This Week's Economic Data Will Only Confuse the Fed

Although the rate-hike guessing game will persist, factors bigger than the Fed are at play in the economy.

There was a lot of economic data this week, but none of the releases were really game changers. Instead, markets chose to focus on a potential U.S. Federal Reserve interest-rate increase in September.

Although minutes from the previous Fed meeting, released this week, seemed to indicate no clear direction for the September meeting, this week’s Fed speakers were decidedly more hawkish. One governor suggested he would like to see a rate increase sooner than later, while another governor indicated that one increase was likely sometime this year, and another said that a September increase remained possible. All of this talk pushed equity markets down at the end of the week despite flat results for the entire week. Interest rates in the U.S. also moved higher. Oil logged some significant gains as rumors of some type of Saudi production agreement resurfaced.

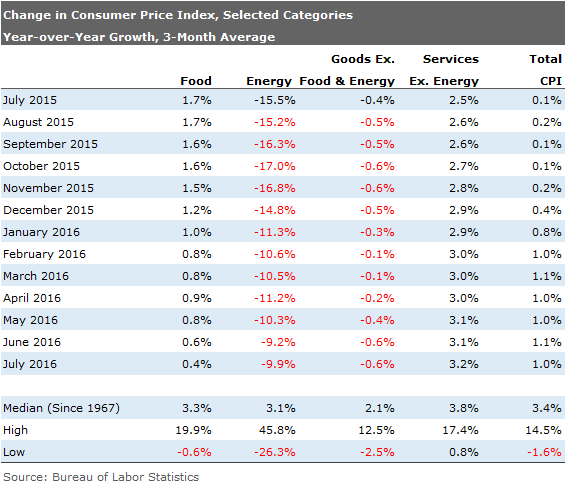

Economic data for the week didn't really add any clarity to the situation. Headline inflation remained at a low 1% year-over-year rate as new categories (this time new and used vehicles) added to deflationary pressures from falling grocery prices that were already evident. Services inflation, while very elevated, didn't get any worse in July. This all gives the Fed a little more breathing room than we would have expected. Also, new-home permits were nothing to write home about, suggesting at least a plateau in the housing market.

Combined with a temporary lull in retail sales reported last week, the economy certainly isn't running away on the upside. Manufacturing looked somewhat better in this week's report on July industrial production, but at 0.3% year-over-year growth, I don't think the Fed has a reason to panic. The upcoming election might also give the Fed reason to pause. And if the August employment report does its usual annual swan dive (most of it related to continuing problems with August seasonal adjustment factors), then all bets are off.

If markets play according to their usual script, equities and bond prices will fall going into the meeting with anticipation of a rate increase. Then some offbeat factor will cause the Fed to chicken out, and markets will resume their rally after they leave rates unchanged at their next meeting.

While markets seem to believe that the Fed’s actions are the be-all and end-all, we aren't convinced. Despite historically low interest rates, economic activity has done little to emerge from its torpid pace for most of this recovery. We continue to believe that demographics of a slower and aging population as well as a slowing in some of the recovery's favorite sectors explains a lot more about the lack of growth than any central banker's actions or pronouncements.

We worry deeply that the things that have helped along this recovery, including oil and gas production, a rapidly expanding

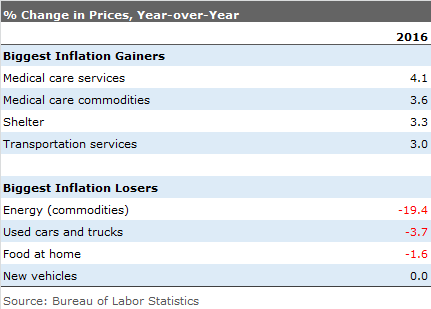

But we do worry about the retiree sector. The July inflation report suggests that without Congressional action, the cost-of-living increase in 2017 for Social Security will be well under 1%, with higher Medicare premiums and deductibles along with higher drug prices eating into most of that. Continued repression of interest rates will also put pressure on this segment of the population.

Headline Inflation Stable at 1% Year Over Year Month to month, there was no increase in the Consumer Price Index, a 0.9% increase year over year and a 1% increase on a three-month moving average basis. The year-over-year averaged number has been stuck at 1% since February, an unusually long period of stability. However, the current 1% is well above the 0.1% rate of last July. Diminution of energy price decreases and services inflation have only been partially offset by a meaningful slowing in food price inflation. Goods deflation has been stable, but more of the deflation is now due to falling auto prices instead of the prices of foreign goods. We suspect that energy prices will no longer be decreasing by October or so, which should bring headline inflation to 2% or more by year end.

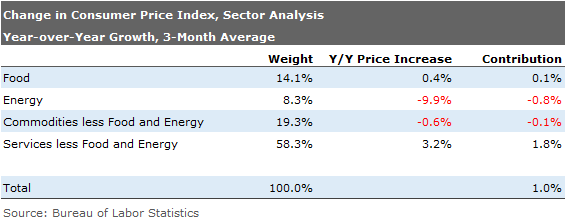

Energy Still a Huge Factor in Reducing CPI, Despite Its Small Size To put the category inflation changes in some prospective, we are providing the category weights (which add to 100%) and multiplying by the price change for that category to get to a contribution for each category, which adds up to the current inflation rate. So despite the fact that energy comprises just 8% of the CPI, its large swings often mean that it continues to have a huge impact on the calculation. This annual July inflation rate would have been 1.8% instead of 1% if energy prices had not declined so rapidly.

Medical Care Inflation a Continuing Problem Along With Rents Many economists are reading the July inflation report as relatively benign given the 0% increase in the month-to-month rate and a month-to-month decrease in rents. We wouldn't read too much into either of those positive events.

Medical services and medical commodities (mainly prescription drugs) remain a problem, both on a year-over-year and month-to-month basis, with both running near 4%. The best we can say about shelter, a large portion of services inflation, is that it didn't get any worse year over year. Although it ticked down by 0.1% month to month, the 0.3% (down from 0.4%) monthly rate for shelter still annualizes to 3.6%. We would hope that increased apartment supply will eventually weigh on rents, but that process is taking far longer than we would have imagined.

Transportation services prices continue to increase faster than we like, with galloping car insurance rates only partially offset by a sudden decrease in airline prices.

Falling import prices are widely blamed for falling goods prices, but more recently falling used-car prices and stable new-car prices have been much bigger contributors to price deflation. With plateauing new-car sales and more competition from leased cars coming back on the market, we suspect that goods inflation may remain lower than we had previously expected. Food prices, which are always volatile, nevertheless seem to be in an important downward cycle as grain prices at the beginning of the food chain continue to fall.

Social Security Adjustment Likely to Be Small in 2017 The annual Social Security cost of living increase is set based on average price indexes between July and September of this year compared with July and September of the last year there was an increase.Unfortunately, that is 2014, making the inflation bogey a little tougher.

The July 2014 to July 2016 increase was a measly 0.1% based on a slightly different version of the CPI (CPI-W versus CPI-U). However, 2014 saw price decreases in August and September of 2014, which could mean the 2016 increase for the full period will be bigger than the 0.1% increase we are seeing for July alone. Unfortunately, the small number we are looking at now and price volatility make the 2017 increase anything but a sure thing.

In any case, the increase doesn't look like a big one, and some of that may be offset by higher Medicare premiums and higher deductibles unless Congress acts to change that. Unfortunately, as the wage base has moved up much faster than inflation, and since there was no adjustment last year, the maximum wage subject to Social Security could move up from $118,000 to the mid-$120,000s for 2017. Medicare payment for high earners will also likely see a big increase in 2017.

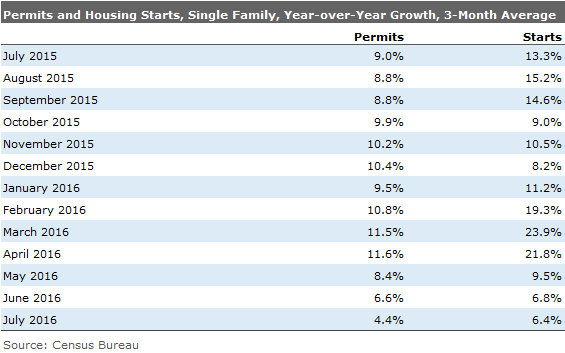

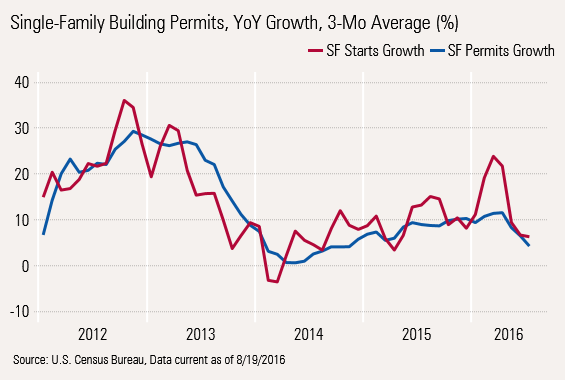

Housing Starts and Permits Slipping Despite Lower Rates We aren't sure why, but the year-over-year data on housing starts and permits are showing modestly disturbing trends. Permit growth for single-family homes has dropped from double digits to less than 5% over the past six months, raising some doubts about our housing starts forecast (8% growth or so for 2016) and real estate's continuing contribution to GDP growth. The data below is for single-family homes. The more volatile and much smaller apartment sector looks worse, but unusual tax credits a year ago are likely skewing that data.

We aren't exactly sure what is going on. Demographics are modestly favorable now, though affordability remains an issue. Lower rates don't seem to have helped much, either. Activity at the high end of the market hasn't been great all year, as soft markets and renewed volatility have spooked potential buyers.

Single-Family Home Growth Plateaued in 2015, Now Trending Lower

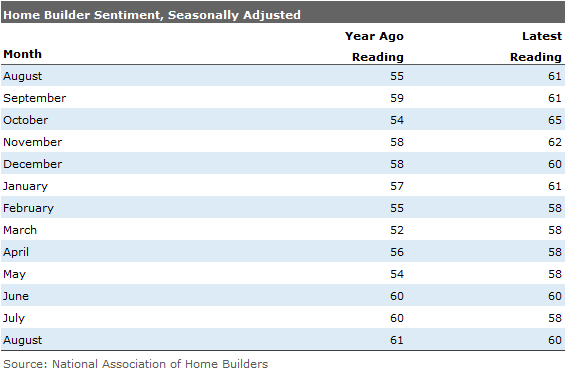

Builder Sentiment and Interest Rates Paint a Brighter Picture While the current permits numbers are a bit disturbing, builders maintained the same level of optimism as they did a year ago and actually a small, but probably statistically significant, increase from July, as shown below. While not robust, the sentiment data doesn't seem to be as dire as the starts and permits data.

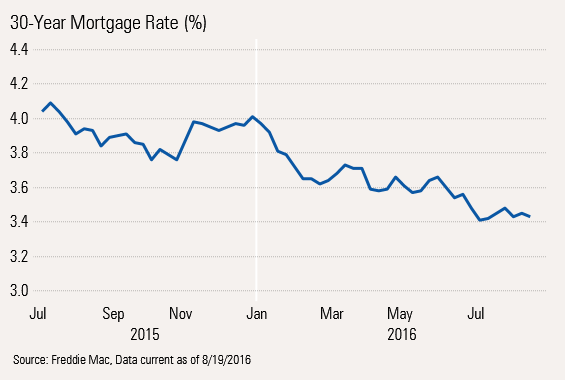

Mortgage rates have dropped for most of 2016, and there was another big leg down around the time of Brexit in June. We might have been too optimistic that those decreases would have helped as soon as July. We will have to wait until August to see if the lower rates finally help homebuilders.

Rates Stabilizing at Low Levels

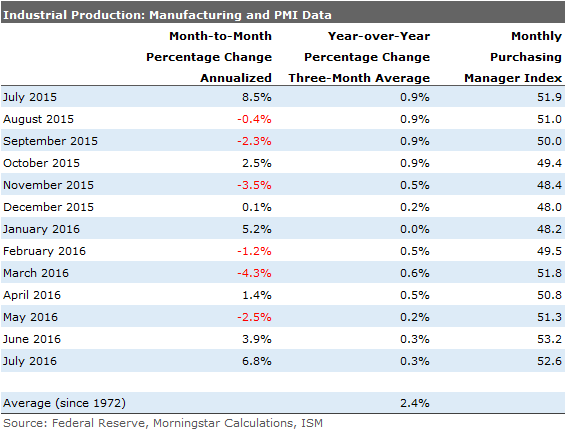

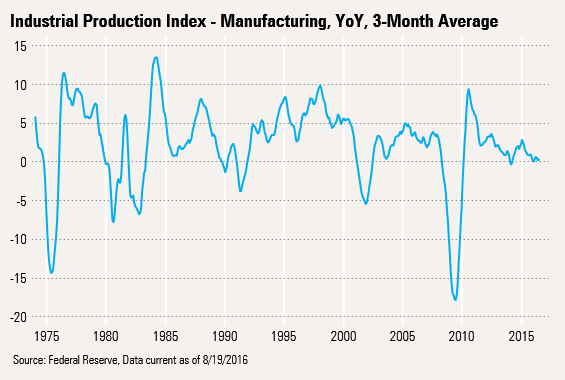

Manufacturing Improvement Continues, but the Glory Days Are Behind Us For the second month in a row, the monthly manufacturing component of industrial production showed an increase and is now up three of the last four months. And every one of the major categories showed an increase in July, and the rate of increase accelerated between June and July. Unfortunately, the year-over-year data appears mired in the mud. Also, purchasing manager data suggests limited improvement in the months ahead.

Manufacturing Recovery Stalling After a Great Start Although we have been excited about the manufacturing recovery at times, a longer-term view of the data and data revisions earlier this year show a disturbing picture. Though there was a normally large jump in the data in 2010. The post-recession bounce has been followed by lackluster data ever since. At 12% or so of GDP, a slow manufacturing sector is a big hurt.

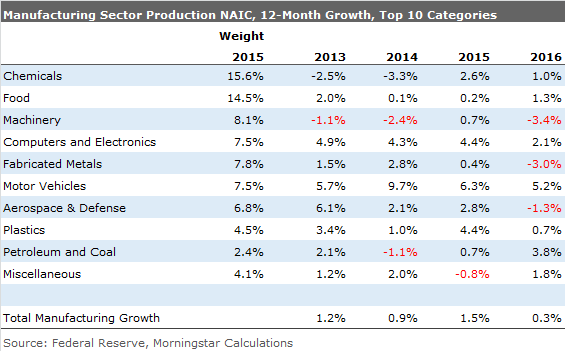

New Leadership to Drive Manufacturing Higher Is Not Clear Everyone keeps looking for a sector to bring manufacturing back to life, but we can't seem to find it. Given the well-known plateauing in auto sector sales, auto production growth will have to likely follow suit, with the hefty 5% to 10% annual gains of the last five years to follow back to near zero. That's an important 8% or so of the manufacturing sector.

Boeing's big ramp-up in jetliner production is now likely complete, and some older programs, including the 747, are drawing to a close. And the appetite for defense-related aircraft isn't great, either.

Drug growth, which was a major portion of chemicals growth, has diminished with more imports and the move to generics. And as computer and electronics markets have matured and shrunk, more of that business is moving outside the U.S. About the only good news is that some of the devastated machinery sectors (related to oil and gas) have gotten so small that any further fall can inflict little damage to the overall data. That phenomenon was already visible in July, when machinery sales improved.

Rolling everything together, we think headline numbers will continue to improve, but longer-term growth may be limited to 1% to 1.5% instead of the more typical growth of 2.4% of the last 50 years.

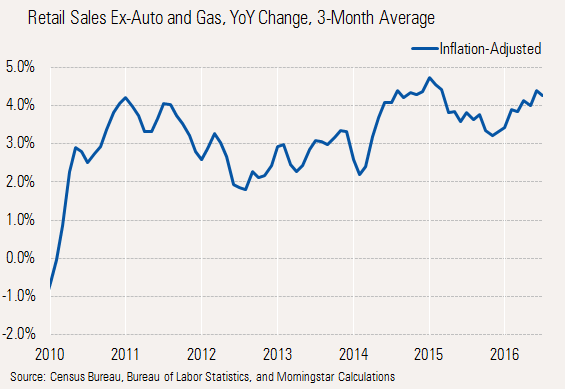

Last Week's Retail Sales Nothing to Worry About We were out last week when retail sales were reported. The stand-alone monthly numbers were relatively depressing, so we were glad to be gone. Month-to-month numbers have become relatively worthless because of ever-changing seasonal factors and shifting purchase categories and locations. Deflation adds an extra level of confusion. However, with year-over-year data, the seasonal factors generally drop out and the deflation adjustments are easier to measure.

We continue to refine our retail sales inflation measures. Several years ago, we just used the CPI for everything. Then when energy prices became more volatile, we switched to adjusting to goods-only inflation. Now we have refined that further, taking out autos from both inflation and sales levels and adding back food inflation, which is reported separately from goods inflation. The result is a more even level of retail sales growth as shown below.

As we related above, there are a lot of reasons to feel a little glum about the economy. Fortunately, despite those nasty headlines last week, retail sales are not one of them. The consumer continues to do quite well, thank you. With consumer incomes holding up well, we suspect they will continue to be the key to U.S. economic growth. What's less certain is where they will spend that money, with interest in cars and clothing continuing to diminish.

We are less sanguine about retiree incomes and spending. Social Security recipients, an increasing segment of the population, are likely getting close to a goose again in 2017 and will continue to suffer, while those still in the workforce are likely to do considerably better. The Fed repression of interest rates is also hurting retirees, who are more likely to have accumulated savings and paid off debts, while young workers buying homes continue to benefit from low interest rates. Of course that analysis all goes up in smoke if Congress acts to increase Social Security, Social Security recipients are forced back to work, or the Fed raises rates more than anyone is anticipating now.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)