Unintended Biases in ESG Index Funds

ESG index strategies can be effective tools for values-based investing, but they may introduce some additional bets that investors may not intend to make.

A version of this article was published in the May issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

Environmental, social, and governance investment strategies can help many investors better align their money with their values. These strategies generally target firms that have a limited negative impact on the environment; promote diversity and have good relationships with key stakeholders, including employees; and strong corporate governance that promotes accountability. Many also exclude companies in certain lines of business such as tobacco, alcohol, and gambling. But there is a risk that this focus might introduce unintended sector or style bets, particularly among index funds. Differences in construction methodology can cause some strategies to have larger unintended biases than others.

Take

The resulting portfolio has greater exposure to the technology, financial services, and healthcare sectors than the Russell 1000 Index, and less exposure to telecom, energy, and industrial stocks. The technology overweighting isn’t surprising, as these companies tend to have a smaller environmental impact than average. These sector tilts may be unintentional, but they can affect the fund’s relative performance. And they are not uniform across all ESG strategies.

For instance,

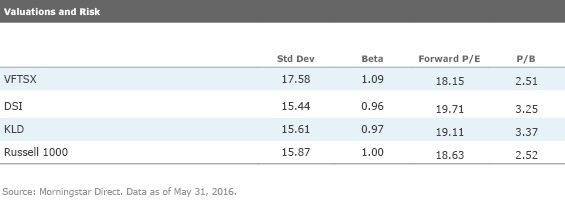

As a result of its sector and tracking error constraints, KLD tends to look more like the market than its peers, as table 1 shows. Of the three funds, it does the best job mitigating active bets that are not directly related to ESG.

Sector weightings aren’t the only differences between these funds. Vanguard FTSE Social Index has been a bit riskier than its peers. It exhibited greater volatility and market sensitivity (beta) than DSI, KLD, and the Russell 1000 Index from December 2006 (the first full month that data for all three funds are available) through May 2016. This was partially due to its large overweighting of financial services stocks, which also gave the Vanguard fund a slightly greater value tilt than its peers. At the end of May, its holdings were trading at slightly lower average multiples of forward earnings and book value than its peers, as table 2 shows.

These differences aren’t inherently good or bad, but they aren’t obvious given the similarity in the funds’ mandates. It is important to look under the hood to understand the bets each fund is making.

Negative Versus Positive Environmental Screens

A deep dive is also necessary to determine whether a socially conscious fund’s investments are consistent with your objectives. Consider

Yet, neither fund considers how much fossil fuel its portfolio companies use in their operations or their carbon footprints. Investors who are concerned about greenhouse emissions may be better served by

Sustainable Impact

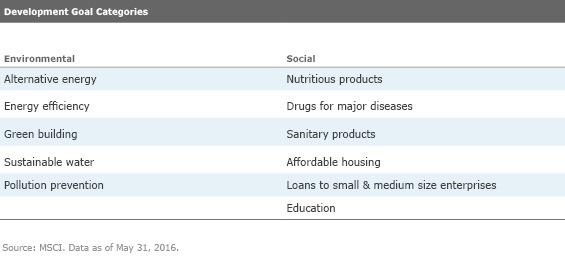

While most ESG funds target stocks that score well on several dimensions of environmental stewardship, social consciousness, and governance in their normal course of business, few explicitly target firms whose primary business objective is to advance social interests. Recently launched

The fund weights its holdings by the revenue they generate from these sustainable impact categories, adjusted by the ratio of their free-float market capitalization to total market capitalization. It caps sector weightings at 20% and individual positions at 4%. The portfolio is rebalanced annually and reviewed quarterly.

This strategy represents a logical progression in ESG investing. However, it introduces some indirect active bets that investors may not expect. For example, it currently has greater exposure to industrials, utilities, healthcare, and consumer defensive stocks than MSCI ACWI. It also has underweightings to financial services and technology stocks and currently has no exposure to the energy or telecom sectors. On top of these sector tilts, the fund has a slight growth bias, a smaller-cap orientation than the MSCI ACWI, and less exposure to U.S. stocks.

It is difficult to for this type of strategy to avoid these inadvertent bets because most stocks do not meet its demanding selection criteria (it currently holds fewer than 100 names). And these bets aren’t necessarily bad. In constraining a portfolio to look more like the market, investors must own some companies with less-attractive absolute ESG characteristics than an unconstrained portfolio. This is a trade-off investors make. Those who do take a less constrained approach should be mindful of potential unintended bets and be comfortable with their potential impact on performance.

Summary

- ESG funds with similar mandates can have very different portfolios. Unconstrained funds often introduce active bets that ESG investors may not intend.

- Constrained funds, like KLD and CRBN, mitigate active bets that are not directly related to ESG. But these constraints may also increase the funds' exposure to firms with less desirable ESG characteristics.

- Investors can go beyond traditional ESG investing with MPCT, which invests in companies whose primary business is related to the advancement of key social interests.

- Check whether each fund's approach is consistent with your objectives. Strategies that exclude some stocks, like those with fossil fuel reserves, may still have exposure to others with undesirable characteristics, like large carbon footprints.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)