Credit Markets: Snap-Back Rally Stalled

The impact of the ECB's asset purchase program should at least partially offset Brexit-related volatility.

- The corporate bond market will be pressured by the uncertainty caused to the global economic outlook by the U.K.'s decision to exit the EU. However, the impact of the ECB's asset purchase program should at least partially offset this volatility.

- As credit spreads in Europe tighten and new supply of U.S. corporate bonds diminishes, it will naturally result in tighter credit spreads in the U.S. as well.

- Between the reduced probability of a near-term rate increase and the flight-to-safety spurred by Brexit, long-term interest rates are lower across the yield curve than at the end of last quarter and have added to gains in the fixed-income market in the second quarter.

The snap-back rally that began in mid-February stalled out in May, and corporate credit spreads have traded in a relatively narrow range since then. In the near term, the corporate bond market will be pressured by the uncertainty caused to the global economic outlook by the U.K.'s decision to exit the EU; however, at least partially offsetting this volatility, corporate bonds will benefit from new demand spurred by the ECB's expanded asset purchase program, which started purchasing non-financial corporate bonds in June. With over $10 trillion of sovereign debt trading at a negative yield, the yield on U.S. fixed-income securities appears attractive to global investors.

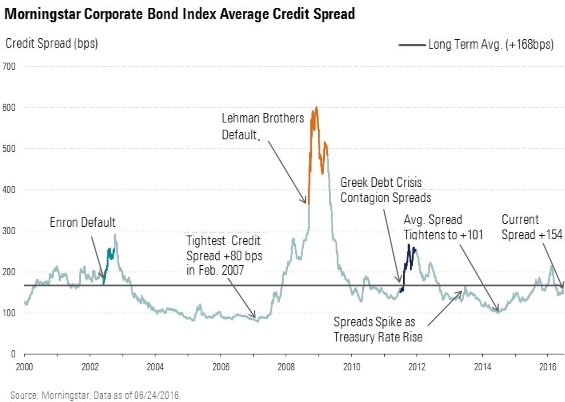

In our Credit Weekly dated May 2, we highlighted that the snap-back rally in the investment-grade corporate bond market had run out of steam. Since then, the average spread of the Morningstar Corporate Bond Index has traded within a relatively narrow range. Earlier in the year, at the end of February, after credit spreads had widened dramatically in sympathy with declining oil prices and signs of global economic disruption, we noted that U.S. economic metrics were coming in better than expected and that oil prices had appeared to find a near-term bottom. Considering credit spreads at that time were near levels more consistent with recessionary periods, we opined that with the improvement in the economy and further recovery in oil prices, credit spreads could tighten in a snap-back rally.

As oil prices bounced and economic metrics stabilized, the corporate bond market quickly recovered much of its losses in March and April. However, as credit spreads normalized and approached their long-term averages, we noted in May that, in our view, the current level of corporate credit spreads appeared to reasonably balance risk and reward. This is based on our assessment that over the near term, corporate credit risk will be balanced between continued slow domestic economic growth that will generally support credit quality, which will be offset by sector-specific weakness and idiosyncratic catalysts.

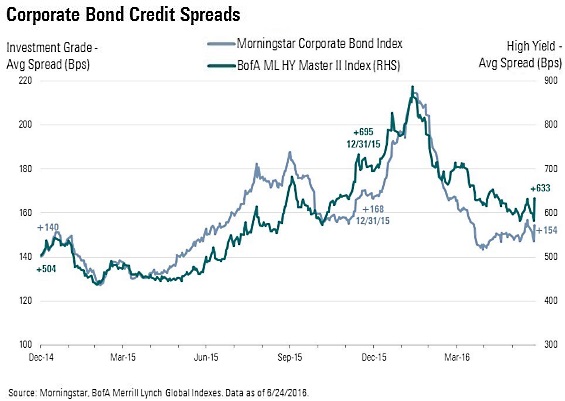

Over the past quarter, credit spreads on investment-grade corporate bonds tightened in early April but have traded within a narrow range over the remainder of the quarter. Quarter-to-date, the average spread of the Morningstar Corporate Bond Index (our proxy for investment-grade corporate bonds) has tightened 11 basis points to +154. In the high-yield space, credit spreads tightened over the first half of the quarter and then remained within a relatively narrow trading range over the latter half. Thus far this quarter, the average spread of the BofA Merrill Lynch High Yield Master Index has tightened 72 basis points to +633.

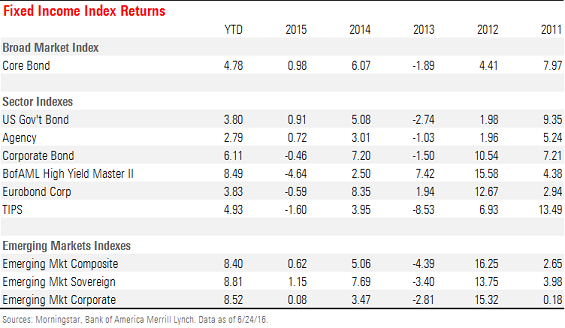

Treasury bond yields rose in April when investors began to price in a higher probability that the Fed may raise rates at the June meeting; however, after a discouraging May payrolls report revealed unexpected weakness in the labor market, the market-derived probability of a June rate rise fell precipitously into the single digits. Between the reduced probability of a near-term rate increase and the flight-to-safety spurred by Brexit, long-term interest rates are lower across the yield curve than at the end of last quarter and have added to gains in the fixed-income market in the second quarter.

While corporate credit spreads widened slightly in May, year to date, returns in the corporate bond market have been substantially higher than our original expectations for the year. Gains have been driven by a combination of declining interest rates, tightening credit spreads, and yield carry. Since the end of last year, yields on long-dated sovereign bonds, including U.S. Treasuries, have fallen with several reaching new historic lows, and in some cases they are now priced to deliver negative yields. Demand for sovereign bonds has stemmed from the ECB's asset purchase program, requirements for banks to hold greater amounts of government debt as capital, and investors' apprehension as to whether the stock market can make further gains as earnings expectations have diminished.

In the near term, the corporate bond market will be pressured by the economic uncertainty caused by the Brexit; however, the impact of the ECB's asset purchase program should at least partially offset this volatility. Corporate bonds will benefit from new demand spurred by the ECB's expanded asset purchase program, which started purchasing nonfinancial corporate bonds in June.

Based on the amount of purchases it has made thus far, if the ECB continues at the same pace, it would acquire between EUR 8 billion to EUR 10 billion per month. These purchases will effectively remove supply of corporate fixed-income securities from the public markets and create new cash that must then be reinvested. As this cash is then reinvested, bond traders may have to push prices up on European corporate bonds, thus lowering credit spreads, in order to buy bonds to reinvest the proceeds. Furthermore, companies will likely shift new bond issuance toward euro-denominated bonds to take advantage of the lower all-in yields. As credit spreads in Europe tighten and new supply of U.S. corporate bonds diminish, it will naturally result in tighter credit spreads in the U.S. as well.

Our outlook is based on the following forecasts:

- Real U.S. GDP growth will average 2.2% in the second half of 2016.

- Downgrades will continue to outpace upgrades.

- Earnings will remain under pressure as the stronger dollar and weaker global growth hampers earnings growth.

- Energy prices, specifically oil, will trade in a seesaw fashion, or "fits and starts," through the second half of 2016 with the overall trend being slightly higher.

Still there remains significant potential for heightened downward volatility. The main risks to our outlook are:

- U.S. economic growth stumbles and enters a recession.

- Oil tumbles back below $40.

- Chinese and emerging-markets' economic activity slows down meaningfully, resulting in a global economic slowdown.

- Heightened idiosyncratic risk (that is, renewed debt funded M&A boom, oversize share buyback programs, and so on)

- The re-emergence of European sovereign debt and banking crisis.

However, with the expansion of monetary stimulus and extension of the ECB's asset purchase program to include corporate bonds, the degree of downside volatility should be suppressed as compared with the amount that corporate credit spreads widened out during the first quarter. In addition, the Fed appears to be on hold for the near term; whereas, earlier this year the market expected several increases in the federal funds rate. Finally, other global central banks, such as the Bank of Japan and the Bank of China, continue to pursue seemingly ever-easier monetary policies, which add to the amount of global liquidity.

More Quarter-End Insights

Stock Market Outlook: A Year of Contradictions

Basic Materials: Recent Commodity Rallies Leave Few Opportunities

Consumer Cyclical: Market Underestimating Apparel and E-Commerce

Consumer Defensive: Not a Lot to Feast On

Energy: Supply Glut Continues, but Some Respite on Pricing

Financial Services: Accounting for Brexit and the Fiduciary Rule

Healthcare: Stock Selection Increasingly Important

Industrials: Valuations Stretched, but Opportunities Still Exist

Real Estate: 'Safety' Becomes More Expensive

Tech & Telecom: We See Opportunities in Apple and Microsoft

Utilities: Is a Sector-Shaking Pile-up Coming?

Second Quarter in U.S.-Stock Funds: The Winners and Losers

The First Half in International-Stock Funds

Second-Quarter in Bond Funds: Risk Pays Off

Benz: A 5-Step Midyear Portfolio Checkup

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)