A 'Check the Runner' Moment for Global Macro Funds

Did Brexit catch these go-anywhere alternative funds leaning the wrong way?

We won’t know for some time whether the immediate post-Brexit market volatility augurs a longer-term global market decline or just a short-term bout of uncertainty. (Although, as of this writing, the markets had rebounded firmly.) At a minimum, however, for investors in global macro funds, the two days of post-Brexit market volatility served as a “check the runner” moment.

In baseball, when a player reaches first base, the pitcher will adjust his pitching routine to incorporate various “checks” on the runner, which may include altering his windup, looking over at the runner, and tossing the ball to the first baseman. Through these actions, the pitcher can gauge the runner’s intentions and perhaps catch the runner leaning the wrong way--which, with a good pickoff move, can result in an out.

Similarly, the recent volatility across regions and asset classes serves as an opportunity for investors to determine if global macro funds have been “leaning” the wrong way. This is of particular relevance for global macro funds, both because they have the flexibility to change their allocations greatly over short periods and because their heavy use of derivatives makes it difficult to discern their true economic exposures through typical portfolio data. By contrast, if you own a traditional equity fund, its most recent portfolio holdings disclosure would likely give you a pretty accurate sense of how it was positioned and likely to perform in a stock market downturn.

Moreover, unlike some recent spells of volatility, the Brexit-induced market-shudders are more global and multiasset in nature, including significant currency movements, an area in which most global macro funds trade significantly. Thus, Brexit represents an opportunity for global macro managers to prove what they often contend: Their strategies thrive on dispersion and volatility in financial markets, and they can respond quickly to hedge and take advantage of opportunities.

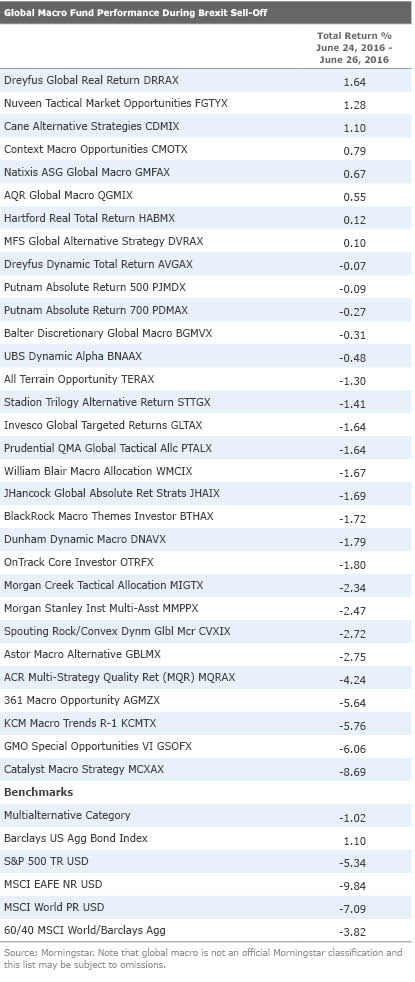

Promising Early Results The good news is that global macro funds, which are a subset of the multialternative Morningstar Category, held up relatively well in the first two days of post-Brexit trading in the United States. The multialternative category as a whole lost 1.02% on average, relative to negative 5.34% for the S&P 500, negative 7.09% for the MSCI World Index, and negative 3.82% for a blended 60% MSCI World/40% Barclays US Aggregate Bond Index. (Many multistrategy funds in the category use managed futures, which once again proved their value during market sell-offs, with the category gaining 3% in the two-day period.) A subset of 31 funds we've identified as global macro in nature did not perform quite as well on average (with a mean loss of 1.6%), but that's skewed by several outliers with big losses. Overall, 27 of the 31 funds lost less than the blended global 60/40 index, 22 of the 31 lost less than half the blended index, and nine of the 31 (or more than a fourth of the group) ended up in positive territory. Of course, few funds or asset classes did as well as plain old bonds, as the Barclays US Aggregate Bond Index rose more than 1%.

The average losses for the multialternative category and the global macro subset over the two-day period are of lesser magnitude than one might have predicted based on the three-year downside capture ratio of around 40% for each group. That suggests that managers had been positioning themselves more defensively, perhaps in part due to concerns about the risks of the Brexit vote and in part due to equity valuation sensitivity. In addition, many global macro managers have been long the dollar versus other currencies, particularly the euro, given diverging central bank monetary policies, a stance that would have been a boon during this span.

Dreyfus Dynamic Total Return AVGAX, for instance, subadvised by Mellon Capital, which lost just 0.07% during the downdraft, had been reducing exposure to European and Asian equities as part of its scenario-testing process modeling the Brexit risk. In addition, the fund has for some time held a significant defensive stake in U.S. Treasuries and cash. And it has been long the U.S. dollar with a modest short position in the British pound, all of which helped.

William Blair Macro Allocation WMCIX, a Morningstar Prospect, lost 1.67% during the stretch. Manager Brian Singer incorporates game theory into his analysis of geopolitical dynamics and had been modeling populism and Brexit into the fund’s risk scenarios. The fund had been maintaining relatively low equity beta, while incorporating shorts on the pound versus the Canadian dollar and the yen. However, the fund had previously increased exposure to European financials within its long equity sleeve for valuation reasons, which undoubtedly was a detractor, though European equities represented only 6% of the overall portfolio at the end of March.

Among funds receiving Morningstar Analyst Ratings, Bronze-rated

Bronze-rated

Concluding Thoughts One of the characteristic traits of global macro funds is that they can change positioning quickly, so it is hard to say with confidence whether positions held several months back were still in place at the time of the Brexit vote, and it is equally possible that managers took advantage of the volatility to take profits and reposition their portfolios. And a two-day period of volatility centered on a specific though broad-reaching event is a limited statistical sample. But investors can take some confidence from the generally robust results of global macro vehicles, which appeared not to be caught out in unexpectedly risky spots and, indeed, in many cases seem to have had the right bets in place. There are a few outlier funds that appear to take on a lot of volatility or big bets, but those seem to be in the minority. If market volatility continues to rise in 2016, there will be further tests for these funds.

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)