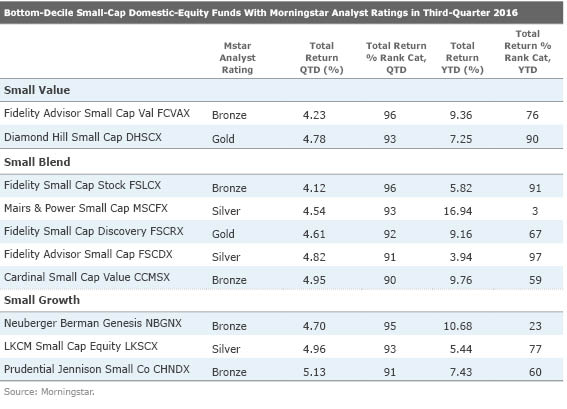

Small-cap funds outperformed their larger-cap counterparts in the third quarter, as they did in the second quarter. Small-growth was the top-performing Morningstar Category in the Morningstar Style Box for the third quarter through Sept. 22, gaining 9.0%.

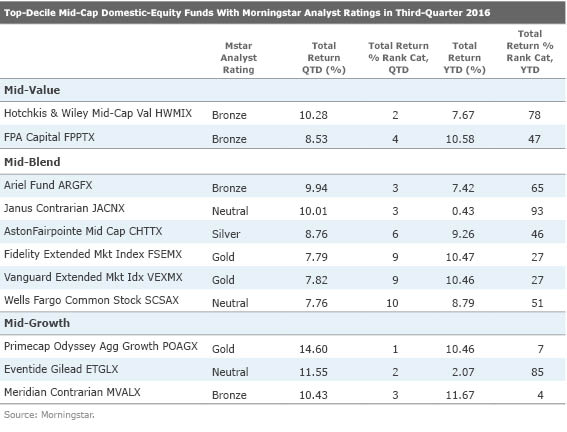

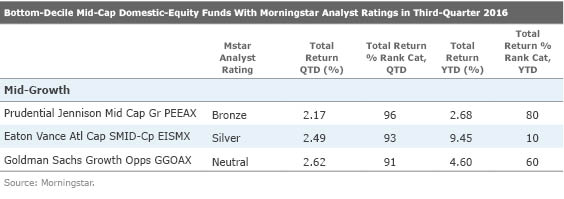

There was little dispersion between the mid-growth, mid-blend, and mid-value categories during the quarter, as all gained approximately 5%. Bronze-rated

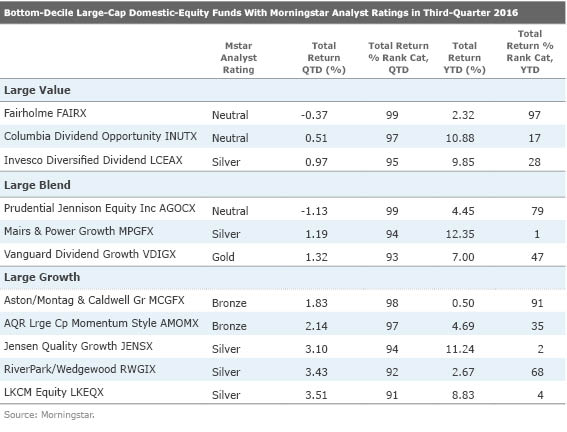

The large-growth category gained 6.0% this quarter. Bronze-rated

Large-blend and large-value were the weakest-performing categories in the Morningstar Style Box for the third quarter, though both still gained about 4%. Neutral-rated

For additional details on Morningstar Categories, please click here.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)