7 Sustainable Large-Value Funds

These Medalist funds could be good fits for investors considering sustainability factors.

U.S. large-cap value can be a difficult area for investors wanting to incorporate sustainability into their portfolios. There are only a few funds with explicit sustainable or responsible investment mandates in the U.S. large-value Morningstar Category, and conventional funds often have higher exposure to sectors like energy and utilities, which include companies with heavier carbon footprints and environmental risks. Rather than give up altogether on a large-value allocation or concede it to a fund that doesn't reflect sustainability concerns at all, investors can use the Morningstar Sustainability Rating to identify funds that are holding companies managing their environmental, social, and governance, or ESG, risks and opportunities relatively well.

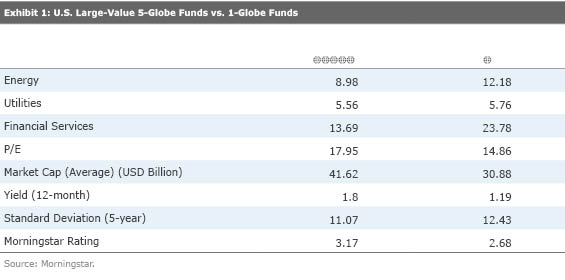

Funds in the U.S. large-value category with the highest Sustainability Rating of 5 globes tend to have less exposure to energy, utilities, and financial services than those with lower ratings, as can be seen in Exhibit 1. They also tend to be less deep-value and higher-yielding, with larger average market caps. While we can't say that they would have earned 5 globes in the past because our rating is new and based on their most recent portfolios, their track records show they are less risky and have better overall Morningstar Ratings.

Keep in mind, though, that our portfolio-based sustainability rating methodology is not designed to penalize a fund simply for holding companies in any particular industry. An oil company or a utility could make a relatively positive contribution to a fund's score unless it lags behind its industry peers in the way it handles ESG issues or is involved in a significant controversy. What a higher Sustainability Rating does say about a portfolio is that the companies held in it generally handle ESG-related challenges better than their industry peers.

Let's consider the large-value funds with a sustainable/responsible investment mandate first. The category only contains six choices out of 356 unique funds in the category: two index funds, two actively managed upstarts with short records and small asset bases, and two more-established active funds--one with a focused portfolio and the other with an emphasis on yield. None are covered by Morningstar analysts. Touchstone Premium Yield Equity TPYAX, subadvised by Miller Howard Investments, is a yield-focused fund that uses an ESG overlay. Its 2.26% 12-month yield is among the highest in the category. Ariel Focus ARFFX is a concentrated quality-value fund focused on buying firms with strong business franchises selling cheaply. It avoids tobacco and handguns and considers a firm's environmental record before purchasing. With its expense ratio of 59 basis points, the year-old Calvert U.S. Large Cap Value Responsible Index CFJAX is a relatively cheap way to get exposure to the category, plus investors get the added value of Calvert's efforts to engage firms on ESG policies and practices.

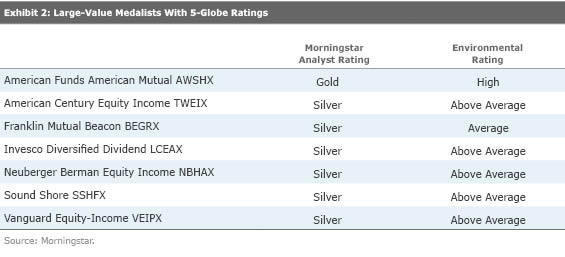

Among the large-value funds with a Sustainability Rating of High (5 globes) or Above Average (4 globes), investors can find many attractive choices. As of the end of July, 20 of the 42 Medalist funds in the category also rated 4 or 5 globes, while only eight of the 42 Medalists in the category rated 1 or 2 globes. Seven Medalists, listed in Exhibit 2, rated 5 globes. These are all funds that are highly recommended by Morningstar analysts and also rank in the top 10% of the category on our measure of sustainability. Those more concerned about the environmental performance of their holdings may want to refer to our environmental metric rather than the broad-based sustainability score. All but one of the seven Medalists in Exhibit 2 also have High or Above Average Environmental ratings.

The Sustainability Rating is based on portfolio holdings only, so it should be used alongside other metrics that assess a fund's style and overall quality. That said, the rating can be used to broaden the set of funds that might fit into a sustainable investor's portfolio, particularly in categories like U.S. large-cap value that lack strong self-identified sustainable/responsible options. Rather than simply ignoring those categories altogether or selecting funds without considering sustainability at all, investors can use the Sustainability Rating to identify viable options.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)