Ultimate Stock-Pickers: Top 10 Buys and Sells

Our top managers were net sellers during the most recent period but still found several names worth buying.

By Eric Compton | Associate Stock Analyst

As many of you already know, our primary goal with the Ultimate Stock-Pickers concept is to uncover investment ideas that our equity analysts and top investment managers find attractive and to reveal that information in a timely enough manner for investors to gain some value from it. As part of this process, we scour the holdings of our listing of top managers as they become publicly available, attempting to identify trends and outliers among the holdings, as well as highlighting the highest-conviction purchases and sales that were made during each period.

In our last article, we walked through our early read on the buying activity of our Ultimate Stock-Pickers during the second quarter of 2016 (which was based on the holdings of two thirds of our top managers), with a focus on high-conviction purchases and new-money buys. At the time, we noted that while we'd seen an increase in buying and selling by our top managers during the first quarter of this year, with the sell-off in the market creating opportunities for our Ultimate Stock-Pickers, it looked like the buying activity during the second quarter was much lower than we'd seen in previous periods. This was despite the volatility associated with the British referendum vote.

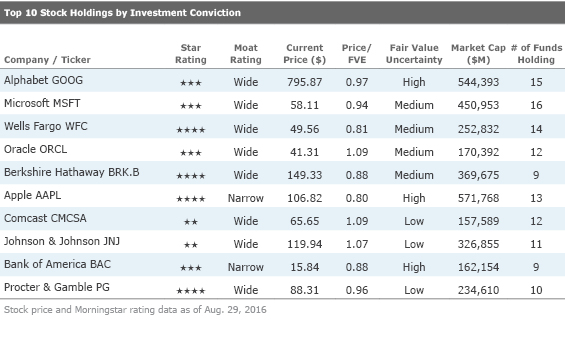

Now with all but one of our managers having reported their holdings, we have a nearly complete picture of what everyone was up to during the most recent period. Both the amount of conviction buying and conviction selling decreased during the second quarter, and net conviction remained negative for the period, indicative of net conviction selling on the part of our top managers. One notable difference between the volatility during the first quarter and that of the second quarter was that the market decline after the Brexit vote was much more transient, with most markets having nearly fully recovered after just a week (while the markets sold off for much of January and February before rallying through to the end of March). Our managers continued to remain cautious during the second quarter, exemplified by their net conviction selling, as well as by the tone of their quarterly commentaries. That being said, our Ultimate Stock-Pickers were still finding some stocks that piqued their buying interest, even as they followed through on names they wanted to sell.

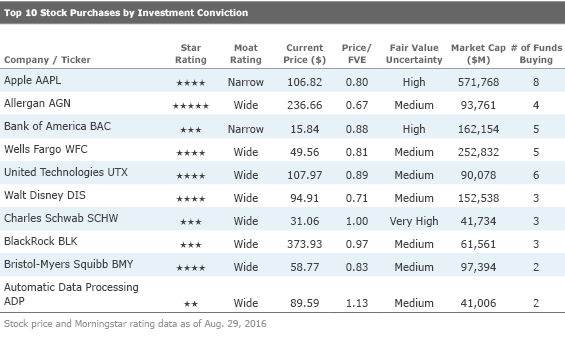

Most of the conviction buying during the latest period was focused on high-quality names with defendable economic moats—exemplified by a greater number of wide- and narrow-moat companies on our list of top 10 (and top 25) high-conviction purchases. Looking back at the early read we had on the second quarter's buying activity in our

, five of the companies on the list of top 10 high-conviction purchases—wide-moat-rated

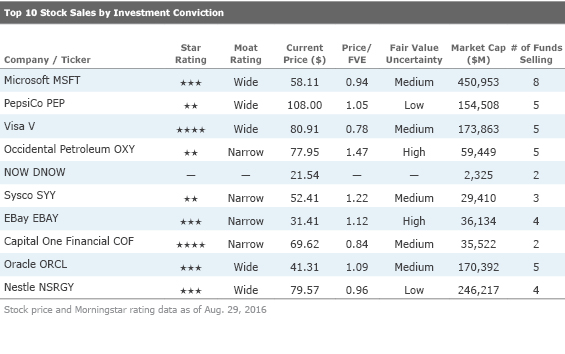

As for the selling activity, it looks like much of it revolved around the trimming of larger holdings, likely in an effort to either manage position size or simply trim stakes that had come closer to internal estimates of fair value, especially if a manager needed to raise cash to meet redemption requests. These included names like wide-moat

Amid this activity, our top managers remained underweight in energy, communication services, healthcare, and utilities relative to the weightings of those sectors in the S&P 500 at the end of June. They also continued to hold overweight positions in the financial-services, technology, consumer defensive, and basic materials sectors (with their exposure to real estate, consumer cyclical, and industrials more or less in line with the benchmark index).

The overall makeup of the top 10 stock holdings by investment conviction did not change all that much during the quarter. Only one company—PepsiCo—fell off the list after it was trimmed by five of the 11 managers that held the stock during the second quarter. Three of the sales were done with conviction, with one of those sales being an outright sale by

The final departure was Pepsi, which we brought about five years ago. Given the muted growth potential for the company and the likelihood of meaningful margin expansion from here, we concluded that Pepsi's price-to-earnings multiple of 21x was simply too high.

Morningstar analyst Adam Fleck wouldn't disagree, and currently values shares of PepsiCo at $103 per share, compared with a trading price right now of around $108. In his most recent note on the firm, Fleck said that shares look slightly overvalued and that he doesn't believe they offer a suitable margin of safety to account for potential downside risks associated with the name, such as renewed macroeconomic concerns, increased competition, and regulatory challenges. He also notes that recent productivity gains have come with a price tag: about 50 basis points of operating margin over the past five years in restructuring costs. Fleck doesn't assume any additional productivity costs in his long-run free cash flow forecast, and therefore any margin upside from here will likely be tempered by additional expenses.

PepsiCo was replaced on our list of top 10 holdings by wide-moat-rated

. Comcast saw a conviction sale and a conviction purchase during the period, along with several other smaller moves, all of which basically offset each other. As such, Comcast rejoined the list by virtue of the selling of PepsiCo rather than a flurry of buying of the name. With Comcast reclaiming its spot on the list of top 10 holdings, we were intrigued by the comments from one of our top managers,

Notably, Comcast has also been the top contributor for Core Select over the last three- and five-year periods. The Company continued to achieve steady performance in its core cable and broadband business, in which moderating churn rates, higher rates of customer up-selling and bundling, and share gains in the small and midsize business market have driven mid-single digit revenue growth. While some of this top-line benefit is being offset by higher programming costs as well as investments in customer service and advanced infrastructure, the cable business overall remains solidly cash generative. Comcast also announced in May its plan to acquire DreamWorks Animation for $3.8 billion…Strategically, we believe that DreamWorks fits well alongside Comcast's Illumination animation studio, but the purchase price appeared high to us.

That said, for us Comcast is a perfect example of a company with significant competitive advantages that are already being priced in by the market. With the shares trading at 110% of his $60 per share fair value estimate, Morningstar analyst Michael Hodel does not view the stock as being undervalued. Hodel generally agrees with BBH's commentary, including the thoughts around the DreamWorks acquisition, which he has previously noted as being richly priced. Hodel did, however, point out that the acquisition was so small, it was unlikely to have a material impact on Comcast's overall fair value. While the firm has an enviable position in its industry, with its wide moat rating stemming from its strong networks and its efficient scale, price always matters, and in this case we believe that investors may do better to wait for a better price on the shares before making a long-term commitment.

As we noted above, five of the top 10 stock purchases this time were also represented on the list of top 10 high-conviction purchases from our

. We also saw new-money buying in eight of the names on the list, with wide-moat rated

While our list of top 10 stock purchases this time around once again favored financial services names, Apple was perhaps the most notable high-conviction purchase during the period, with eight managers, including wide-moat-rated

We established a position in Apple as we believe that the iPhone 7 will outperform the 6S cycle as it will anniversary the launch of the 6 two years ago, be the first anniversary of Apple's new annual iPhone replacement program, and be up against easy comparisons. The company's services business currently stands at around 10% of total revenue and is growing at 10-15% which should provide revenue and earnings stability and garner a higher multiple. Qualcomm was increased following first quarter results that exceeded expectations for revenues and operating profits. Microsoft was initially trimmed after the company provided updated guidance that pushed out the earnings recovery for another year as the growth in cloud has yet to reach sufficient scale to offset the gravitational pull of the decline in legacy transactional business. The position was subsequently eliminated as the company's exposure to Europe presents a new headwind following the UK vote to exit the European Union.

We covered Apple in more detail in our last article, and we would point readers to that piece for more details on the company. However, since our last article was published, Apple has been hit with a new tax bill from the European Union, which ruled that Ireland gave illegal tax benefits to Apple. Analyst Brian Colello concedes that $3 per share, or just over 2% of his fair value estimate, is at risk with the ruling, but the timing and amount of the final payment remain uncertain. Apple will not take a financial charge for the tax bill in its near-term results, and the fine may be placed in restricted cash but will not be immediately paid out. Colello expects both Apple and Ireland will appeal the ruling, and a final decision could take years. Apple has almost $215 billion in international cash on hand, so the record tax bill will make only a small dent in the firm's cash cushion. Further, Apple indicated that the ruling will not have an effect on its long-term tax rate, presumably because its Irish tax structure in question was modified in 2015. Regardless, Colello continues to view Apple as fundamentally undervalued, and the company remains one of our best investment ideas in the tech sector.

The pharmaceutical industry cannot seem to get out of its own way, with more bad publicity coming out regarding price hikes and the political backlash that inevitably follows such things. Sometimes the ick factor associated with poor headlines is indicative of something being truly wrong with the underlying business of a company or an industry, and investors need to look no further than the saga at

So it was no surprise, even in the face of ongoing headline and political risk, to see some of our top managers wade into the group, with Alleghany making a high-conviction new-money purchase of

We took advantage of weakness in Allergan as investors continued to adjust estimates after the proposed merger with Pfizer failed to occur. This provided an opportunity to add to our position at an attractive valuation for a company that will soon benefit from the sale of its generic business to Teva, allowing further clarity on capital deployment.

Allergan has since completed the sale of its generics and distribution segments to

Wells Fargo, which remains the cheapest of the financial-services names on the list, was the recipient of not only a conviction purchase from

We decided to buy Wells Fargo after many years of waiting for the right entry point. At the time of our purchase, the stock was trading at a slight discount to other regional banks, and at a major discount to the overall stock market. In addition, the company had just lowered guidance for important return-on-capital measures at its May investor day. We think the company will meet or exceed these new targets, which should provide support for the stock over our three-year investment horizon. As for the quality of the company, simply put, we think Wells Fargo is the best large bank in the country. It has an enviable balance of fee income and net interest income, a widely diversified customer base and a culture that emphasizes risk management.

Morningstar analyst Jim Sinegal views Wells Fargo's dominant market position as its largest structural advantage. He notes that it is the largest deposit gatherer in major metropolitan markets across the country, with more than one third of the bank's deposits coming from markets in which Wells Fargo is the pre-eminent player, and more than two thirds of its deposits gathered in markets in which the company ranks among the top three players. Sinegal believes that Wells Fargo's long-standing focus on cross-selling has helped it to lock in customer relationships, as well as access to low-cost funding. The bank builds on its funding advantage, in his view, through efficient operations and solid underwriting, which minimizes costs at the same time that it maximizes the revenue associated with every dollar held on its balance sheet.

That said, Sinegal also notes that recent results have been less than ideal for Wells Fargo, with profits being essentially flat over the past 12 months, as provisioning for loan losses more than doubled (due to weakness in energy portfolios and expansion of the company's allowance for car and auto loans). However, he does not think investors should read too much into these short-term trends, believing that the size and direction of rate changes will have a bigger impact. In the meantime, charge-offs remain negligible, nonperforming loans are actually falling, and the home lending group has actually benefited from lower rates as more people have either bought houses or refinanced their current ones. Sinegal notes that investing in banks is not easy right now, and with increasing deposit costs, as well as a slight decrease in assets under management, during the quarter, Wells Fargo has its share of headwinds to navigate. With the shares of the wide-moat bank currently trading at around 80% of his $61 per share fair value estimate, the stock is not quite as cheap as it has been at times during the first and second quarter, but does represent good value for long-term investors.

As for the top 10 sales by investment conviction, there continued to be a fair amount of outright selling with conviction selling during the second quarter once again outweighing the amount of conviction buying. As we noted above, the managers at Aston/Montag & Caldwell Growth completely eliminated its stake in Microsoft, even as five other managers were adding to their positions. Of note were higher-conviction purchases by the managers at BBH Core Select,

Microsoft's shares were weaker during the quarter due to a modest earnings disappointment. We think CEO Satya Nadella is doing an excellent job of repositioning the company for solid long-term growth and the stock is attractively priced.

And Chuck Bath and Chris Welch at BBH Core Select remained positive on Microsoft's long-term strategic vision in their own commentary:

[W]e are pleased with the trajectory of the business overall as Microsoft continued to execute its strategic plan centered around cloud-based solutions and high-value, differentiated tools and experiences for enterprises, business users, consumers and developers. The newly-announced combination with LinkedIn appears to be well aligned with this vision…we view LinkedIn as a unique asset with an attractive business model in a growing industry in which classic network effects fortify a strong competitive advantage.

While Microsoft is paying a high price for LinkedIn, Morningstar analyst Rodney Nelson believes the acquisition makes strategic sense. While he acknowledges that capturing enough value, given the price paid, will require a significant degree of execution on Microsoft's part, he argues that the use cases around LinkedIn's user data align much better with Microsoft's long-term business, creating a much lower likelihood of failure compared with Microsoft's prior large-scale acquisitions--such as Nokia or aQuantive, companies that did not mesh with Microsoft's core business. After the company's shares recovered from their initial selloff during the beginning of the second quarter, Nelson currently views shares as fairly valued, trading at more than 90% of his $62 per share fair value estimate. Nelson ascribes the firm a wide economic moat and is positive on Microsoft's competitive position longer term. Investors may do well to wait for a better entry point, though, such as the one offered earlier this quarter, given that the shares have traded up more than 20% since the lows seen just a couple of months ago.

Even though Visa is the most undervalued stock on our list of top 10 stock sales list, there was no significant commentary from the managers that were selling during the most recent period. Aston/Montag & Caldwell Growth and Alleghany both made conviction sales of Visa during the period, and five of the seven managers that held the stock at the start of the second quarter were selling during the period. Sinegal remains positive on the name, even amid the fast-changing payments landscape. While he expects the next five years to likely see rapid changes in the nature of the payment business as cards are slowly replaced by electronic payment methods, Sinegal believes that this presents an opportunity for Visa in the form of volume growth tailwinds; even as new competitors attempt to manage the payment process and develop new ways to authenticate payments. He believes Visa is on track to ensure that its connections in the virtual world are as plentiful, as well as being as secure as they are in the physical world, and that its competitors will have a tough time replicating the network's offering. Sinegal further argues that complex international regulatory regimes create a significant barrier to entry, and he still sees the successful coordination of financial institutions and merchants around the world as a herculean task. While Visa could lose some share of electronic payment processing over time, the growing market and the company's network, brand, and scale should, in his view, ensure excellent results for years to come. The latest high-profile move by Visa was its partnership with PayPal, which should support the traditional network model over time, effectively heading off competition at the pass. With the Visa brand and network now being displayed and promoted by PayPal, both firms should be incentivized to help the other be successful in the changing payments space. After updating estimates for the most recent quarterly earnings, Sinegal continues to believe shares are undervalued, trading at roughly a 20% discount to his fair value estimate.

As for the other sales, we had more than a few managers selling stakes in PepsiCo, Oracle, and Nestle, as well as narrow-moat

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Eric Compton has an ownership interest in Allergan. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)