Second-Quarter in Bond Funds: Risk Pays Off

Brexit-related volatility was not enough to take the sheen off an otherwise strong quarter for risky assets.

The biggest news of the second quarter came in the final days of June, when voters in the United Kingdom unexpectedly voted to leave the European Union. However, while the Brexit vote dominated headlines and led to sharp losses in the equity markets, the initial impact on the fixed-income markets has been relatively muted. To be sure, Treasuries rallied sharply in the days following the vote, but by the end of the day on Tuesday, June 28, the yield on the 10-year Treasury stood at 1.46%, not far off levels seen earlier in the month.

Meanwhile, riskier corners of the bond market, including high-yield and emerging-markets bonds and currencies, suffered losses on Friday and Monday but bounced back on Tuesday. The British pound fell sharply, although this had a limited impact on most core bond portfolios, which rarely have concentrated exposures to individual nondollar currencies.

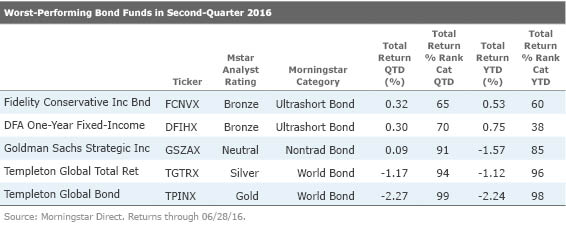

The hardest-hit funds on Friday and Monday were those with significant exposure to emerging-markets currencies, such as

As fixed-income investors grapple with the longer-term impact of Brexit on the markets, there are still plenty of unanswered questions about the impact on European economic growth, global currencies, and Federal Reserve policy. Encouragingly, we've heard from managers that fixed-income markets have been fairly orderly and that liquidity has been robust.

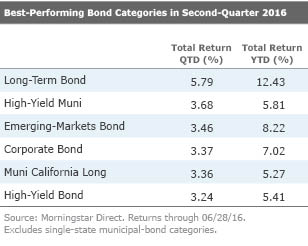

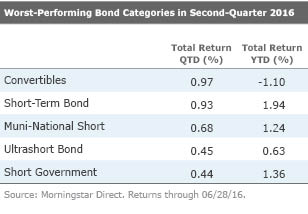

Risk Continues to Pay

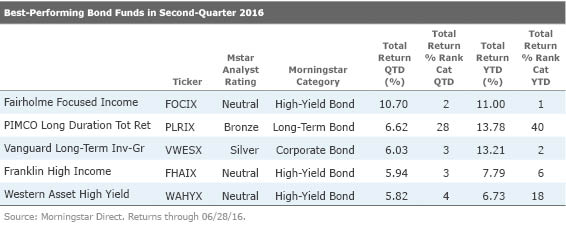

Indeed, Brexit-related volatility was not enough to take the sheen off an otherwise strong quarter for risky assets. Junk bonds have been one of the big beneficiaries, with the high-yield bond Morningstar Category up 5.4% for the year through June 28 and roughly 3.2% for the second quarter to date against the backdrop of a rebound in energy and other commodity-related bond prices. That's despite continued distress in the energy and metals and mining sectors, which have seen 12-month trailing default rates climb to roughly 20% even as oil prices have stabilized. Some of the strongest performers for the year to date include those hardest hit in 2015, with funds such as

A preference for riskier assets extended to munis. High-yield municipal-bond funds, which, unlike their taxable cousins, posted respectable gains in 2015, have also shone so far in 2016. Tobacco-backed bonds and industrial-development revenue bonds, which support private projects, have been particularly strong performers. Even the threat of more Puerto Rico debt defaults on July 1, which would include $800 million of general-obligation debt, hasn't been enough to slow the sector significantly.

Interest-rate risk was also a winner for the quarter. After a disappointing May employment report, the Federal Reserve did not raise short-term rates at its June meeting and noted that inflation measures had fallen. With a dovish Fed and negative yields increasingly prevalent abroad, Treasury yields fell across most of the maturity spectrum over the quarter. That helped the the long-term bond category outperform all other fixed-income categories for the quarter to date through June 28.

Core Bonds Post a Better Quarter and First Half The Barclays U.S. Aggregate Bond Index and intermediate-term bond category are also on pace for strong returns through the second quarter. Given that the yield on the Aggregate Index started the year just a bit north of 2.5%, that benchmark's year-to-date gain of 5.3% is impressive. The index also posted a roughly 1% gain during Friday and Monday's market turmoil, once again proving its worth as a valuable source of diversification in rocky equity markets.

Investment-grade corporates, which had come under pressure during 2014 and into 2015, fared particularly well during the quarter. That buoyed funds with sizable overweightings to corporate bonds, such as

The Scorecard

/s3.amazonaws.com/arc-authors/morningstar/bc7d88a3-8cc9-454a-994a-b769dee12e69.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/bc7d88a3-8cc9-454a-994a-b769dee12e69.jpg)