How Sustainable Is Your 401(k) Plan?

Even funds without an intentionally sustainable mandate can score well under our Sustainability Rating methodology.

Investor interest in sustainability issues continues to grow, especially among younger investors. As Jon Hale noted back in March, this interest led us to launch our new Morningstar Sustainability Rating, a tool that allows investors to assess the underlying sustainability profile of most managed investment products, not just the small percentage of funds with an intentionally sustainable investment approach.

Such sustainable funds tend to score very well under our sustainability methodology, and some investors have access to offerings from well-known players in the sustainable/socially responsible space, such as Parnassus, Neuberger Berman, and Calvert, via their employer-sponsored retirement funds. Yet no intentionally sustainable funds show up among the 100 funds that have garnered the most assets from defined-contribution plans. However, that doesn't mean retirement investors don't have access to investment options that score well under our new sustainability metrics.

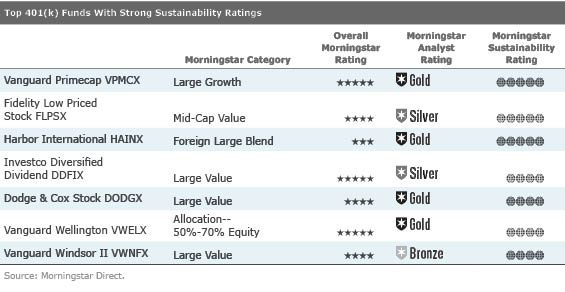

, even without a specific sustainability mandate, a management team's approach might result in a portfolio of securities that score well under our sustainability methodology, which creates a Portfolio Sustainability Score for a fund's portfolio. Funds are then ranked within their Morningstar Categories and assigned a Sustainability Rating, with the top 10% of funds within a category receiving 5 globes, the next 22.5% receiving 4 globes, the next 35% receiving 3 globes, the next 22.5% receiving 2 globes, and the bottom 10% receiving a single globe. He highlighted Vanguard's Primecap offerings, four of which receive our highest Sustainability Rating of 5 globes. One of the best-scoring funds is

Two other actively managed funds from Vanguard also score well, as both

A similar spread can be seen among the Fidelity funds popular within defined-contribution plans.

Other popular 401(k) funds that shine in our sustainability methodology include the 5-globe

So how sustainable is your retirement plan? We invite 401(k) investors to take a look, using this new rating framework. Because our Sustainability Rating for funds can be applied to any portfolio, investors can use it to better understand their investment options. Even without intentionally sustainable investment choices, retirement plan participants can still consider sustainability issues as part of their investment selection process.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/s3.amazonaws.com/arc-authors/morningstar/32fdd21d-72cb-4981-8f21-b7d0a3f7c87e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/32fdd21d-72cb-4981-8f21-b7d0a3f7c87e.jpg)