A Flurry of New Analyst Ratings in August

Plus, funds from Fidelity and Vanguard are upgraded, and two Weitz funds are downgraded.

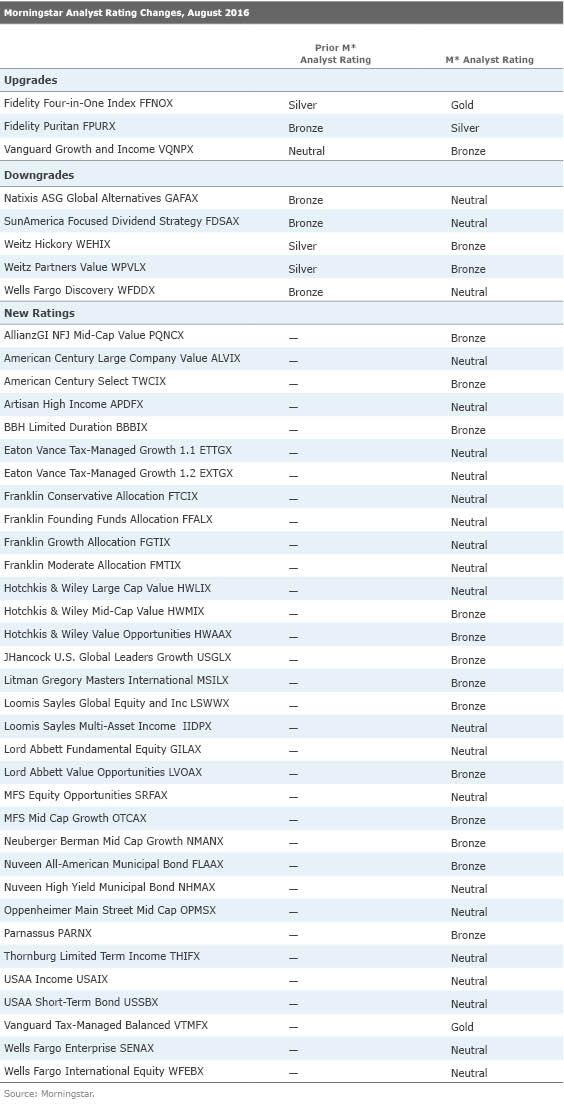

In August, Morningstar Manager Research upgraded the Morningstar Analyst Ratings for three funds, downgraded five funds, and published new ratings for 33 funds--one of the busiest months for new ratings in some time. Below are some highlights. See the table for complete details of August's ratings activity, and read more about some recent ratings in last week's Fund Spy, "Check Out These 9 Newly Rated Funds."

Upgrades

Fidelity Four-in-One Index FFNOX: Silver to Gold

Fees are the most important factor for index funds, so Fidelity's move to reduce this fund's expense ratio to 0.11% from 0.22% drove its upgrade from Silver to Gold. The fund is a simple combination of four underlying index funds, targeting an 85% stake in equities and 15% in bonds. It's cheap, straightforward, and well managed.

Fidelity Puritan FPURX: Bronze to Silver

The managers of this balanced fund have continued to execute well, producing competitive results relative to peers in the allocation--50% to 70% equity Morningstar Category. Lead manager Ramin Arani has shown skill in stock-picking and asset allocation since his 2007 start. His decision to boost the fund's equity exposure about 10 percentage points higher than its 60% base level in recent years has paid off. The bond portion of the fund is well run, combining high-yield and investment-grade debt. Plus, expenses are low. Taken together, these factors warranted an upgrade from Bronze to Silver.

Vanguard Growth and Income VQNPX: Neutral to Bronze

This quant fund divides assets evenly among three subadvisors. Vanguard's quantitative equity group, Los Angeles Capital, and D.E. Shaw use different models that aim to outperform the S&P 500 while keeping tracking error and beta in line with the index. The strategy is distinct enough to give the fund an edge, and the fund has outperformed the benchmark on a risk-adjusted basis under the current mix of subadvisors. Plus, among actively managed large-blend funds, it's one of the cheapest options out there.

Downgrades

SunAmerica Focused Dividend FDSAX: Bronze to Neutral

This fund follows a rules-based process that selects some of the highest-yielding names from the Dow Jones Industrial Average and others that meet certain criteria from the Russell 1000 Index. The fund's avoidance of financials over the past decade has been a tailwind, but might not always be. Meanwhile, the architect behind the model left in 2013. Finally, the fund's expense ratio has actually increased despite a surge in assets over the past few years. Its rating dropped from Bronze to Neutral.

Weitz Hickory WEHIX and Weitz Partners Value WPVLX: Silver to Bronze

These funds have shied away from their contrarian past, taking more of a quality-oriented bent as the managers have loosened the valuation requirements in their process. Now, more stocks may come up on the managers' radar, including high-quality ones that were often too expensive in the past. While that could result in lower volatility, it does present additional valuation risk. Meanwhile, above-average expenses remain a hurdle. Both funds' ratings were lowered from Silver to Bronze despite being under the steady guidance of longtime lead manager Wally Weitz.

Wells Fargo Discovery WFDDX: Bronze to Neutral

This fund was downgraded from Bronze to Neutral after lead manager Tom Pence announced that he would step down on Aug. 31. (He'll remain as an advisor until the end of September.) Michael Smith and Chris Warner, who have worked with Pence for several years and were named comanagers in 2011 and 2012, respectively, plan to continue using the same approach, which looks for small- and mid-cap stocks with above-average growth prospects. While the fund had a good record under Pence, results have looked more mediocre since Smith and Warner assumed additional responsibilities.

New Ratings

Vanguard Tax-Managed Balanced VTMFX: Gold

It's hard to argue with this fund's merits, which include low fees, an experienced management team, and a tax-conscious strategy that combines an indexed equity portion and a municipal-bond sleeve. The fund hasn't made a capital gains distribution since its 1994 inception, a rare feat for an allocation fund with a track record that long. It earns a Gold rating.

Loomis Sayles Global Equity and Income LSWWX: Bronze

Composed of three sleeves, this allocation fund has the management experience and track record to support a Bronze rating. Dan Fuss runs the multisector sleeve and David Rolley oversees a global-bond strategy; both managers run stand-alone funds that are Morningstar Medalists. Eileen Riley and Lee Rosenbaum pick global equities and have a shorter tenure on this fund. However, the process, focused on company-level research, is sound.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)