Better Bond ETFs?

A new crop of rules-based bond ETFs is attempting to improve on traditional market-cap-weighted alternatives.

A version of this article was published in the June 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

There's a lot to like about market-cap-weighted bond index funds. They offer low fees, a consistent and transparent approach with no key-manager risk, and low transaction costs because they favor the most-liquid issues and have fairly low turnover. But market-cap weighting may not be the optimal way to construct a bond portfolio because it tilts toward the most heavily indebted issuers. The implications of this are different in the investment-grade and high-yield market segments. In the investment-grade market, cap-weighting skews most portfolios toward low-yielding Treasuries and agency mortgage-backed securities, dragging down expected returns. In the high-yield market, the biggest debtors may have particularly high credit risk.

Several recently launched bond exchange-traded funds apply alternative screening and weighting approaches in an attempt to offer a better risk/reward profile than market-cap-weighted alternatives while retaining the benefits of traditional indexing. Each of these funds takes a distinctive approach and should be analyzed as an active strategy, even if it tracks an index. There are some promising candidates in this lineup, but they aren't all worthy of an investment.

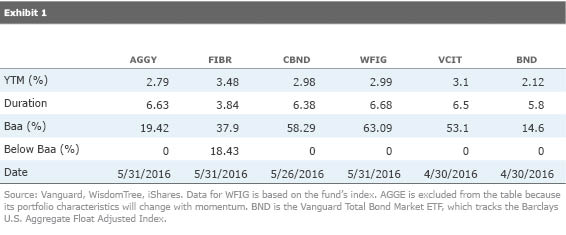

Core-Bond ETFs The Barclays U.S. Aggregate Bond Index is a natural starting point for thinking about a core bond allocation, as it is built to represent the U.S. investment-grade bond market. Many active managers and ETFs tracking alternatively weighted indexes attempt to boost returns relative to the Aggregate Index by taking more credit risk. This isn't difficult, as Treasuries and agency MBS jointly represent over 60% of the index.

WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield ETF AGGY accomplishes this by reweighting the constituents of the Aggregate Index. It divides the benchmark into 20 subcomponents based on maturity (short, medium, and long term), credit quality, and sector (government, corporate, and securitized). Each month it reweights the subcomponents to maximize yield, subject to a few constraints. These include limiting tracking error relative to the parent index to 35 basis points each month, capping its sector tilts and allocation to lower-credit-quality subcomponents at plus or minus 20 percentage points of their levels in the parent index, and limiting turnover. Additionally, the fund's duration cannot be more than a year greater than that of the parent index.

The end result is a modest pickup in yield relative to the Aggregate Index, greater exposure to lower-quality (A and Baa rated) debt, and slightly greater interest-rate risk. Overall, this fund is a compelling option for investors who want a little more return and are willing to take a little extra risk to get it--especially as it charges a very attractive 0.12% expense ratio.

IQ Enhanced Core Bond U.S. ETF AGGE (0.34% expense ratio) takes a more aggressive approach to boost returns. It applies a trend-following momentum strategy within five segments of the investment-grade bond market, including corporates, MBS, and short-, intermediate-, and long-term Treasuries. This is based on the well-documented tendency for recent performance to persist in the short term, which has been observed in every major asset class. A compelling explanation for this is that investors may under-react to new information, causing prices to adjust more slowly than they should. Once a trend is established, investors may extrapolate recent performance too far into the future and pile into the trade, further contributing to momentum.

While momentum has historically worked on paper, profiting from it in practice is a significant challenge because it requires high turnover. This is particularly true in the fixed-income market, where transaction costs tend to be far greater than in the equity market. To address this issue, AGGE is set up as an ETF of ETFs, which improves liquidity and reduces the number of required transactions.

The trend-following signal it uses is based on a 45/90-day moving average. When each of the five segments' 45-day moving average price exceeds its 90-day moving average, the fund gives an overweighting to that sleeve relative to the Aggregate Index or an underweighting when the opposite is true. This is a short-term signal compared with those that traders typically apply in the equity market, but Index IQ (the creator of the fund's methodology) found that it worked better in the fixed-income market. The fund adjusts its segment tilts based on the segment's volatility. More-volatile sectors get smaller over- or underweightings, respectively. It also sizes its bets by the magnitude of each segment's momentum. The index limits each segment tilt to plus or minus 30 percentage points of its weighting in the Aggregate Index. However, no sector may account for more than 50% of the portfolio, and there is no shorting. The fund is rebalanced monthly.

This is an interesting strategy, but there is a risk that transaction costs may erode the benefit from its momentum exposure and that the signal it is using may be too short. Only time will tell whether it is able to profit from momentum in practice. This fund is worth watching, but I'm not comfortable with it yet.

More Credit Risk Where AGGE attempts to profit from behavioral biases, iShares Edge U.S. Fixed Income Balanced Risk ETF FIBR attempts to boost return by taking on more credit risk, extending its reach into high-yield territory. This actively managed fund is distinct because it attempts to take on identical amounts of credit and interest-rate risk to improve diversification (think of it as a type of intra-asset-class risk parity approach). In contrast, interest-rate risk dominates the Aggregate Index and investment-grade benchmarks like it.

This fund focuses on five segments of the bond market that have historically offered attractive risk/reward profiles including MBS, short- and intermediate-term investment-grade corporate bonds, BB rated high-yield bonds, and high-yield bonds rated below BB. (Treasuries were not eligible for inclusion.) There is not a compelling theoretical reason to expect these sectors to continue offering more-attractive performance than the excluded sectors, like U.S. agency securities.

To achieve a balanced risk profile, the managers evaluate the contribution of credit and interest-rate risk to each segment's performance during the past 24 months and extrapolate those risk characteristics into the near future. If interest-rate risk exceeds credit risk, the managers short Treasury futures to reduce interest-rate risk and balance the risk contribution in each sleeve. If the opposite is true, they take long positions in Treasury futures. Finally, they weight each sleeve so that it has an equal contribution to the portfolio's overall volatility and rebalance the portfolio monthly. The resulting portfolio has a lower duration than the Aggregate Index and greater exposure to lower-credit-quality borrowers, though more than 80% of the portfolio is currently invested in investment-grade securities. It also offers a higher yield to maturity.

The diversification of the fund's portfolio is its greatest strength, but there are some weaknesses. A sector's past volatility and exposure to credit and interest-rate risk is not necessarily indicative of its future risk. For example, many MBS didn't look very volatile in the early 2000s, but they still carried considerable risk, as investors later discovered. This strategy also requires high turnover, which could create meaningful transaction costs that can erode its return. But it's one that should hold up better than its peers in a rising rate environment and is a reasonable long-term option.

Corporate Fundamental Weighting/Screening A few corporate-bond ETFs use issuers' fundamental characteristics to screen out less-desirable securities or size positions. SPDR Barclays Issuer Scored Corporate Bond ETF CBND (0.16% expense ratio) does this by assigning sector-relative scores to all eligible publicly traded investment-grade corporate issuers based on year-over-year changes in return on assets and interest coverage (EBITDA/interest expense). For the utilities sector, it substitutes current ratio (current assets/current liabilities) for interest coverage. Larger positive changes in these metrics are more desirable.

The fund sets its three sector weightings (industrials, financials, and utilities) equal to the Barclays Capital U.S. Corporate Index, but within each sector it weights each issuer according to its score relative to its sector peers. It rebalances back to these target weightings each month and updates issuer weightings twice a year. When an issuer has more than one qualifying security, the issuer's weighting is allocated among them pro rata based on their market value.

While the fund's weighting approach should tilt the portfolio toward higher-credit-quality issuers, this effect appears to be modest. Most of its assets are invested in Baa rated bonds. It offers a higher yield than the Barclays Intermediate U.S. Corporate Index and comes with greater interest-rate risk. But this fund doesn't have a clear edge over market-cap-weighted alternatives with similar duration like Vanguard Intermediate-Term Corporate Bond ETF VCIT.

The same could be said of WisdomTree Fundamental U.S. Corporate Bond WFIG (0.18% expense ratio). It ranks publicly traded investment-grade bond issuers based on return on invested capital, free cash flow/debt service, and total debt/assets, and it filters out the bottom 20% in each sector. This uses a more granular sector classification system than CBND, which improves comparability. The portfolio includes all the remaining securities but assigns larger weightings to those with higher option-adjusted spreads (yields) and lower probabilities of default. Yet, at the end of April, it offered a comparable yield to maturity to VCIT, despite having greater exposure to Baa rated securities and similar duration. This suggests that WFIG's more-complex approach doesn't necessarily yield higher expected returns.

Conclusion

- In their pursuit of higher returns, many alternatively weighted bond ETFs take on more risk (sometimes indirectly) than broad market-cap-weighted benchmarks. Investors should look beyond yield and make sure they are comfortable with the underlying risks.

- Greater complexity in portfolio construction isn't necessarily better. Alternatively weighted bond ETFs may incur high transaction costs and tracking error. And it may be possible to achieve similar exposure to alternatively weighted bond ETFs with market-cap-weighted alternatives that take comparable credit and interest-rate risk.

- AGGY is one of the more compelling alternatively weighted investment-grade bond ETFs available. FIBR is also a promising strategy, and AGGE is worth watching. But investors probably won't miss much by avoiding CBND and WFIG.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)