Sustainable Large-Blend Options That Have Beaten the Best

These 24 funds have high sustainability ratings and have beaten the Vanguard 500 Index Fund over the last decade.

Fund investors interested in incorporating sustainability into their portfolios face a problem virtually all investors have: It is hard to beat the market. Over the past decade,

VFINX, the lowest-cost index fund widely available to retail investors and the largest mutual fund in the world, outperformed 82% of the funds in the large-blend Morningstar Category. Among those that beat Vanguard 500 Index were 16 other index funds that happened to edge it out, mostly from tracking different large-cap or total market indexes. That leaves only 42 actively managed large-blend funds, 13% of the category, that have beaten Vanguard 500 Index over the past 10 years (through August 2016).

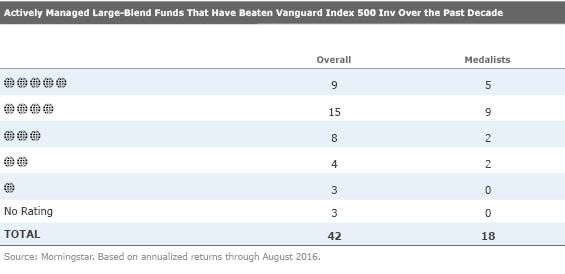

As you might imagine, these are generally high-quality funds. Because the Morningstar Rating is a category-relative measure of risk-adjusted performance, it is not surprising that 33 of these funds have Morningstar Ratings of 4 or 5 stars. Those ratings, earned over a period that still includes the financial crisis, reflect performance under a variety of market conditions. Morningstar analysts cover and assign Morningstar Analyst Ratings to 18 of the 42, and all 18 receive Analyst Ratings of Gold, Silver, or Bronze. A Morningstar Medalist fund is one that our analysts believe will outperform its peer group and relevant benchmark over the coming years, based not only on past performance but also on a broad assessment of the fund’s management, investment process, resources, and cost. In sum, this group of 42--especially the 18 covered by Morningstar analysts--have proved themselves to be excellent core holdings over the past decade and can make a pretty good case for themselves being high-quality offerings going forward.

So, how do these funds fare on our new Morningstar Sustainability Rating? Very well, it turns out, as you can see in the first table. Of the 42 actively managed large-blend funds that outperformed Vanguard 500 Index over the past decade, 39 have Morningstar Sustainability Ratings, and 24 of them have Sustainability Ratings of 4 or 5 globes. By contrast, only seven receive the lowest ratings of 1 or 2 globes; the rest are in the 3-globe middle. Among the 18 Medalists, 14 receive Sustainability Ratings of 4 or 5 globes, and only two receive 2 globes; none receive 1 globe.

Now, let's add some caveats to this. The Sustainability Rating is a portfolio-based rating that measures how well the companies held in a fund's current portfolio are managing their environmental, social, and governance, or ESG, risks and opportunities relative to their industry peers. We don't know and we can't say whether these funds would have also had good Sustainability Ratings over the past decade, so we're not making a cause-effect argument here.

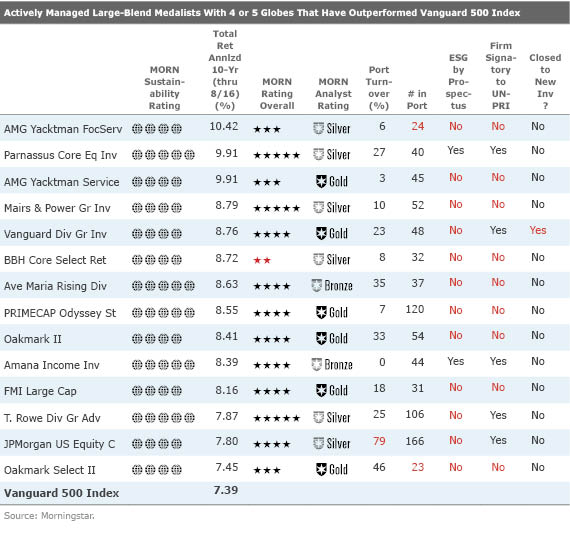

But if you are interested in incorporating sustainability into your portfolio and are looking for a high-quality core fund that has demonstrated it can outperform the S&P 500, you might want to sift through the 24 large-blend funds that have both outperformed the S&P over the past decade and have high current Sustainability Ratings. Or, to tighten the frame a bit more, you might consider the 14 of these funds--shown in the second table--that have outperformed Vanguard Index 500, have high current Sustainability Ratings, and are Morningstar Medalists.

A second caveat is that because the Sustainability Rating is based on a fund’s most-recent portfolio, there is no guarantee going forward that a rating won’t change when a fund releases its next portfolio. A good rating today may turn into a bad one tomorrow, especially if a manager is paying no attention to ESG issues in stock selection. We don’t expect this to be a widespread issue because most portfolios don’t change that much over shorter-term periods; also, investors will soon be able to track any changes to the Sustainability Rating over time.

That said, there are several other indicators you can use now to give you more confidence that a fund’s Sustainability Rating will remain stable. One is portfolio turnover. The lower the portfolio turnover, the greater the likelihood of a rating that remains stable over time. Most of the funds in the second table are indeed lower-turnover funds. Only two had annual portfolio turnover of more than 35% last year. Another indicator to watch is the number of holdings in a portfolio. A concentrated portfolio is less likely to have a stable rating than a more broadly diversified one because a change to a large holding will affect more assets. While only three funds on the list have more than 100 holdings, most are sufficiently diversified, especially considering their low turnover. Two funds have fewer than 30 holdings, though, and one,

Finally, and importantly, there is “intentionality.” Certainly, we would expect those funds for whom incorporating sustainability is an explicit part of their investment process to exhibit greater stability in their Sustainability Rating. The second table includes a column that indicates whether the fund manager has signed the UN Principles for Responsible Investment, which is an indicator that the firm is incorporating ESG factors into its investment process. (A list of UN-PRI signatories is available on its website.) Two funds have both intentionality by prospectus and are advised by managers who are UN-PRI signatories:

In closing, one more obvious caveat: Just because a fund outperformed the market over the past decade doesn’t mean it will over the next. Too many variables at play, and hopefully we won’t have another 2008-style meltdown. But these funds have proved their mettle and are likely to remain quality holdings going forward. Using the Morningstar Sustainability Rating allows investors the opportunity to build portfolios that take ESG factors into consideration alongside other key fund quality and performance metrics.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)