How ETFs Are Incorporating Sustainability

A spate of recent launches has given sustainable investors a greater range of diversified choices within the U.S. ETP universe.

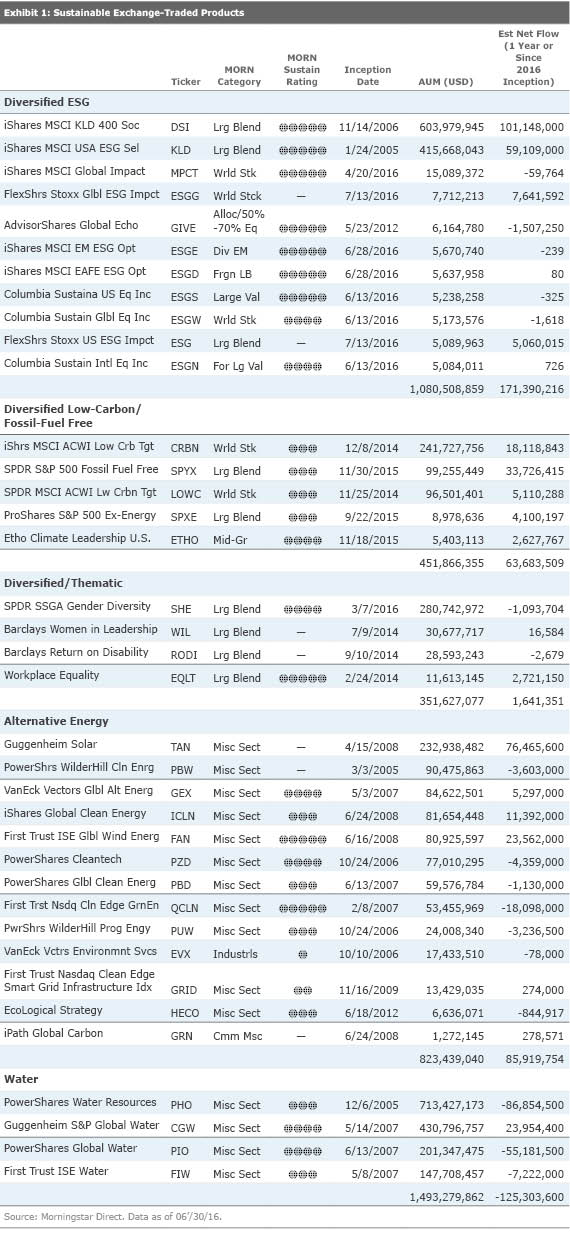

As interest in sustainable investing has increased, U.S. exchange-traded products have moved to offer more diversified options. For years, the vast majority of ETPs in the space were alternative energy and water portfolios, virtually all of which were launched between 2005 and 2009. Those 17 offerings today have $2.3 billion in assets (see Exhibit 1) but have experienced modest flows in recent years. Given recent performance issues and the general difficulty of fitting them into a traditional allocation, net flows to alternative energy are modestly positive and net flows to water are negative.

While the two largest diversified sustainable investment options have been around for a decade, the diversified set now totals 20 funds, with 17 launched in just the past two years, nine of them so far in 2016, reflecting growing demand for sustainable investment products as well as more general investor interest in passive portfolios. This group now has $1.9 billion in assets, and with about $500 million of that coming in over the past year alone, it is poised to surpass the alternative energy and water portfolios in terms of assets.

Diversified Sustainable ETPs The 20 diversified sustainable ETPs are aimed at investors who want to incorporate sustainability into their equity allocations. There is one allocation fund in the group and no bond funds. On the equity side, investors could use these options for their allocations to U.S., international, or global large cap, as well as emerging markets.

The portfolios in the group encompass several different approaches to sustainable investing. The first approach emphasizes companies that are considered strong sustainability performers relative to their peers, an evaluation based on how well a firm manages the environmental, social, and governance, or ESG, risks and opportunities it faces in its industry. This is also the thrust behind the Morningstar Sustainability Rating for funds, which provides a measure of how funds stack up with their peers. Not surprisingly, of the nine funds in this subgroup that have Sustainability Ratings, seven have a rating of High (5 globes) and the other two have a rating of Above Average (4 Globes).

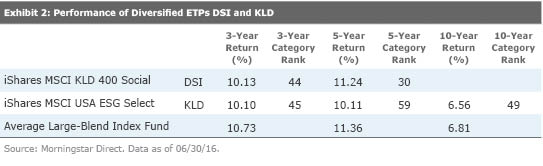

The two oldest and largest diversified ETPs share this approach. IShares MSCI KLD 400 Social DSI is based on what was originally called the Domini 400 Social Index, launched in April 1990 as the first socially responsible index and conceived as an alternative to the S&P 500. The index, now called the MSCI KLD 400 Social Index, has returned 10.06% annualized from inception through June 2016, outperforming the S&P 500's 9.64% annualized return. DSI focuses on companies with higher ESG ratings and excludes companies whose products have negative social or environmental impacts based on a set of screening criteria. IShares MSCI USA ESG Select KLD also focuses on companies with strong ESG ratings but uses fewer exclusions and is optimized to minimize sector tilts and tracking error relative to the MSCI USA Index. DSI and KLD have performed generally in line with conventional index funds (see Exhibit 2).

So-called "impact" investments may represent the next wave of sustainable investing.

Impact portfolios focus not only on companies with strong ESG performance but also attempt to advance certain environmental or societal development goals through their investments. That's the idea behind iShares MSCI Global Impact MPCT, launched in April 2016, which invests in companies that are addressing the environmental and societal challenges outlined in the UN Sustainable Development Goals, while also requiring holdings to meet certain ESG standards. (The two just-launched FlexShares funds have "impact" in their names but are focused on company ESG performance rather than measuring impact.)

The second approach within the diversified group is for investors who wish to reduce the carbon footprint of their portfolios and is reflected in three U.S.-focused and two global options that have all launched in the past two years. All three U.S. options aim to be fossil fuel-free. SPDR S&P 500 Fossil Fuel Reserves Free SPYX avoids companies with fossil fuel reserves but otherwise has some exposure to energy equipment and service providers, while ProShares S&P 500 Ex-Energy SPXE simply avoids the entire energy sector. Etho Climate Leadership U.S. ETHO not only excludes the energy sector, it selects stocks primarily based on their carbon footprints relative to their industries. The global options, iShares MSCI ACWI Low Carbon Target CRBN and SPDR MSCI ACWI Low Carbon Target LOWC both track the same MSCI low-carbon index, which is an optimized version of the MSCI ACWI that emphasizes companies across all sectors with low carbon emissions.

Four recently launched options--two exchange-traded funds and two exchange-traded notes--have gender or workplace equality themes as an overlay on diversified U.S. stock portfolios. SPDR SSGA Gender Diversity Index SHE is based on a market-cap-weighted index of large-cap U.S. companies that rank in the top 10% in their sectors for their ratio of women in high-level positions.

Alternative Energy and Water Exchange-Traded Portfolios The 17 alternative energy and water offerings were launched in the 2005-10 period, with the exception of one launched in 2012. Two water funds, Guggenheim S&P Global Water CGW and PowerShares Water Resources PHO take up nearly half of overall assets. A sustainable investor may be interested in a water fund as a long-term investment in companies that are helping solve the planet's water problems through better infrastructure and technology. As niche players in a portfolio, water funds have posted competitive returns over the trailing 10 years but have underperformed broad markets in four of the past five years.

Alternative energy offerings, such as VanEck Vectors Global Alternative Energy GEX, have a somewhat wider purview. They could be used in a diversified portfolio that is low-carbon or fossil fuel-free. It makes sense in theory--divest in carbon, invest in alternatives--but from a traditional sector-exposure perspective, adding an alternative energy fund to an otherwise diversified portfolio will result in overweightings to industrials, technology, and even utilities, increasing tracking error and volatility. Such funds have suffered in 2016 because of low oil prices and, in particular, their exposure to solar stocks, which are reeling from overcapacity in an industry still reliant on government subsidy. Similar to an investment in a water fund, an alternative energy investment is a way to direct capital to companies that are moving the world away from its reliance on fossil fuel, but investors should expect volatility and have a long-term view.

Three funds in this group account for virtually all the positive flows. None of them are the broader-based alternative energy options, however; Guggenheim Solar TAN focuses on solar, First Trust ISE Global Wind Energy Index FAN on wind, and CGW on water, an indication that investors may be using them as narrowly targeted industry plays rather than long-term investments.

Diversified Sustainable ETPs Are Meeting Investor Demand For investors interested in sustainability, the U.S. ETP universe now has a number of diversified options emphasizing positive ESG selection, low- or no-carbon, and gender-aware approaches, rather than being limited to the thematic quasi-sector plays in clean energy or water that used to characterize the group.

Many of the newer diversified ETPs remain small, with only six of the 20 having more than the $75 million or so in assets generally seen as necessary to attract the attention of larger investment platforms. Three of the newer portfolios that pass that threshold have been developed with institutional investors, an effective model for getting a new ETP to scale quickly. SHE was seeded in March 2016 with $250 million from the California State Teachers Retirement System. Both CRBN and LOWC were seeded in late 2014 by the United Nations Joint Staff Pension Fund.

Overall flows reflect significant growth. In addition to the $250 million in seed capital that went into SHE, $236.7 million has flowed into the diversified group in the past year, based on Morningstar's estimated net flow data through July 2016, significantly more than the estimated net flows of $153.2 million over the previous two years combined.

Diversified sustainable investment ETPs should continue to grow, in terms of assets if not also the number of offerings, because of the broad and still-growing interest in passive investing generally, the widespread development of strategic-beta strategies within the exchange-traded universe, and the growth in demand for sustainable investment products from both institutional and retail investors.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)