Munis Keep Raking in Cash, Posting Respectable Gains

Despite concerns about Puerto Rico and higher rates, municipal-bond funds have continued their run in 2016.

After a strong showing in 2014 on both an absolute and relative return basis, muni bonds again emerged as a top-performing asset class in 2015. Driven by strong inflows to municipal-bond funds and a mostly benign credit environment, the national muni-bond fund Morningstar Categories were among the best-performing of Morningstar’s U.S. bond categories. Yet with the fear of additional Federal Reserve rate hikes and the muni market’s largest default looming as Puerto Rico’s credit quality deteriorated, some market watchers cast doubts on whether muni bonds would continue to their run into 2016.

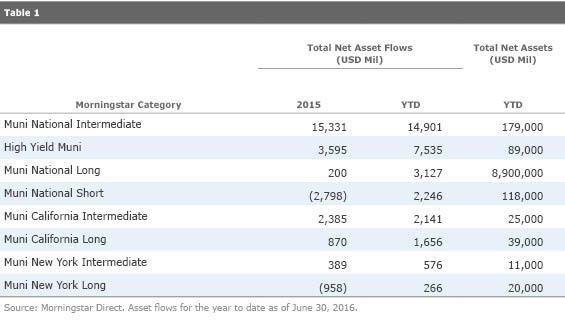

Flows Into Muni-Bond Funds Remain Strong Those worries faded quickly in the first half of this year. The Fed's rate hike failed to materialize, and overall credit quality throughout the muni market remained solid. Assets continued to pour into muni-bond funds, offsetting an increase in supply as more municipal borrowers came to market. Through June 2016, funds in Morningstar's open-end municipal bond categories experienced nine consecutive months of net inflows totaling roughly $37.4 billion. The biggest recipients of those assets were the more interest-rate- and credit-sensitive of the group, with strong net flows into the muni national intermediate-term, muni national long-term, and high-yield muni categories.

Open-end funds have been the beneficiary of the majority of net inflows, but muni-bond exchange-traded funds have also seen consistent growth in assets. In fact, the ETF U.S. muni-bond category has recorded net inflows every month beginning in November 2013. For the year to date through June 30, 2016, muni ETFs have garnered more than $3.2 billion, bringing total assets to roughly $22 billion. These assets continue to be concentrated in the largest ETFs. So, while there are 35 muni ETFs in Morningstar’s database, only a handful have gathered over $1 billion in assets to date. The largest muni ETF,

Investors Shrug Off Negative Headlines Investors have thus far shrugged off occasional negative headlines from the muni market's few trouble spots. As expected, Puerto Rico defaulted on several large debt obligations, resulting in turbulence for those most heavily exposed to the commonwealth's uninsured debt, although at this point exposure is generally limited to a few funds. The restructuring of Puerto Rico's more than $70 billion of debt obligations will be the largest ever undertaken in the $3.7 trillion muni market. Several other significant issuers, meanwhile, continue to wrestle with financial stress including the states of Illinois and New Jersey, the City of Chicago, and Chicago Public Schools. At their core, these high profile issuers share a similar story: Years of spending beyond their revenues, increased borrowing to pay for short- and long-term needs, and ballooning pension obligations have led to limited financial flexibility and weakened credit quality. Long-standing political stalemates exacerbate the state of Illinois' stress, contributing to the its historic yearlong budget impasse in fiscal 2016 and a dismal credit rating that's just above junk status. The city of Chicago and Chicago Public Schools, both of which are rated below-investment-grade, continue to struggle with outsize pension obligations that strain current operating budgets. And while the state of New Jersey's financial position has improved, it remains stressed, and the state's very high debt burden, including its large unfunded pension liability, remains a concern.

Beyond these trouble spots, however, municipal fundamentals remain solid. As the U.S. economy continues to grow, albeit slowly, local and state tax revenues have largely rebounded, providing more stability for municipal budgets across the country. At the same time, many municipalities trimmed operating costs and limited borrowing in recent years, which eased budget pressure and boosted financial flexibility.

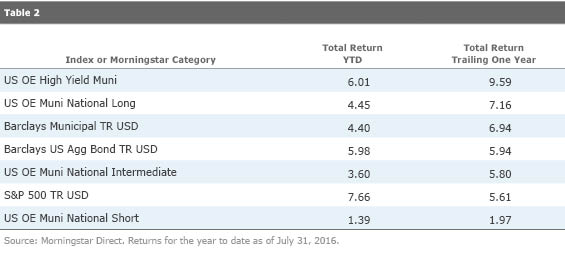

These fundamentals underpin a generally strong start to 2016, as bonds backed by tobacco revenues; industrial-development revenue bonds, which support private projects; and bonds issued by entities in the healthcare sector, such as hospitals, have all flourished. Within the fund universe, the strongest performers continue to be those funds that take on more credit and interest-rate risk, including many members of the high-yield muni and muni national long categories.

A number of Morningstar Medalists shone over the period. For example, in the high-yield muni category, Silver-rated

/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11772336-913b-401e-8a52-aceef6752c90.jpg)