Solid Emerging-Markets Funds With High Sustainability Ratings

Though most focus on larger companies in developing markets, these Morningstar Medalists span the value-growth spectrum.

Emerging-markets investing can benefit from the consideration of environmental, social, and governance, or ESG, factors. According to Sustainalytics’ research, emerging-markets firms generally lag behind developed-markets companies in their implementation of policies, governance structures, and systems to manage their ESG risks. On corporate governance, in particular, emerging-markets companies generally have weaker protection of minority shareholder rights, higher levels of corruption, and fewer policies in place to combat corruption, and they are more frequently involved in the most severe ESG controversies that can impact a company’s reputation and bottom line.(1) Being able to identify firms that are leaders in terms of how effectively they are addressing the ESG risks and opportunities they face in their businesses could be a significant competitive advantage for an emerging-markets portfolio.

Fund investors wanting to incorporate sustainability into the selection or monitoring of emerging-markets funds can use the Morningstar Sustainability Rating to help identify funds that hold companies that are managing their ESG-related risks and opportunities better than their peers. In fact, the rating can be especially helpful in this category because few emerging-markets funds have any kind of sustainable or responsible mandate in their prospectus.

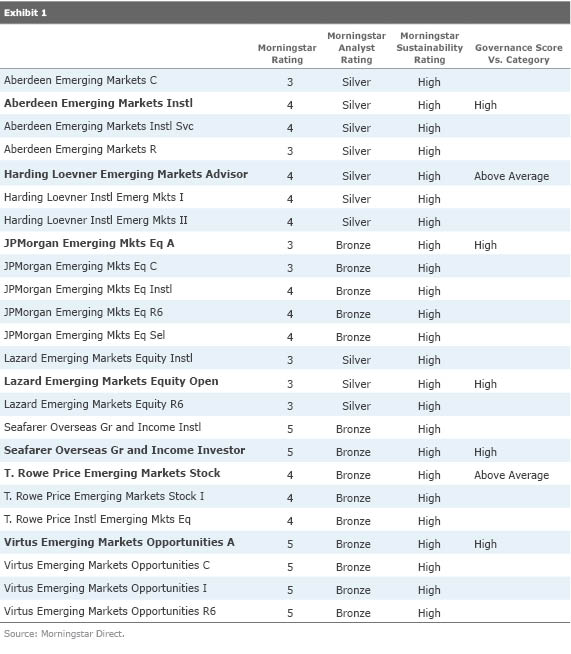

To identify those funds whose holdings have the best ESG profiles, I screened the diversified emerging-markets Morningstar Category for funds with our top Sustainability Rating. Because the Sustainability Rating is a portfolio-based measure that does not directly address a fund’s performance or process, I added a screen for funds with an overall Morningstar Rating of at least 3 stars and looked for funds that have been awarded medals by our analysts, indicating their conviction in the funds’ ability to outperform in the future. The results are shown in Exhibit 1.

Emerging-markets fund investors have several strong options among those with Morningstar Sustainability Ratings of High. They span the value-growth spectrum, and while all are large-cap oriented overall, there is also a range of market-cap exposure on the list. T. Rowe Price Emerging Markets Stock has one of the category’s highest average market caps, while Seafarer Overseas Growth and Income has one of the lowest. These funds also vary in their exposure to China.

The overriding similarity among these funds is their commitment to quality, which is described in the current analysis of every fund on the list. Aberdeen Emerging Markets may be of particular interest to sustainable investors. The fund, according to Morningstar Manager Research senior analyst Patricia Oey, looks for high-quality companies with strong balance sheets and a track record of good corporate governance. Only existing shareholders currently have access to the fund, however.

Those interested in corporate governance might want to focus on our Governance metric, rather than the broad-based Sustainability Score. Five of the seven funds on the list scored High on Governance, and the others scored Above Average.

While Virtus Emerging Markets Opportunities passes all of our screens here, it does invest in tobacco companies, which many sustainable investors consider off limits. Our Sustainability Rating doesn’t flag funds with tobacco exposure; the company ESG score of a tobacco company would simply be part of the overall asset-weighted average ESG scores of all companies in a portfolio.

One of the benefits of the Sustainability Rating is that it can be used to broaden the universe of funds that might fit into a sustainable investor’s portfolio, particularly in categories that lack strong self-identified sustainable/responsible options. Expanding our search to funds with Sustainability Ratings of Above Average as well as High would have lengthened this list further. Rather than simply ignoring those categories altogether or selecting funds without considering sustainability at all, investors can use the Sustainability Rating to identify viable options.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)