New Stocks in the Morningstar Wide Moat Focus Index

We've added to the roster of attractively priced, competitively advantaged companies.

Those who are familiar with the Morningstar Wide Moat Focus Index know it as a 20-stock index that provides exposure to the most undervalued, highest-quality companies in our coverage universe. Those are the only two qualifications for inclusion: Companies must have an economic moat rating of wide (meaning we think they have advantages that will fend off competitors for at least 20 years), and their shares must be trading below their fair value estimates, which are determined through independent research conducted by the Morningstar Equity Research team.

The index, which launched in October 2007, was rebalanced quarterly so that each holding started the quarter with an equal 5% weighting. Over the past 10-year period, this index has returned 11.4% per year, including dividends, versus a 7.4% annual total return for the S&P 500. Over shorter periods, results are also impressive: The index has outperformed the S&P 500 by more than 160 basis points over five years, and 50 basis points over three years.

What's New? We recently made some improvements to the index based on feedback from internal and external stakeholders. (The Wide Moat Focus Index is intended as an investment strategy and is licensed for investable products, but many individuals like to use it as a watch list or a place to find investment ideas.) Importantly, the index's fundamental character will remain intact: It will continue to target attractively priced, competitively advantaged companies. The changes are intended to significantly reduce portfolio turnover (and lengthen stock holding periods), and limit volatility.

Though it will remain a concentrated, high-conviction strategy, we've increased the index's capacity and changed the rebalancing rules to allow stocks to be held longer. The index now consists of two subportfolios of 40 stocks each, which are reconstituted semiannually, but with staggered rebalancing occurring quarterly. (One subportfolio reconstitutes in March and September; the other in June and December.) The number of holdings will move from 20 stocks to a minimum of 40 (if the constituents in the subportfolios overlap) and a maximum of 80 stocks (if there is no holdings overlap). Expanding the number of holdings should also minimize volatility.

In order to limit turnover, the index will implement a buffer. At the time of reconstitution, current holdings can remain in the index as long as they are within the 60 cheapest wide-moat stocks based on price/fair value ratios.

Finally, to limit unintended sector bets, the index will also implement sector caps, so that exposure to any Morningstar sector won't exceed 40% of index weight in most circumstances.

Latest Changes to the Holdings Stocks can come in and out of the index based on market appreciation--in other words, the stock is no longer trading at a sizable enough discount to fair value that we think there is a lot of upside there. Stocks can also enter and exit due to analyst downgrades, such as a cut to the fair value estimate, or a downgrade to a stock's moat rating.

In the last index reconstitution, in June, a few stocks were removed. The removal of

"IBM has failed to adapt aggressively to the shift toward cloud-based infrastructure (unexplainable in light of its history in the mainframe business)," said Morningstar strategist Mike Hodel. "Qualcomm's intellectual property position is likely deteriorating as firms and governments around the world work to break its position in the wireless market."

Finally,

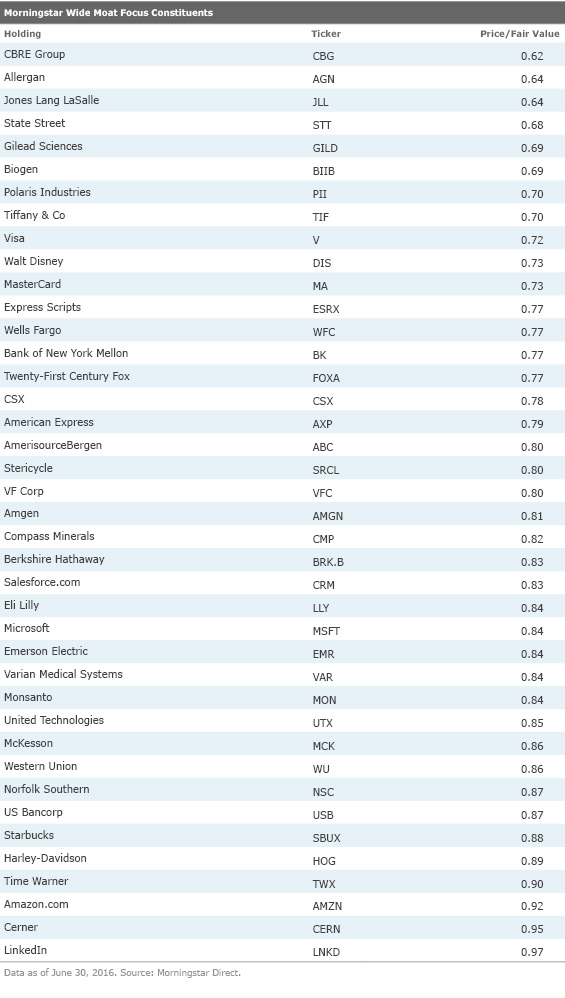

Current Holdings

Currently, the index has 40 positions. To see updated positions, please click

.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)