World-Bond Funds Grapple With Japan's Negative Yields

Japanese government bonds' big role in global-bond indexes make them hard to avoid.

Managing world-bond funds has become much more difficult because the overseas government debt market is awash with roughly $13 trillion in bonds sporting negative yields. Japanese government bonds, hereafter JGBs, represent the vast majority of this debt, more than 4 times as much coming from France or Germany, which have issued the next-largest amounts.

Given Japan's prominence in global bond indexes (typically 20%-35% of overall exposure), yields on those benchmarks have been feeling the crunch since the two-year JGB dipped into negative territory in December 2014, and this year, 10- and 20-year JGB yields slid below zero.

In Europe, negative-yielding debt has become more prominent as well: two-, five-, and 10-year German bunds and Swiss government bonds across the maturity spectrum sport negative yields, for example.

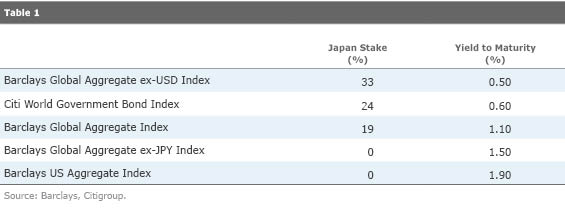

Table 1 displays Japan exposure and yield to maturity for several bond indexes as of June 30, 2016.

Japanese bonds may seem a necessary evil for world-bond fund managers, especially those that need to align a fund's risk/return profile with that of the benchmark. But JGBs can still be a useful tool. Many managers use JGBs to some extent to balance a portfolio's higher credit risks, and the yen has historically provided ballast in times of market stress. Japan's currency climbed by 23% versus the U.S. dollar in 2008, for instance, and it also strengthened versus the dollar during the third quarters of 2011 and 2015 when emerging-markets currencies sold off. A negative-yielding JGB can still generate capital gains by rolling down the yield curve as the bond nears maturity, which would cause its yield to fall further if the yield curve maintains its current shape. JGBs can also realize gains if Japanese interest rates slip deeper into negative territory. However, there is the risk that if rates fall too far, the negative yield would wipe out any potential capital gains.

That said, most actively managed world-bond funds have had an underweighting to Japan and/or the yen during the past two years. For example,

A handful of managers with more flexibility have avoided Japan completely.

Another reason to avoid Japanese government debt is the risk of interest rates nudging upward, which could have a significant impact on a low-yielding portfolio. So even if JGBs have diversification potential, there is risk in choosing a world-bond index fund or exchange-traded fund over an actively managed option that has already dialed down that exposure or can tactically manage it. Investors in

/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)